Ukraine & Commodities, Futures Trading Levels 3.03.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

Russia, Ukraine & Commodities

By Mark O’Brien, Senior Broker

In a recent blog post, it was noted, “We’re just one month into this calendar year with more developments ahead – geopolitically, weather-related and monetary policy related – all set to cause commodity prices across a range of asset classes to exhibit potentially rugged price action. Keep an eye out.” Now two months into this calendar year, it appears that statement was subdued.

Many of the market moves stem from the escalating war activities in Ukraine, which will remain a dominant force in determining prices of several commodities. Russia and Ukraine account for nearly 20% of global corn exports and 25% of wheat.

May corn traded to new contract highs overnight (747¾, basis May).

May wheat traded up its 75-cent limit today to the highest level since March of 2008. Russia is responsible for up to 40% of the

palladium supply to the world, a commodity not typically among any trader’s top-ten to keep an eye on. It’s seen a ±$300/oz. move up since Friday’s close and is poised to close at daily contract highs. Prices in

crude oil surged again today, trading intermittently to life-of-contract highs above $112/barrel. These and other markets – think metals, other energy products, stock index futures – will continue to exhibit outsize moves. And while fears of physical supply disruptions, a ratcheting up of inflation expectations and other forces have sellers moving to the sidelines across numerous commodities, these traders are not gone. Take care.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

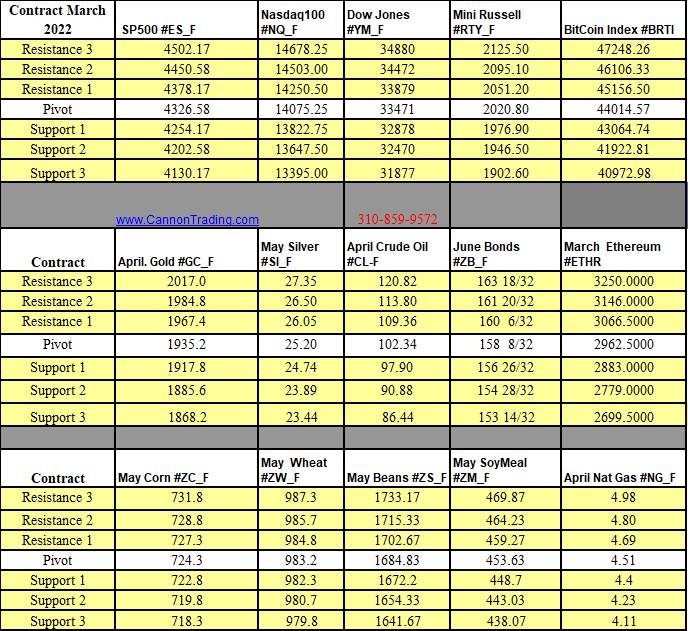

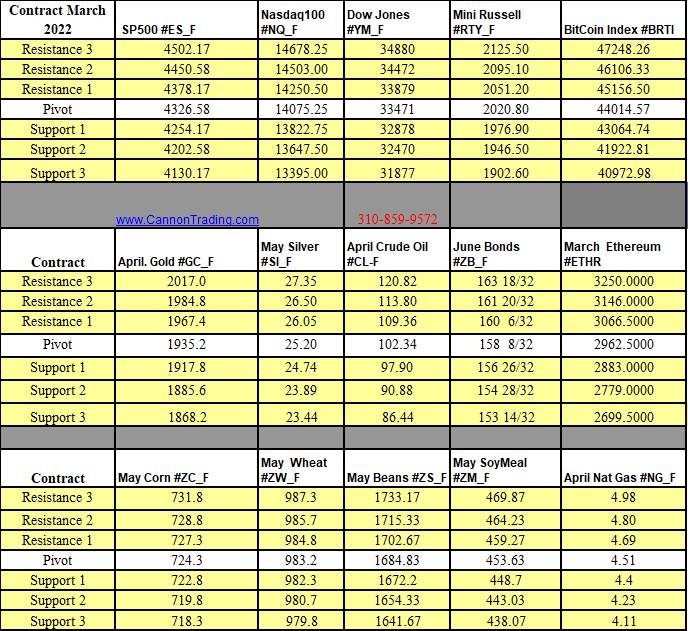

Futures Trading Levels

03-03-2022

Improve Your Trading Skills

Economic Reports, Source:

http://BetterTrader.Co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | Grain Futures