FOMC, Earnings, NonFarm Payrolls Ahead

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

The week Ahead:

By John Thorpe, Senior Broker

The Week ahead…. FOMC, More Earnings, earnings ,over 2000 companies reporting, who’s got the earnings ! another heavy week of earnings reports, AMD, Pfizer, Apple Headline earnings this week, both AMD and Pfizer are tomorrow, Pfizer pre opening and AMD after the close.. Apple reports after the close on Thursday May 4th.

FOMC WEEK! but wait! that’s not all… NonFarm Payrolls Friday morning before the open. This week, the fed fund futures market is anticipating a 92% probability of a .25 rate increase.. in spite for the suffrage of some banks and confidence of many depositors. Probabilities are measured thru the CME FedWatch tool, what happened to the other .08% probability? that’s what has been assigned to the” remain @ 4.75-5.0 percent” at the fed window. Wednesday @2pm EDT is the rate announcement followed 30 minutes later by the Honorable Fed Chair Jerome Powell’s statement followed by a brief q &A language is key in these matters to see if the Federal Open Market Committee thinks it’s time to lay of the gas for the near future.

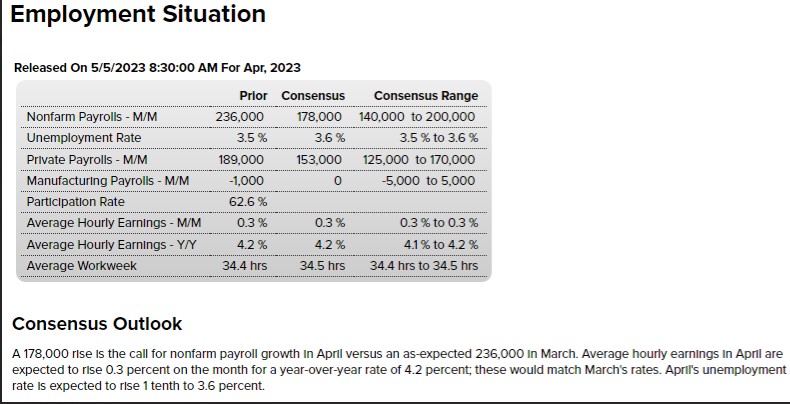

Lastly, Friday NonFarm Payrolls are to be released as they tend to be on the 1st Friday of the new month for the prior month,, here are the anticipated results, any real numbers that differ from the anticipated numbers will always move the market as the anticipated set of data tends to have already been discounted by the market.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

for 05-02-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.