Adjust your Trading to Volatility & Futures Trading Levels 8.31.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

December is now the front month for bonds, ten years, Silver, Copper, most grains, metals and softs.

ASP unemployment early in the session and later Crude oil inventories.

Also tomorrow is the last trading day of the month.

Last Friday Powell 8 minute speech injected volatility back into the markets.

Few pointers below, hope it helps.

*While I have no idea were the market is going from day to day, minute to minute, week to week etc. I do know that in the past, some of the sharpest and largest rallies were short covering after a large sell off. More often than not market sell offs and volatility like we are seeing do not end up as V type of action but more like U or W when it is all said and done.

*Expect the unexpected…

* Have an idea of what you are looking to do, keep in mind possible risk and have a game plan. Now more than ever, plan your trade and than trade your plan!

* Think money management, hedging risk while you are still trying to figure out how to profit.

* Know what is going on, reports, current margins, current limits and more.

· Consider short term options instead of futures and/or MICROS

*Trade smaller. The bands are much larger. Watch the VIX.

* DO NOT assume anything…if you are not sure, contact us and we will try our best to assist with the combined, vast experience we have here as a team.

My colleague, John Thorpe, Ex floor broker, contributed the following on the VIX and the VVIX:

We recommend all stock indices intraday traders to keep an eye on the VIX for directional clues and study, many of you have access through other means to view this critical trading barometer, VIX now trades 5 days per week ,23 hours per day. if you need to add the VIX data to your trading platforms , it’s 3 bucks per month, penny wise and pound foolish if you don’t. Contact your broker on how to add the Volatility Index traded through the CBOE to your trading platform

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

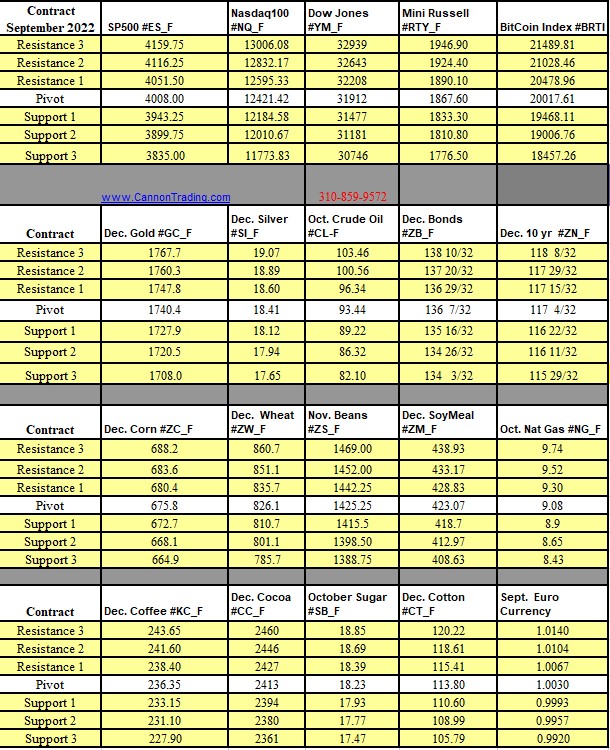

Futures Trading Levels

08-31-2022

Improve Your Trading Skills

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.