A Note on using Futures Spreads & Support and Resistance Levels 3.22.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

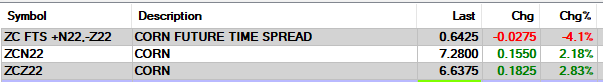

A Note on using Futures Spreads

By John Thorpe, Senior Broker

Futures spreads are a way to get involved in trending markets at a lower margin cost and often times can give the trader staying power to last weeks if not months. If you were thinking about entering the

Crude market, or the

Grain markets but were psyched out by the volatility of an outright long or short futures position.

Futures Time Spreads or Calendar spreads where the trader goes long one month and simultaneously goes short another month of the same commodity is a way to engage your margin dollars in a trend. Some advantages of using a spread are

1.) Timing-you can be wrong about the timing of entry but have staying power to be patient for the trend.

2.) Cost efficient- the margin dollars required to hold a spread can be significantly lower than holding an outright position.

3.) Charting-you can chart a spread just as easily as you can an outright and run all the same technicals you are used to.

4.) Liquidity-most common

calendar spreads are liquid at all times of the day. allowing you to enter or exit with ease.

Some examples of Calendar spreads would be in the grain markets,

Long July Corn and Short December Corn, this would be a Bull spread. Or

Long July Soybeans and Short November Soybeans, again this is an example of a Bull spread. Another term for Grain spreads such as those mentioned are Old crop/New Crop spreads. buy the current marketing year crop ( harvested last year) and sell the futures contract that represents the crop yet to be harvested, the new crop.

On the E-Futures trading platform

(FREE DEMO) you can pull up the market for these spreads using a simple formula, and you can view the DOM as well!.

If you are looking for other reference material please

contact your Cannon Broker for lists of solid, informative and helpful trading tomes

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

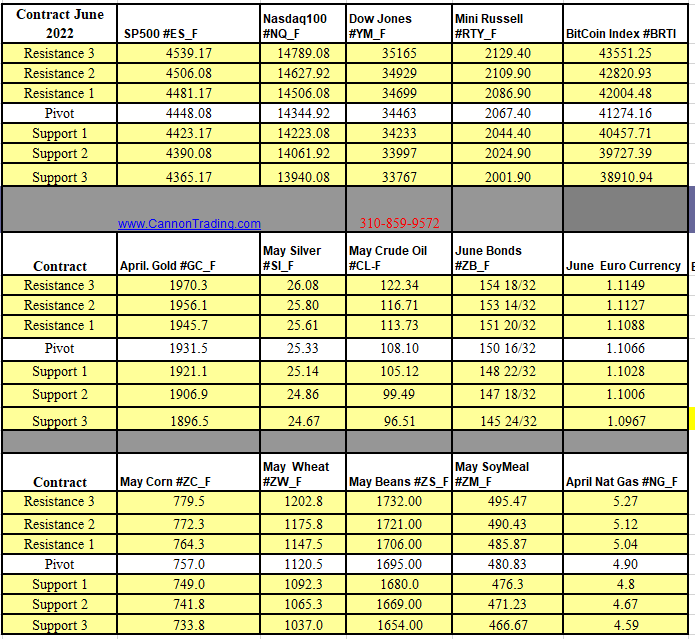

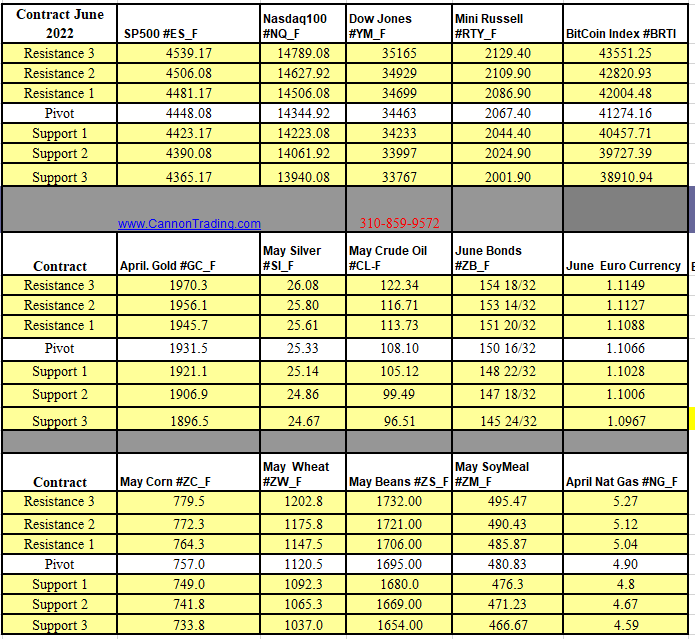

Futures Trading Levels

03-22-2022

Improve Your Trading Skills

Economic Reports, Source:

http://BetterTrader.Co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | Grain Futures