Limit Moves & Daily VIX chart & Trading Levels 6.12.2020

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

I’ve received some questions about the price limits or circuit breakers we have seen mostly in stock index futures. Hopefully this explains things a bit better:

A price limit is the maximum price range permitted for a futures contract in each trading session. When markets hit the price limit, different actions can occur depending on the product being traded. Markets may temporarily halt until price limits can be expanded, they may remain in a limit condition or they may stop trading for the day, based on regulatory rules.

This is for Stock Index futures but keep in mind MANY other markets are experiencing LARGE swings and moves.

Overnight limits (5:00 P.M. – 8:30 A.M., Central Time): the futures contract is limited to a 5% price move up or a 5% price move down, based on the futures contract’s prior day’s settlement price (3:15 P.M., Central Time).

This applies to the main stock index futures contracts available, such as the ES, MES, NQ, etc.

What is so dangerous you may ask?

If you are long an ES during the night session and the market is limit down (5%) you can NOT get out. There is a chance that when the market opens up at 8:30 AM CDT that the market will then go down the 7% limit with out you being able to exit. That means that on certain situations you can lose MORE than you have in your account.

If you don’t understand how the circuit breakers/ price limits work…make sure you call us and talk to a broker at + 1 310 859 9572

This only applies for the overnight session ending at 8:30 A.M. Central Time. At that point, a new set of rules kick in ONLY to the downside….

-7% Trading Halt 15 mins

-13% Trading Halt 15 mins

-20% Closed for rest of day

_______________________________________________

So we went from 6 weeks of lower volatility, overall higher stock prices to Dow being down over 1900 points at one point today!!

This is MAJOR alert in my opinion that market sentiment has changed.

Be aware and if the below applies, you are in a better spot….

If you know how to take a loss.

If you know how to reduce trading size based on volatility.

If you know how to trade spreads ( NQ vs ES?)

If you understand options spreads.

THAN there are some very interesting set ups out there ( STILL with HIGHER RISK than normal). However if none of the above applies to you, the risks outweighs the potential opportunities. – PERSONAL opinion

Watch the 40 level basis the July contract!!

Good Trading

Trading Futures, Options on Futures, Gold Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

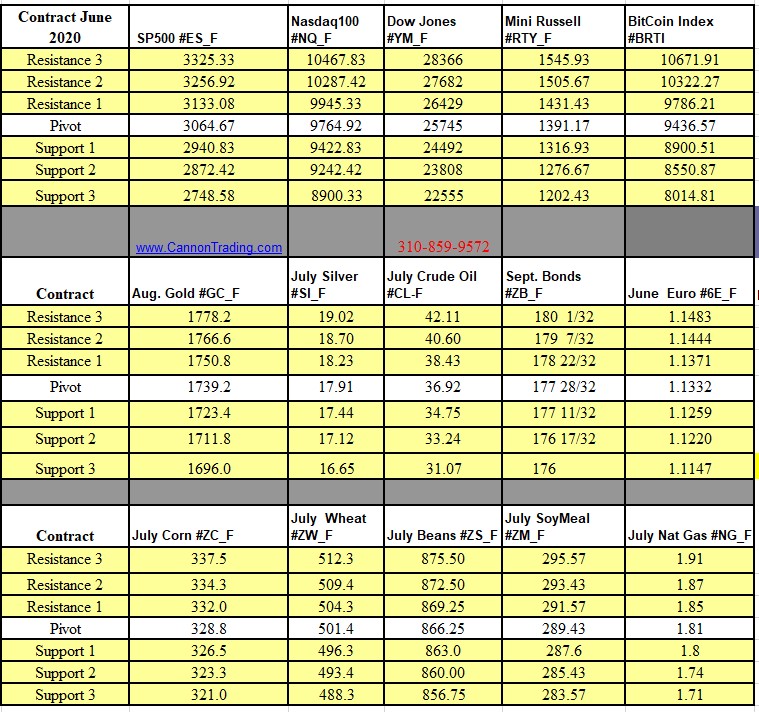

Futures Trading Levels

06-12-2020

Did you know?

Economic Reports, source:

Order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained.

Posted in: Future Trading News