Wheat Limit UP, Futures Trading Levels 3.02.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

More on LIMIT Moves: Wheat

By John Thorpe, Senior Broker

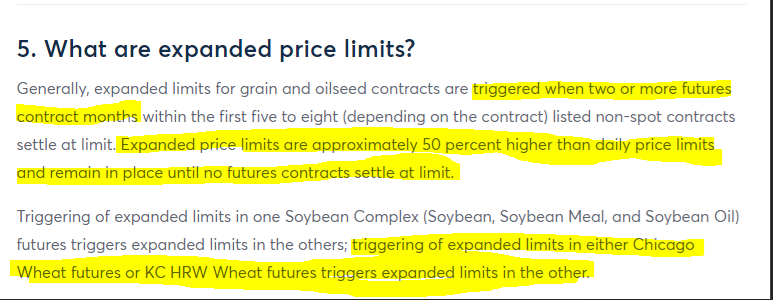

Futures contract limit moves during extreme volatility….. rules are different for each commodity that does have a hard daily price limit. not all futures contracts have

daily price limits. Here is a discussion from the CME of Daily Price limits

Product Examples for Daily Price (Trading) Limits – Electronic Platform Information Console – Confluence (cmegroup.com) a current list of markets where limits are enabled is here

Price Limits: Ags, Energy, Metals, Equity Index (cmegroup.com) the reason we draw your attention to this is the current state of the

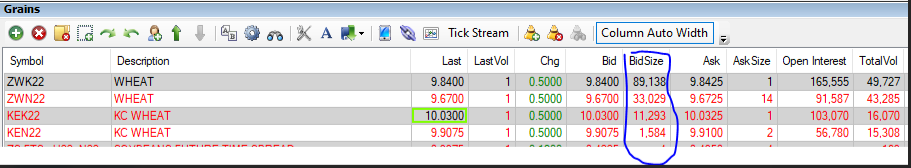

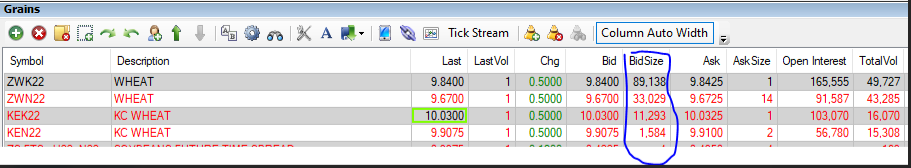

Wheat market with the first 2 months in the Chicago Soft contracts and of the KC Hard red winter contracts. Limit markets are also known as Limit Bid or limit offer markets where there are Bidders or offerors “jumping into the Pool” clamoring to get long or short.. we refer to the excessive bids or offers as “the Pool” when exterior pressures create the perception of shortage of a commodity, as is the case for wheat this week, markets make limit moves. near today’s close I took this snapshot of the number of unfulfilled bids in the pool is seen in the bid size column :

The Wheat market will re-open tonight @ 8:00 PM EST if the exchange moves to a .75 cent limit the dollar value of a limit move is $3750.00 per contract.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

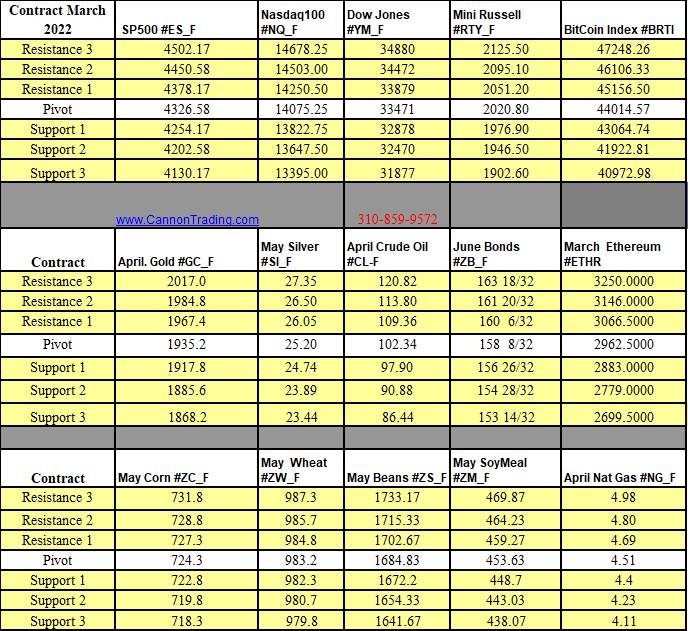

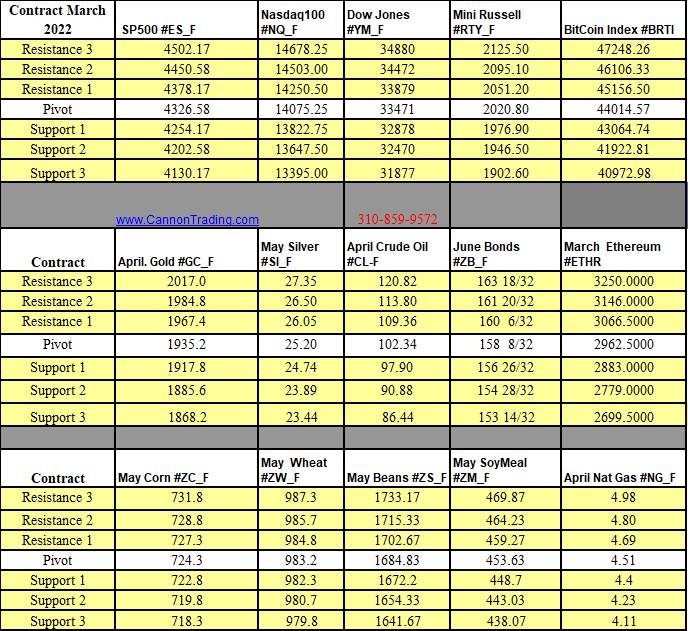

Futures Trading Levels

03-02-2022

Improve Your Trading Skills

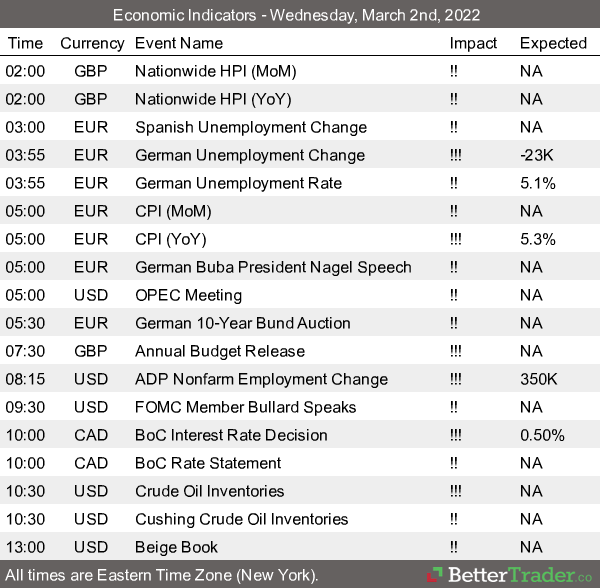

Economic Reports, Source:

http://BetterTrader.Co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | Grain Futures