The Week Ahead: CPI, PPI & Govt. Shutdown + Futures Trading Levels for Nov. 14th

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

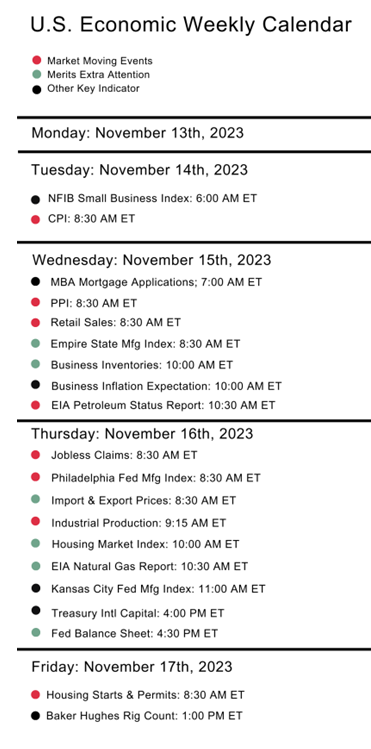

The Action Packed Week Ahead: Govt releases inflation numbers, over 2k earnings numbers, the Budget talks Friday deadline and 11 fed speeches.

By John Thorpe, Senior Broker

A respected daily futures market analyst : Hightower (free with a live trading account using the E-Futures trading platform, no charge) says about this week in the equities market:

“The next five days of trade could present historical volatility “

The Reasons are varied, from the issuance of the inflation numbers this week, CPI and PPI, to the Debt ceiling and the Moody’s downgrade of the U.S.’s debt to the middle of earnings season.

Tuesday:

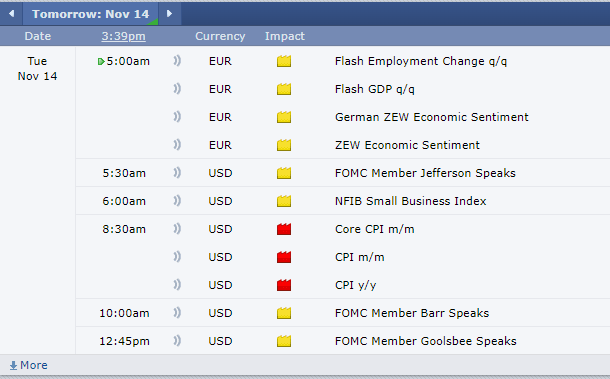

For CPI Expectations tomorrow morning @ 7:30 a.m. CST.

This from the Analysts desk at Morningstar: The Consumer Price Index report for October 2023 is forecast to show a continued overall decline in inflation, led largely by moderating energy prices.

However, economists expect core CPI (which excludes volatile food and energy prices) to show stickiness rather than improvement, holding at levels well above the Federal Reserve’s target.

According to FactSet, the overall CPI is forecast to come in at a 3.3% annual rate in October, down from 3.7% in September. Meanwhile, core CPI is expected to remain at September’s levels, with a 4.1% increase from a year ago.

CSCO Cisco earnings after the close1.03 EPS estimate

TGT Target earnings in the middle of the day EPS 1.46 sh estimate

Wednesday:

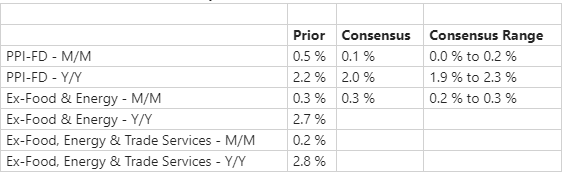

For PPI final demand the econoday estimates are as follows:

Thursday:

Ahead of the open Walmart WMT analysts expect 1.41 / EPS

Jobless claims @ 7:30a,m, CST the consensus range is 201k -225K new claims

Industrial Production @ 8:15 a.m. CST

Friday:

Housing Starts and Permits @ 7:30 a.m. CST

And a total of 5 fed speakers through out the day.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

11-14-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Improve Your Trading Skills

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.