FOMC Week + Futures Trading Levels for 6.14.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

FOMC Week!

By John Thorpe, Senior Broker

Federal Funds rate, the DOT Plot and CPI vs PCE

Wednesday , June 15th the U.S. Fed will release it’s guidance on short term interest rates in lieu of recent inflationary measures. One of the purposes of markets is to discount the potential for future events. When a rate announcement is made, price action in markets affected by the change tend to be muted. Conversely, a surprise announce will create more volatility in both directions as bids are cancelled, removing price floors or offers are cancelled removing price ceilings.

Here are some fascinating tools that are available to the novice and professional alike. If you have any questions about how to use them or read them please call your CannonTrading broker @ 800-454-9572.

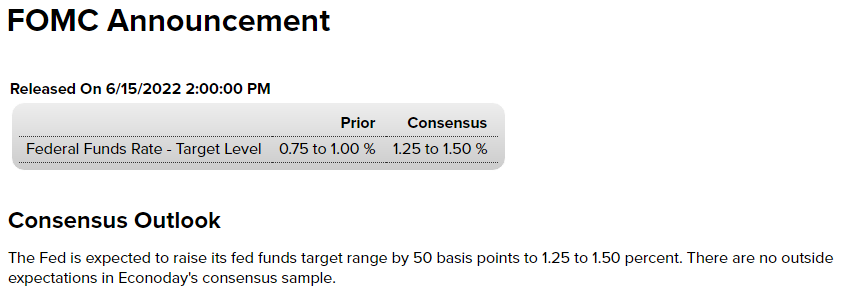

First here is a snapshot of the consensus from

There is a futures contract based on the FOMC Fed Funds rate and it’s the

30 Day Federal Fund Futures contract, listed monthly

ZQN22 will be the July FF Futures contract.

Please pull up the quote and feel free to trade this liquid contract.. The market prices actually reflect the probability of future rate changes. As most of us are aware, the Fed is currently in a rate hike mode and shouldn’t surprise you to know that by hiking short term interest rates, that’ should reduce the supply and appetite for cheap dollars. By raising rates, the fed would like to influence consumption of goods and services to stop the trend of inflationary price hikes across the broad economy.

The Fed has suggested during previous guidance that they key off of the PCE ( Personal Consumption Expenditures Price Index ) rather than the CPI (consumer Price Index) to base rate change decisions upon. A description of the differences can be found here

https://www.bls.gov/osmr/research-papers/2017/st170010.htmAnd Finally the CME has a wonderful “probalistic” tool called the “Fed Watch Tool” you will find the DOT Plot, probabilities of future rates all the way out to July 2023

Plan your trad and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

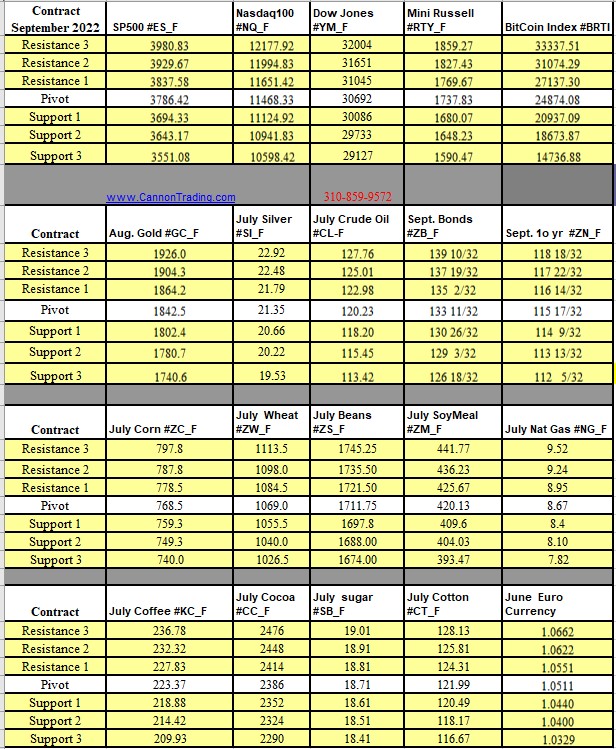

Futures Trading Levels

06-14-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Financial Futures | Future Trading News