CPI, PPI, Fomc…busy week ahead + Futures Levels 6.13.2023

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

The Week Ahead:

By John Thorpe, Senior Broker

Stock index price volatility is anticipated to pick up this week with the release of several key U.S. Government reports tied to inflation. It begins early Tuesday morning and continues through Thursday.

Before we get into the details , volatility typically = additional risk.

Some traders welcome the additional price movements as it may play into their collective strategic hands, while many other traders not only create a strategy that is based on smaller more well defined price movements but, rely on reduced volatility to trade successfully.

It is an urgent matter to understand what kind of trader you are, what type of system and indicators you employ and plan your trade around these reports as you see fit.

In anticipation of the release of these numbers, some clearing firms will be increasing the day trade margin rates during this time. Please contact your broker for any questions as it relates specifically to your clearing firm and and account so you have plenty of time and capital resources to plan for these changes. Many times these short term increases in margin rates are for a matter of minutes. be prepared.

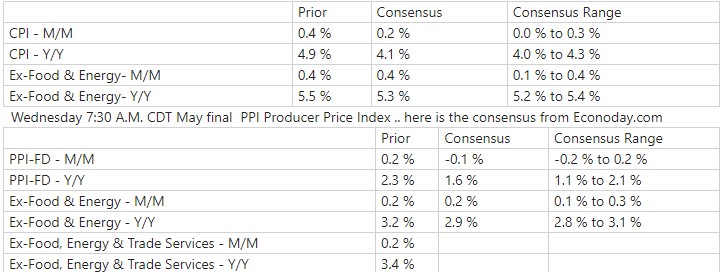

As for the details, : Tuesday 7:30 a..m. CDT May CPI Consumer Price Index here is the consensus from Econoday.com

and Finally @ 1:00 P.M. CDT the Fed meeting concludes and the decision on the target range for fed funds will be released, followed by a 1:30 P.M. J, Powell News Conference with a Q & A session.

Thursday, Jobless claims, Retail sales and Industrial production close out the meaningful reports for the week as Friday should be a balancing day prior to the weekend and after the June ES expiration! Strap your seat belts on!

Understanding expectations will allow you to trade with more confidence when there is a sudden change in policy directives!

Rollover is here for stock indices. i.e., the E-mini and Micro S&P, Nasdaq, Dow Jones and Russell 2000.

Volume in the June contracts will begin to drop off until their expiration next Friday, June 16th (8:30 A.M., Central Time). At that point, trading in these contracts halts. Stock index futures are CASH SETTLED contracts. If you hold any June futures contracts through 8:30 A.M., Central Time on Friday, June 16th, they will be offset with the cash settlement price, as set by the exchange.

The month code for September is ‘U.’ Please consider carefully how you place orders when changing over.

Watch the video below on how to rollover your market depth and charts!

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

for 06-13-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.