Trading Competition! Win REAL Cash + 4th of July Trading Hours

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Bullet Points, Highlights, Announcements

By Mark O’Brien, Senior Broker

General (agriculture):

The U.S. is well into summertime and with it agricultural futures, particularly field crops like corn, wheat and soybeans have gained in stature as already-planted crops are growing and developing toward their fall harvest. At the same time, corn, wheat and soybean futures contracts have seen seasonal and meaningful increases in trade volume. Along side this development, this year has seen noteworthy volatility in price movement. To provide some perspective on this year’s U.S. crop season is the futures exchange where these agricultural products’ futures contracts are traded: CME Group. While its exchanges make up the world’s largest operator of financial derivatives, it’s also an important source of futures research and education, with a collection of courses, lessons and webinars on trading, as well as a wealth of academic resources. For example, take a look at their report on corn released this week entitled, “Vol is High by the Fourth of July.” Get an understanding of how this crop year compares to other recent ones and what could be in store for prices.

More general (energy)

Keep an eye on the third-smallest country on the continent and the second-least populated there. It’s also one of the least densely populated countries on Earth (±10 people/mi²) with over 40% of its population living below the country’s poverty line. Because ever since the discovery of a collection of astonishing and promising oil finds in recent years – estimated at over 11 billion barrels of oil reserves off its coast – Guyana in South America has become an enlivened player on the world stage. With infrastructure investment dollars and know-how coming in from major energy players like Exxon Mobile, a formal invitation to join OPEC (so far, rebuffed), Guyana with a population of barely 800,000, has become the world’s fastest growing economy and is now ranked as having the fourth-highest GDP per capita in the Americas after the United States, Canada, and The Bahamas.

What level of attention have energy futures paid to the introduction of the largest addition to global oil reserves in the last 50 years? The early answer is very little, but worthy of monitoring. At ±360,000 barrels per day currently, Guyana barely moves the needle alongside the current ±90 million barrel-per day production globally. Still, oil demand is expected to decline in the coming decades and OPEC’s influence over oil prices has regressed in recent years as non-OPEC countries like the U.S. Brazil, Guyana and Egypt have collectively impacted the global supply/demand dynamic. This puts Guyana in a position to be an influential player as it works to increase production – with a planned 1 million barrels per day output by 2028.

Equity Index Futures Trading Challenge

Sign up for the Cannon Trading via clearing partner StoneX + CME Group Equity Index Futures Trading Challenge for your chance to sizzle the competition this summer – Trade Micro, E-mini, and Standard size contracts on the S&P, NASDAQ, Russell, and Dow Jones in a risk-free environment while competing with fe11ow traders for a cash prize•.

Use the Cannon Futures Trader Simulated Trading Environment and a virtual account of $100,000 to trade CME Group Equity Index futures. Increase your balance as much as possible between July 9th and July 21st for your chance to win!

Duration

Start date: July 9th 2023

End date: July 21st 2023

Prizes

1st Place: $1200

2nd Place: $850

3rd Place: $450

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

for 06-29-2023

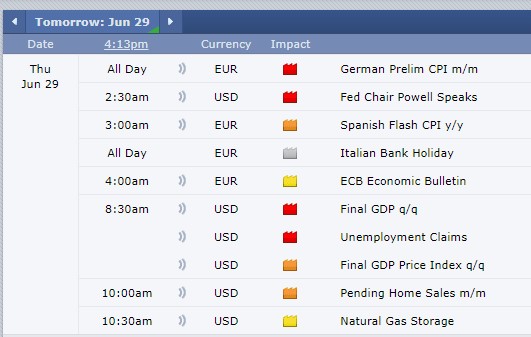

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.