The Week Ahead: Earnings, Govt Reports, Powell Speech + Futures Trading Levels for Nov. 7th

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

The Week Ahead: Earnings, Govt Reports, Powell Speech and any geopolitical developments

By John Thorpe, Senior Broker

Earnings, Govt Reports, Powell Speech and any geopolitical wrangling’s, events or additional crises always have the potential to move markets away from their trading ranges.

First up are the earnings reports, This week, due to the fact we don’t have any big names ( FAANG) reporting. Those 5 stocks individually can swing the markets violently on their respective earnings days with any surprises.

Instead, this week, we have 1400 plus earnings reports out on some names you would certainly be familiar with like Disney. The market is looking this week at sector earnings since there is no large cap phenom reporting the week.

IF the biomedical group stumbles with earnings this week, or the retail sector shows signs of weakening, construction sector, finance, the market will be looking at the health of sectors this week as earnings are pumped out before the open, during and after the trading sessions. So don’t expect sharp movements in the stock index prices this week from Earnings, but you can expect markets turning over in a more measured manner as reports flow.

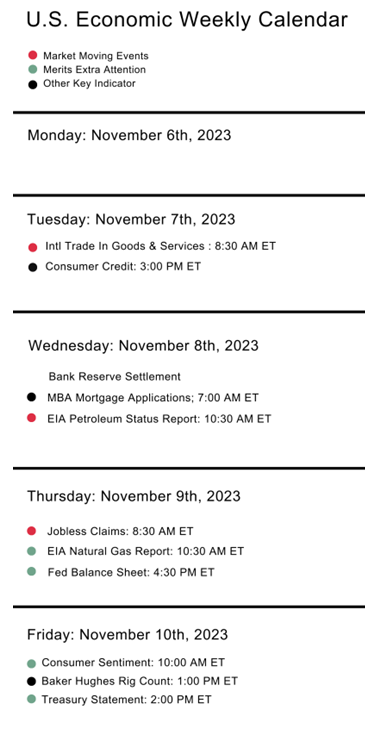

Governmental Reports: yes we have a few but they tend to by a bit more fringe than say NFP or CPI, we do have a Jobless claims number this week on Thursday @ 7:30 CST.

Claims for November 4 week are expected @ 220K vs 217K the week prior. If you are looking for strong undercurrents in the markets you may find that Wednesday and Thursday will be your best bets. FRB Chair Powell will be speaking both days at separate events, Wednesday very early @8:15 CST followed by a later 1PM CST Thursday talk.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

11-07-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Improve Your Trading Skills

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.