I been asked by clients and prospects “What markets do you trade or follow now days?”

As brokers we follow and assist clients trade across many markets…as common as ES and NQ and as rare as overseas markets of all kinds and other markets that we help clients hedge like Cattle, hogs, grains etc.

When it comes to day-trading, especially with the current volatility I am a big fan of the MICROS. Mostly MICRO ES and MICRO NQ.

I personally also like both the 30 yr bonds and 10 yr bonds for shorter term and medium term trading.

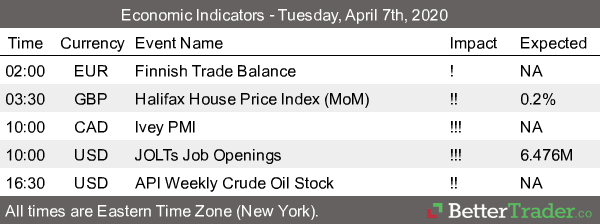

If you are a day-trader, read below and start following the bonds or 10 years and let us know if we can assist you in any way!

The ZB or the 30 year offers a different type of personality than the mini SP and other indices. It is more sensitive to certain economic reports and trades differently than other markets, just a total different personality.

The tick size on the ZB is 1/32 or $31.50 per one point/ tick.

I included some contract specs on the T Bonds futures below as well as an intra-day chart for your review.

The 10 yr notes or the ZN are very similar to the 30 yr except it does trade in half points, so minimum fluctuation is $15.625 and the 10 years will have smaller moves than the 30 yr although 90% in the same direction – MOST of the times…. ( opens the door for spread trading on a daytrading basis).

30 yr Treasury Bond Futures Specs

Hours: 05:00 PM previous day to 4:00 PM Central Time

Margins: $7150 initial, $6500 Maint. ( as of the date of this newsletter)

Point Value: full point = $1000 ( Example: 144.16 to 145.16 ). Min fluctuation is 0.01 = $31.25 ( Example: 144.16-144.17) Settlement: Physical Delivery

Months: Quarterly (March,June,Sep,Dec)

Weekly Options:YES

Some of the basic fundamentals to keep in mind when you are considering trading the U.S. 30yr Treasury Bonds for this matter:

1. Interest Rates.

2. FOMC Rate decisions and Language

3. Focus in macroeconomics

4. Bond Prices have an inverse relationship to Interest rates

5. Correlation to US Dollar prices

6. Inflationary prospects

7. Geopolitical Stability

8. U.S. Fiscal and Monetary Stability

Our brokers here at Cannon will be happy to chat about the Bond market, other interest rate products, other futures, options, futures spreads and much more! Feel free to

contact us at any time.

Trading Futures, Options on Futures, Gold Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.