“What Futures Markets Would you Recommend a Newcomer to Start With?” & Futures Trading Levels 7.31.2020

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

_________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Day Trading Futures

Dear Traders,

Tomorrow is the last trading day of the month. I have noticed markets will sometimes act “different” on the last and first trading days of the month.

Depending on which markets you like to trade, do some homework, look at last and first trading days of the months from previous months, see if there are any patterns you can see, certain times of higher volatility etc.

On a different note, I was asked this morning, “what futures markets would you recommend a newcomer to start with?”

While the answer will vary based on perspective trader risk capital, risk tolerance, personality etc. I do think that there are a few markets that might be a better start for first time futures day trading.

I personally would say, leave the mini SP alone. yes it has the biggest volume but there is quite a bit of size on the bid/ask that may make this frustrating for new traders.

My favorite markets to share with first time traders are:

MICRO mini sp

MICRO NQ

mini Dow

ten year notes

and

mini crude/ mini gold

The MICROS on both NQ and ES will track the ES and NQ 99.99% are tenth the size and are excellent products in my opinion for day trading futures newcomers.

The mini Dow moves similar to mini sp but the value per point/tick is smaller, still has good volume but not as hard to get filled on the limits as the mini SP

The 10 year notes are usually less volatile than the other markets mentioned. Completely different type of trading personality and offer a good diversification option for new traders and experienced traders.

The mini gold and mini crude are another good option because it is the smaller contract size of two markets that can really move, offer volatility and RISK but the availability of the mini sized contracts make these two a better option for beginners until one has experience / risk capital and appetite for the standard contract sizes of gold and crude oil.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

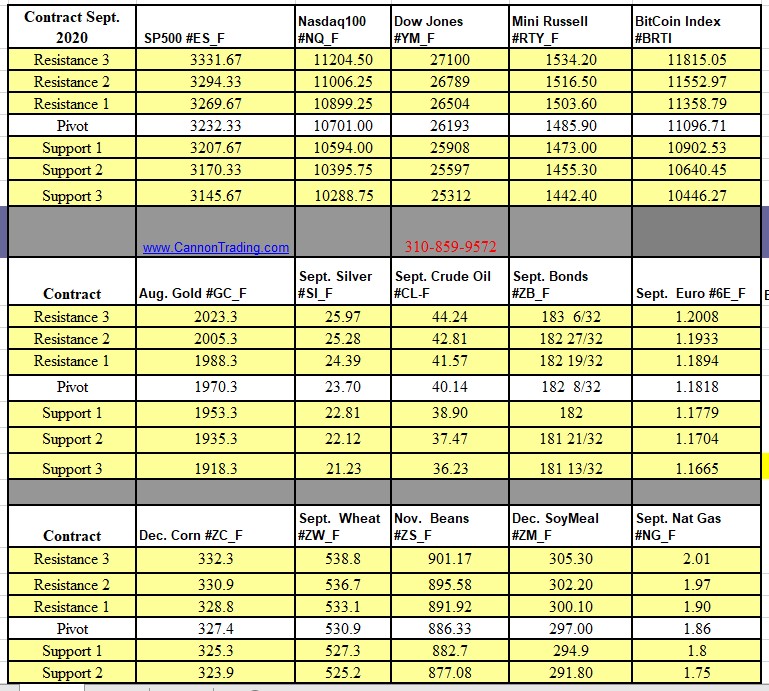

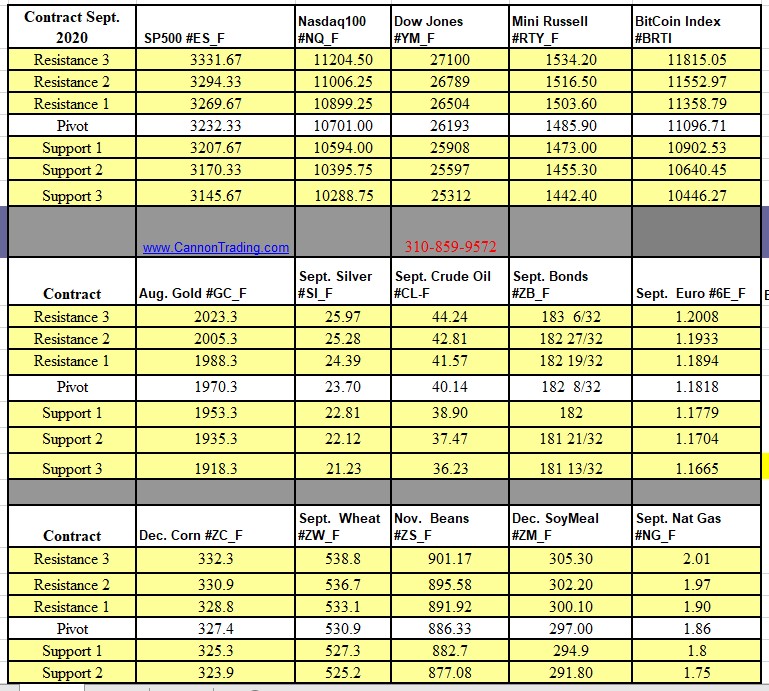

Futures Trading Levels

7-31-2020

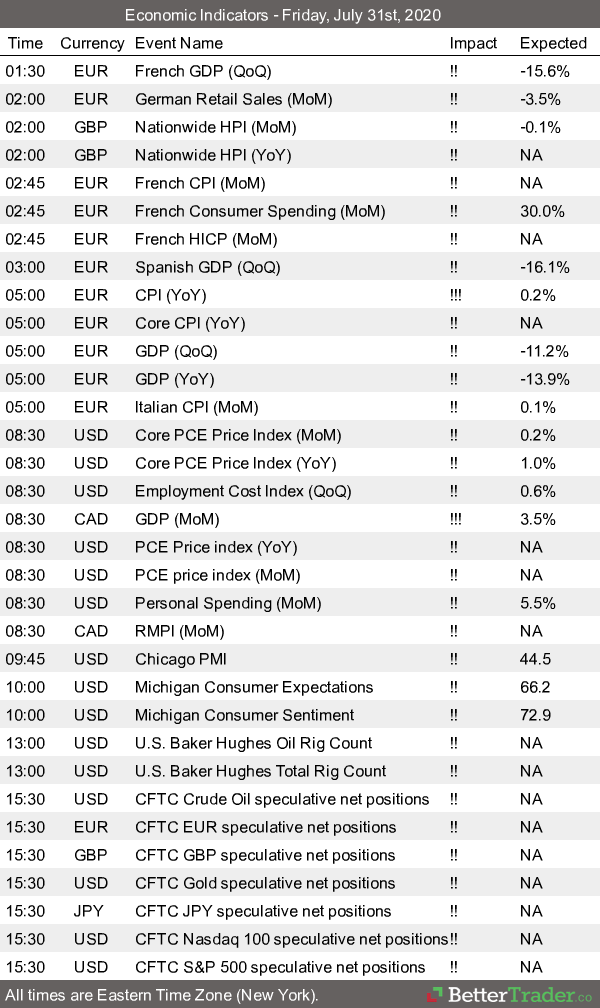

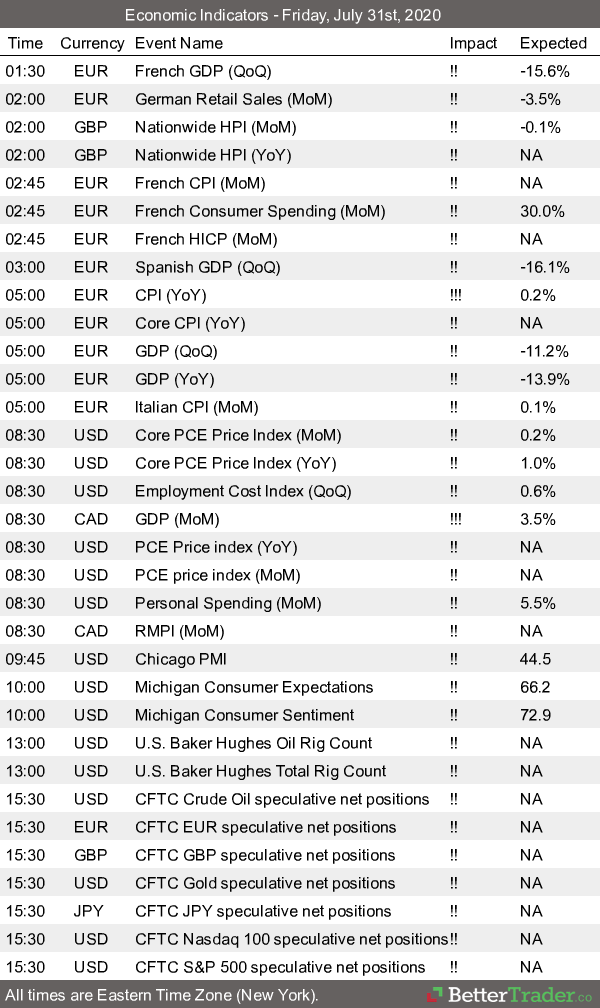

Economic Reports, source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News