Get the latest S&P 500 VIX (Volatility Index) futures prices, monthly S&P 500 VIX (Volatility Index) futures trading charts, breaking S&P 500 VIX (Volatility Index) futures news and S&P 500 VIX (Volatility Index) futures contract specifications.

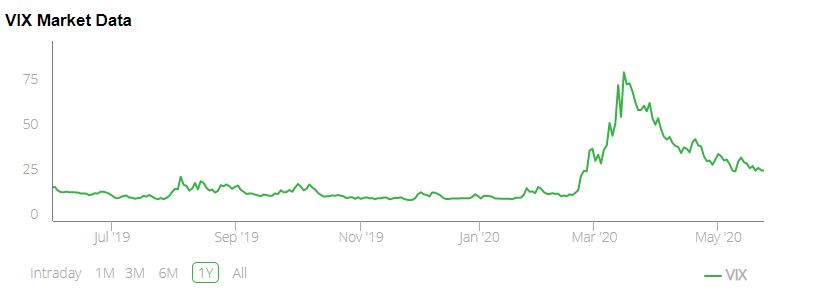

Chart of S&P 500 VIX (Volatility Index) futures updated May 28th, 2020. Click the chart to enlarge. Press ESC to close.

Disclaimer: This material is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

![]()

|

|

| Product Symbol | VIX |

|

|

| Contract Size | $100 X Index |

|

|

| Venue | CBOE |

|

|

| CBOE Hours | 8:30 a.m. to 3:15 p.m. Central Time (Chicago time). CBOE Volatility Index options will not open until the SPX opening rotation is completed. |

|

|

| Price Quotation | Stated in points and fractions, one point equals $100. |

|

|

| Minimum Fluctuation | Minimum tick for series trading below $3 is 0.05 ($5.00); above $3 is 0.10 ($10.00). |

|

|

| Position and Exercise Limits | No position and exercise limits are in effect. Each member (other than a market-maker) or member organization that maintains an end of day position in excess of 100,000 contracts in VIX for its proprietary account or for the account of a customer, shall report certain information to the Department of Market Regulation. The member must report information as to whether such position is hedged and, if so, a description of the hedge employed e.g. stock portfolio current market value, other stock index option positions, stock index futures positions, options on stock index futures; and for customer accounts, provide the account name, account number and tax ID or social security number. Thereafter, if the position is maintained at or above the reporting threshold, a subsequent report is required on Monday following expiration and when any change to the hedge results in the position being either unhedged or only partially hedged. Reductions below these thresholds do not need to be reported. |

|

|

| Last Trading Day | The Tuesday prior to the Expiration Date of each month. |

|

|

| Margin | Purchases of puts or calls with 9 months or less until expiration must be paid for in full. Writers of uncovered puts or calls must deposit / maintain 100% of the option proceeds* plus 15% of the aggregate contract value (current index level x $100) minus the amount by which the option is out-of-the-money, if any, subject to a minimum for calls of option proceeds* plus 10% of the aggregate contract value and a minimum for puts of option proceeds* plus 10% of the aggregate exercise price amount. (*For calculating maintenance margin, use option current market value instead of option proceeds.) Additional margin may be required pursuant to Exchange Rule 12.10. |

|

|

| Exchange Rule | These contracts are listed with, and subject to, the rules and regulations of CBOE. |

![]()