Get Real Time updates and more on our private FB group!

“Take the Time to Learn How to Manage Trading Risks”

By John Thorpe, Cannon Trading Senior Broker

When speaking with customers, the conversation that often times bubbles up when speaking about trading results invariably leads to this question “what do you do when you trade?”, and Invariably my opening salvo is “manage the risks” there are a number of ways to mange the risks and reduce the costs of both losses and fees., You have to ask yourself why you are trading. are you trading just to trade? to alleviate boredom? I swear i have seen so many traders just drop the 25 cent piece into the slot and tug that one armed bandit hard. ” i need another cocktail! Where is my server? “… His or her chances to “win” are less than 10% Forget about luck , the video graphic reels or readouts on the machine are but visual representations of a predetermined outcome , the computers internal memory has already been spinning through millions of combinations the moment you pull the lever ( or push the button, think click your mouse), This may be stimulating for some and perfectly fine if you have the discretionary income to continue to feed your endorphin buzz. .. But for most of us , we need to understand our risk management style to incorporate into our trading. What I talk about is

stop loss orders ( yes stops), but wait, that’s not all and only a small part of the strategy, we need to have an understanding of how we can utilize a low cost options strategy as well, to compliment our trade idea. In addition, we can understand what markets may be correlated to the market you are trading and “spread off” your risk during a trade idea until you can see your plan unfold more clearly, then lift your spread from a correlated product and continue with your trade utilizing training stops, options, or whatever other tools are available, Hell! you can even change the delta on your positions with so many of the

new Micro contracts that have become viable risk management tools as well, Please spend the time to understand these and many other Ideas with a broker, your personal broker here at Cannon Trading, I am, with a degree of certainty, sure you will benefit from that conversation, which may be the beginning of a long term and possibly more profitable relationship. For a more satisfying and rewarding trading experience, as my colleague ,Ilan Levy-Mayer has said for years, ” Plan your trade and Trade your Plan”.

Are you using Sierra charts and looking to implement their Teton order routing?

If so, look no further, Cannon can assist you in getting set up!

The Teton Futures Order Routing service is a high-quality order routing service with advanced risk management from Sierra Chart to provide order routing, for outright futures and spreads, direct to the major exchanges. There is no other intermediary provider.

Orders are routed direct to the exchange with high reliability and very low latency, in under 500 microseconds.

Supported exchanges are CME, CBOT, NYMEX, COMEX, FairX.

This service is offered at no cost to both clearing firms and to users. It has no transaction fee per contract traded. To our knowledge this is an industry first. This Teton Order Routing service still provides very high quality order routing.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

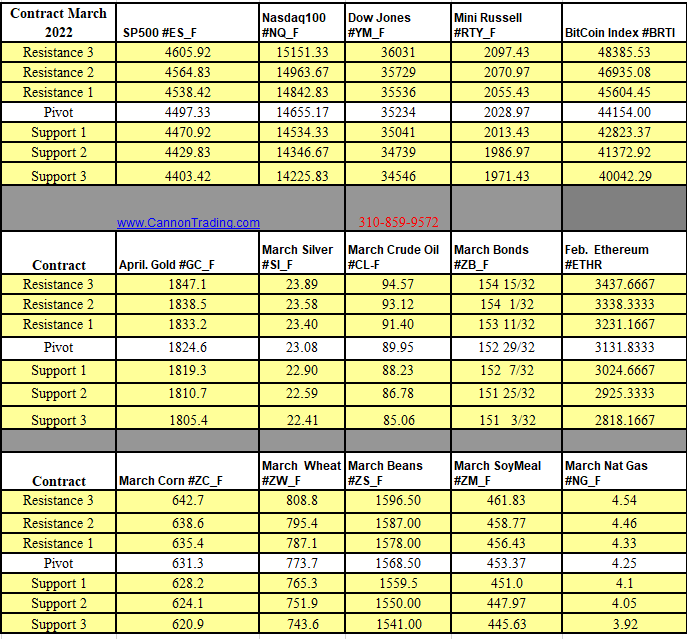

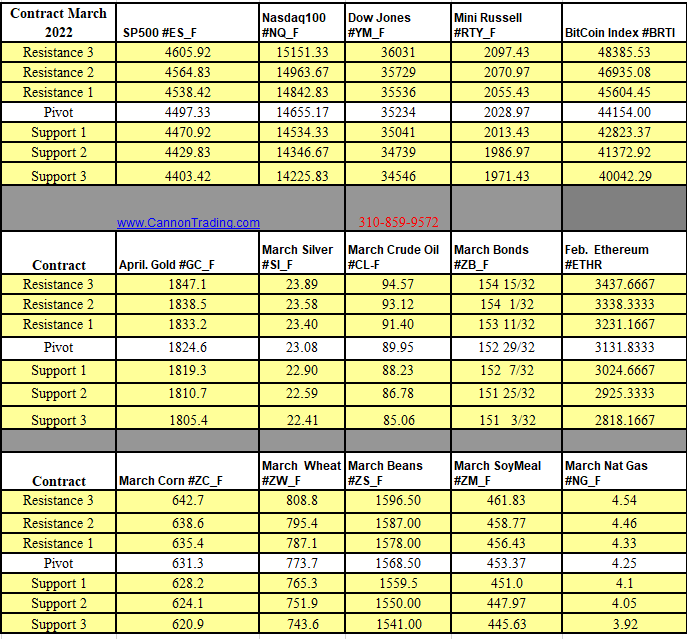

Futures Trading Levels

02-09-2022

Improve Your Trading Skills

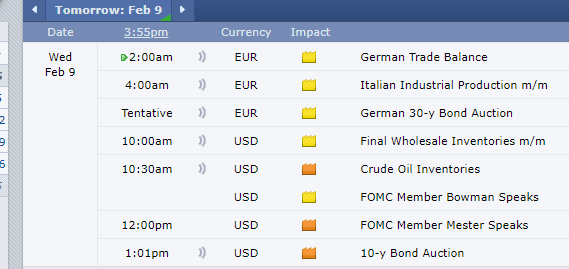

Economic Reports, Source:

ForexFactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.