Get Real Time updates and more on our private FB group!

Overtrading the Afternoon

By Josh Meyers, Cannon Trading Series 3 Broker

Knowing when (or NOT) to trade can be difficult. Keeping a close eye on volume can help. Defining “normal” volume for your trading style will help you through behavioral shifts in the markets. Improving this problem can be as simple as watching volume/price move through time.

Watch volume through time. Holiday sessions, busy days, around FOMC, across different volatility environments, etc. Patterns in your performance will become more evident, and you’ll develop rules and systems around your traits as a trader.

There’s also another aspect that shouldn’t be underestimated. Most discretionary traders are more mentally/physically fatigued in the afternoon, which makes it easier to slip-up, especially in unfamiliar trading conditions. Knowing when to hang it up for the day is an underrated trading skill.

Here are a few tips

(These are for opinion/educational purposes only)

I like to watch a 30m price chart, with a faster chart for volume(1m or faster) so I can compare the two relative to one another. Watch both big and small and take note of the behavior. You don’t always have to trade! Sometimes watching to learn is beneficial. Watching different time frames allows for better context and helps to keep a trader out of tunnel vision.

Define a “normal” trading environment for your system and observe how instrument behavior changes based on external factors like time of day or fundamental factors.

Keep an eye on yourself mentally and physically as you trade. Make sure you’re trading with focus and direction. If your performance is suffering, take a break. Although taking a break can be hard, it’s sometimes the best solution for a trader’s performance. If you don’t feel good about trading, it’s ok to walk away.

Shifts in market behavior can be unexpected. Sometimes it happens slowly, sometimes quickly. Try to avoid tunnel vision or putting too much emphasis on a particular trade/entry as it could lead to an expectation or bias for the following trades.

A few additional tips for the active management of overtrading:

Set a timer between trades

o Pick a spot for an order and let the price come to you.

The need to be right about a trade can be more costly than accepting a loss

- Actively look for better spots. Trade less, look more. Seems simple I know……

- Practice self-assessment. How am I doing? Am I following my plan?

Hope this helps!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

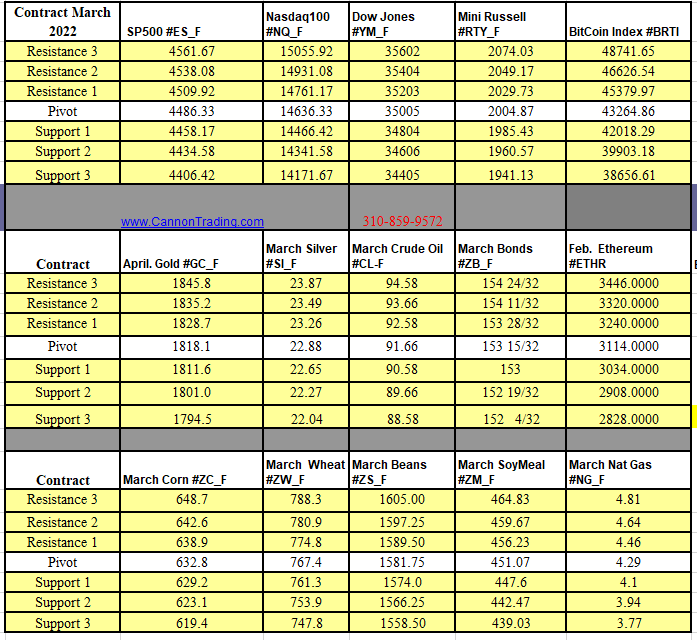

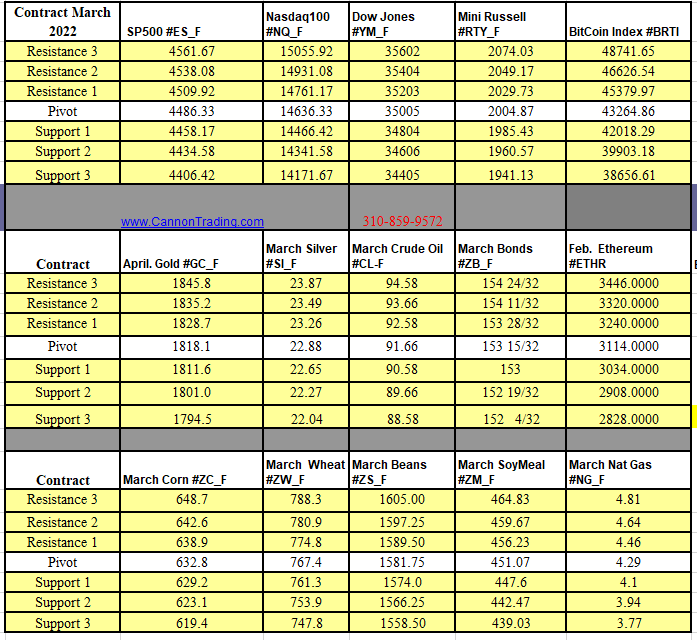

Futures Trading Levels

02-08-2022

Improve Your Trading Skills

Economic Reports, Source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | futures trading education