Weekly Newsletter Issue # 1033 – Trading Resources and more! 12.21.2020

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

_________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Christmas Holiday Schedule available HERE.

PLATINUM Review by Mark O’Brien, Sr. Broker:

This week’s market focus in on a futures contract whose name is derived from the Spanish term platino, meaning “little silver.” This is Platinum, one of the rarer elements in the Earth’s crust (only a few hundred tons are produced annually with 80% of the world’s production coming from South Africa) and one with important applications. This is also a futures contract that has increased in price from ±$600 per ounce last March to ±1050 per ounce as of this typing – a ±$22,500 dollar move.

What’s next for this metal? We think higher prices are in store. Against the backdrop of daily U.S. Covid-19 infection records and incomprehensible CDC projections for the next 3-4 months – and possibly the darkest days of this pandemic, we also are seeing projections of up to 100 million people vaccinated by the end of February and other encouraging statistics related to the ongoing holiday surge in infections rendering people no longer under the threat of illness. Add to that the explosion of Chinese demand for base commodities and our expectation for a continued slide in the dollar, we are camping with commodity bulls and looking up at platinum’s all-time high in 2008 at $2286 per ounce and estimating there is room to continue higher in that direction.

|

|

To access a free trial to the ALGOS shown in the chart along with other tools, visit and

sign up for a free trial for 21 days with real-time data.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

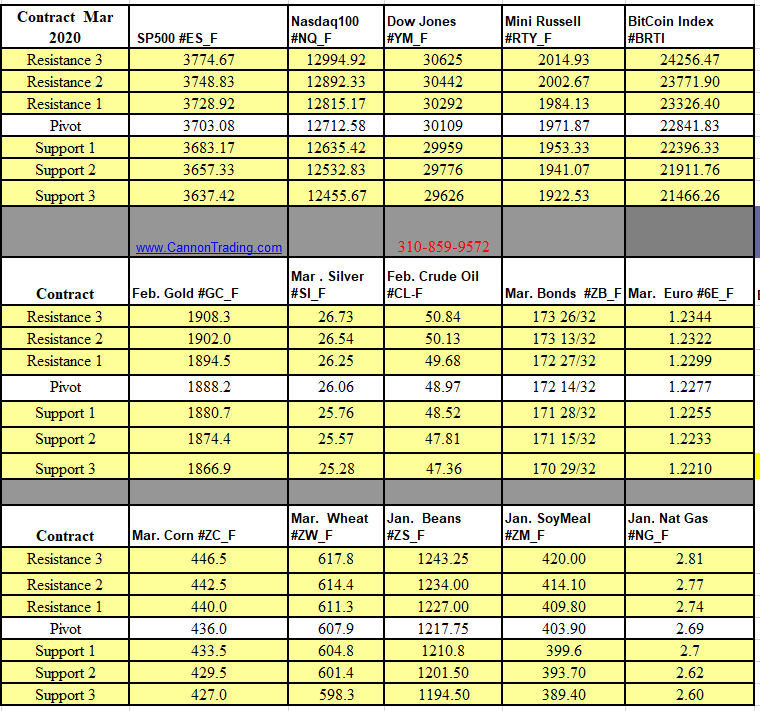

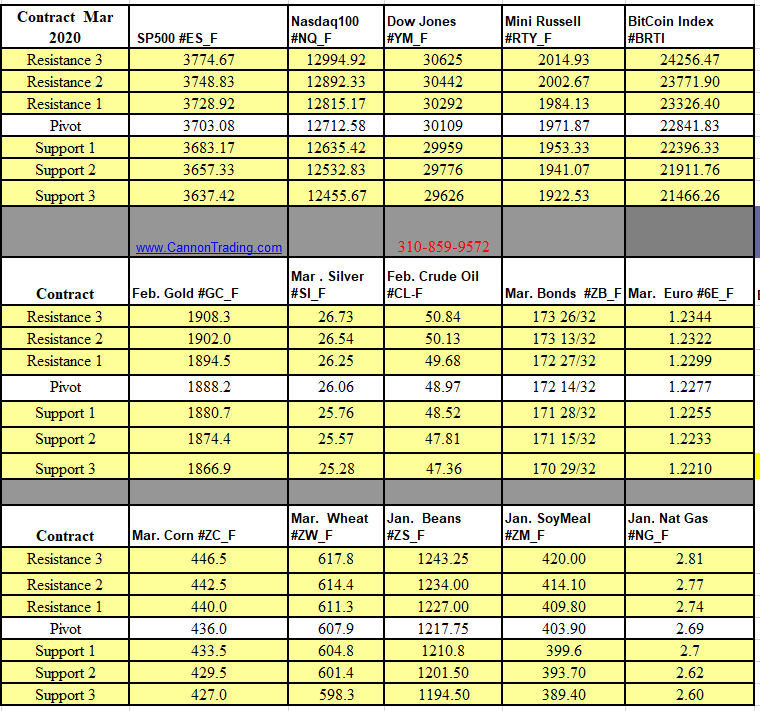

Futures Trading Levels

12-21-2020

Weekly Levels

Economic Reports, source:

www.mrci.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | Weekly Newsletter