Get Real Time updates and more on our private FB group!

Equity Price limits and Circuit Breakers Information by John Thorpe, Senior Broker

As traders during volatile periods, it’s important to know the rules

relative to trading halts and circuit breakers.

The following is largely from the CME rulebook, please understand the rules are different between the Overnight and Day sessions .

Equity product price limits and circuit breakers

Our U.S. Equity futures markets have a range of automated safeguards in place – some of which are coordinated with cash equity markets.

CME Group U.S. Equity futures have 7% price limits overnight and remain open for trading at that limit. If markets reach 7% up or down during the overnight session, they remain open but can only trade up to those price limits. Further, Dynamic Circuit Breakers will be in effect with a width of 3.5%. If a contract market moves beyond +/- 3.5% within an hour during the overnight session, trading will be paused for two minutes.

Daytime trading employs market-wide circuit breakers, a kind of price limit that halts trading for a period of time to help the market reset.

CME Group U.S. Equity futures markets are coordinated with stock circuit breakers at market 7%, 13%, and 20%. The 7% and 13% circuit breakers are each followed by 15-minute trading halts; if the 20% level is reached, the market closes for the trading day. Learn more below:

If you would like to know what the current price levels will be for the Equity markets you are trading at the 7%,13% and 20% levels,

please contact your broker at Cannon Trading as these numbers change daily based on the Previous days settlement price calculated in the last 30 seconds of trading– 2:59:30-3:00:00 PM CST

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

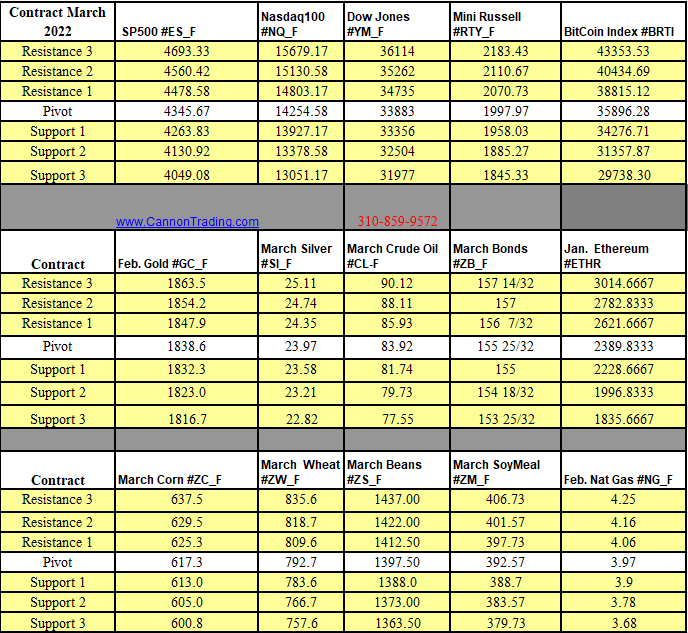

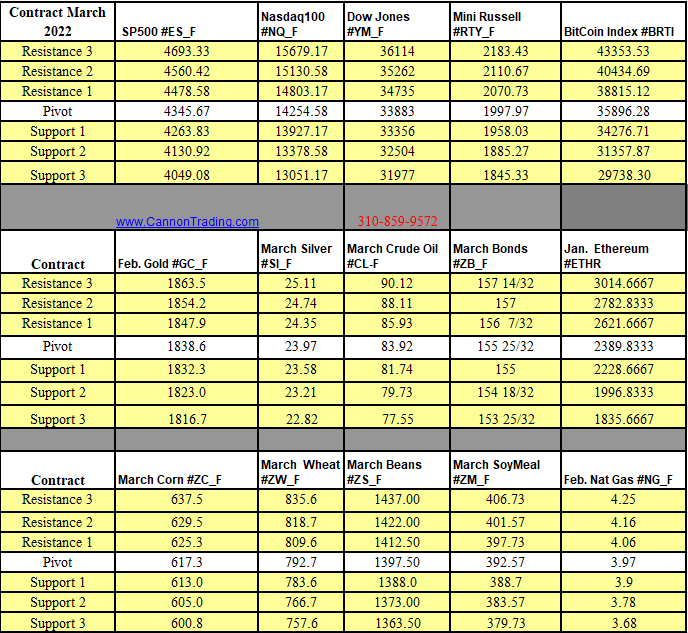

Futures Trading Levels

01-25-2022

Improve Your Trading Skills

Economic Reports, Source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | futures trading education