Gold Futures Outlook & Support and Resistance Levels 4.13.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

IS GOLD’S Lustrous sheen returning for investors?

By John Thorpe, Senior Broker

Stocks lower,

Bonds lower, Inflation higher:

Gold, after months and years of expecting the price of the metal to gain upward price momentum, the value for investors had been tarnished by the positive returns of high stock prices,

Crypto dreams, property values, Gems and artwork whose own luster may now have reached a short term point of no return. The Easy to Easiest money policies over the past decade have caught up and now it’s time to pay of our economic sins. Perhaps these times, the 2022’s and beyond are the right times for investing in the

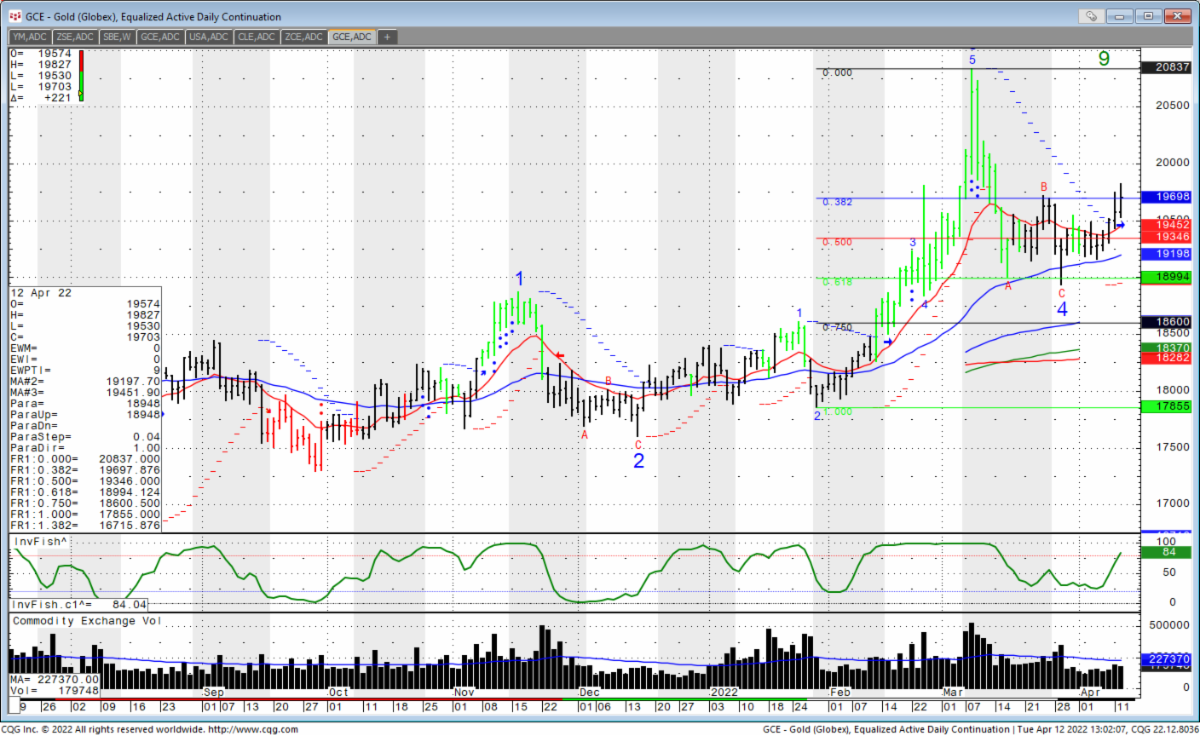

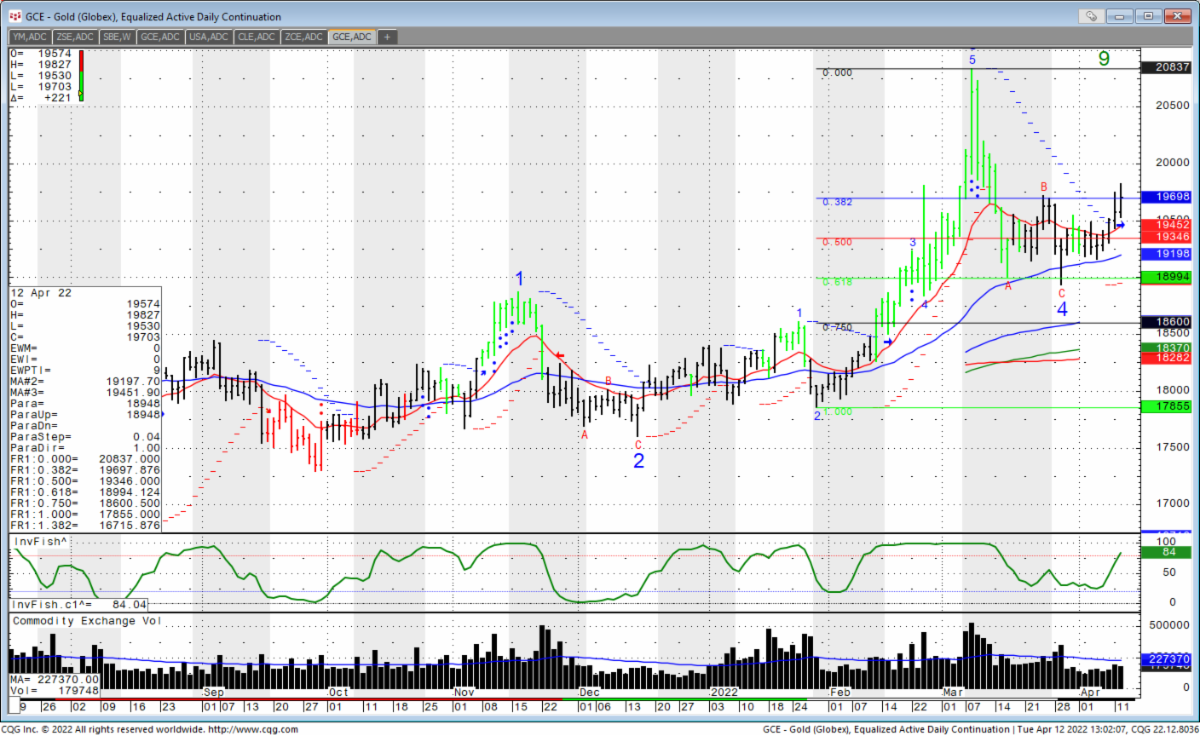

precious metals. Please take a look at the Chart where you will see the importance of the 1920.00 area. It was previously the High of multi year consolidations. 5-31-2021 nearly a year removed , the lows of the past two weeks are skimming along the 50 day SMA. If you are a Steve Nison Fan

you may also notice the long legged Doji on March 29th just 2 weeks ago. any long position should be protected under the 1920.00 area as part of your risk management strategy., I will be following this market throughout the summer, please check back for updates and always have an exit strategy that you can employ!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

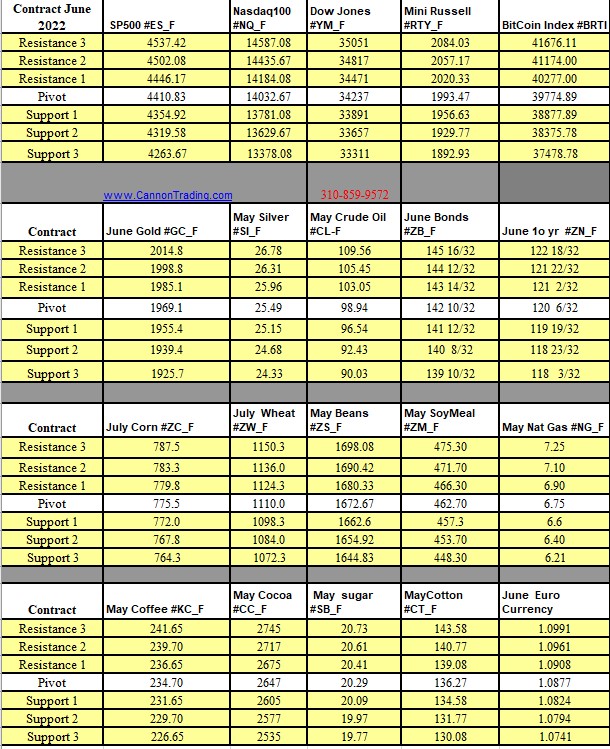

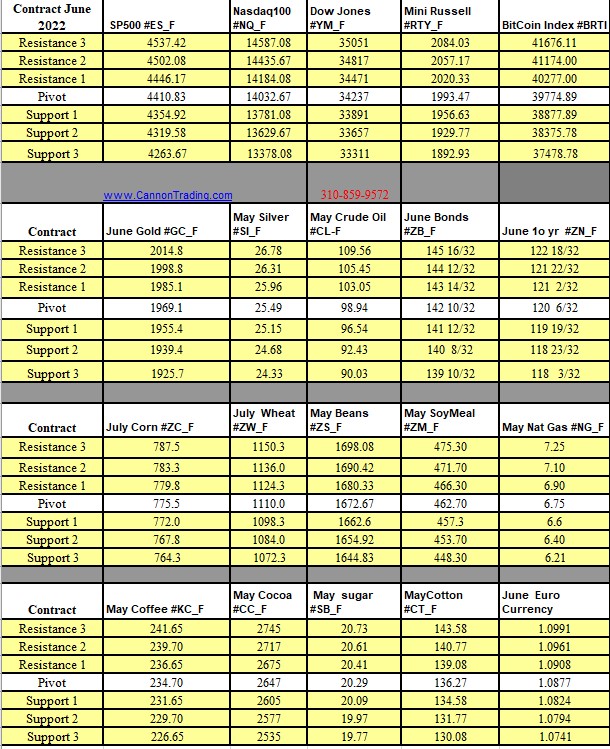

Futures Trading Levels

04-13-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | Gold Futures