FOMC RECAP & Support and Resistance Levels 3.17.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

FOMC RECAP by Mark O’Brien:

All eyes and ears were on the Federal Open Market Committee’s meeting and Fed. Chairman Powell’s post-meeting press conference earlier today. The Fed issued its statement at 1:00 P.M., Central Time. The 0.25% boost to the target federal funds rate (the benchmark for short-term interest rates) was the Fed’s first rate increase since the beginning of the global pandemic. The expectation is that this is just the first of several interest rate increases – one of the means by which our current 40-yr. high inflation reading might be tamed. Despite the seemingly small first step, Fed policy is an ongoing massive and complicated effort to control inflation and spur job growth – the Fed’s well-known and important dual mandate – particularly in these times. The Russian invasion of Ukraine, its accompanying high energy prices – affecting other commodities markets – and their implications on the economy all make the Fed’s decision to take this first step a significant one.

Yet, not to sound trite, but now that this is in the rearview mirror, it’s back to following the less predictable and all-embracing disaster that is the war in Ukraine, which is unquestionably the main catalyst to price instability in the near future.

If you are looking for other reference material please

contact your Cannon Broker for lists of solid, informative and helpful trading tomes

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

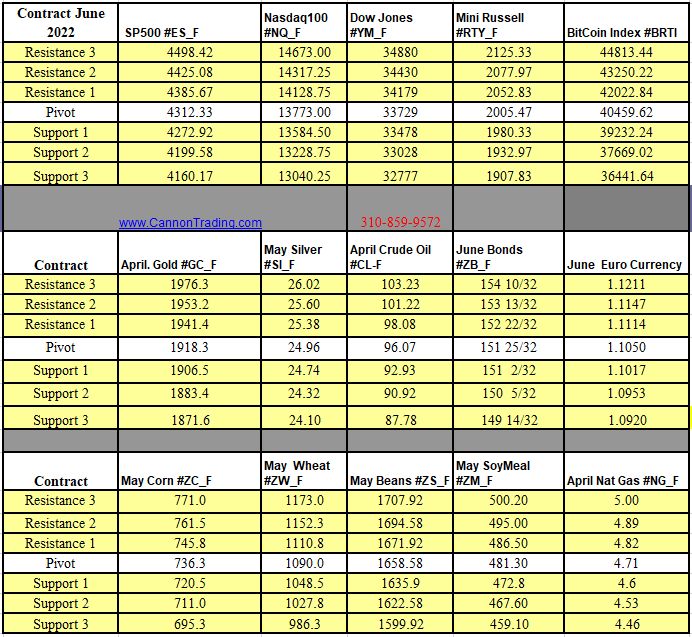

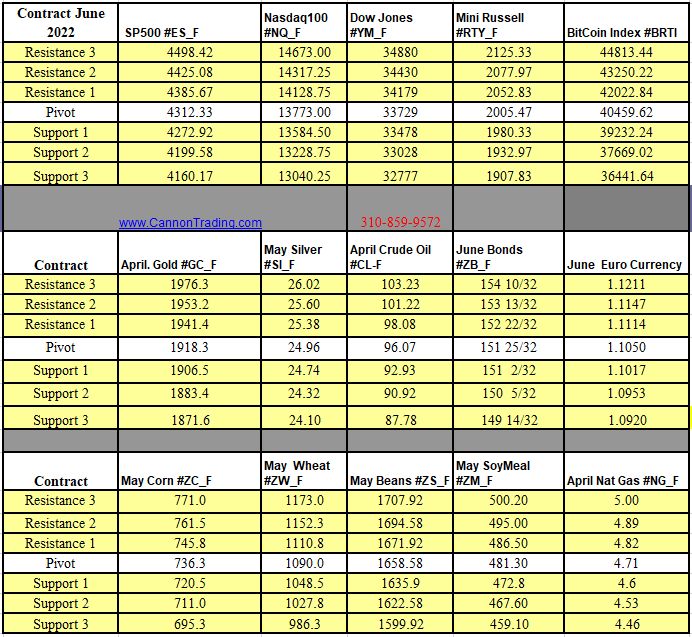

Futures Trading Levels

03-17-2022

Improve Your Trading Skills

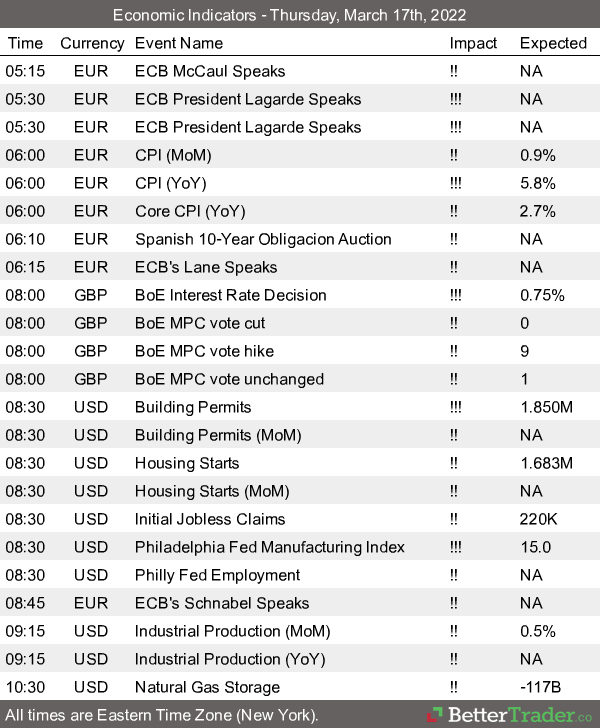

Economic Reports, Source:

http://BetterTrader.Co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | futures trading education