Energies and Equities Volatility & Support and Resistance Levels 1.20.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

Be Watchful for Stock Market & Petroleum Product Oscillations

By Mark O’Brien

The prevailing downward bias in

stock indexes has plenty of justification: a 1.4 million single-day case spike in infections last week, market expectations for up to four interest rate hikes this year, less-than-robust readings for last week’s initial jobless claims and retail sales, potential Russian military action against Ukraine, surging energy prices (

crude oil traded up to a 7-year high yesterday).

Yet, there are supportive elements capable of counteracting the equity index sell-off of recent days: traders may look at this latest correction as sufficient to compensate for future Fed. policy actions, rate hike fears will tend to moderate with softening economic data. The latest Omicron developments continue to be encouraging. New Covid-19 cases are plummeting in a growing list of places. Since early last week, new cases in Connecticut, Maryland, New Jersey and New York have fallen by more than 30 percent. They’re down by more than 10 percent in Colorado, Florida, Georgia, Massachusetts and Pennsylvania. In California, cases may have peaked. Acknowledging the tensions between Washington and Moscow, U.S. Secretary of State Anthony Blinken will meet with his Russian counterpart on Friday and promised “relentless diplomatic efforts to prevent renewed aggression and to promote dialogue and peace.”

Crude oil traders should expect the recent price increase to be met with increased volatility as political tensions involving major producers such as the United Arab Emirates and aforementioned Russia could exacerbate the already tight supply outlook. Blow-off tops should not be downplayed.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

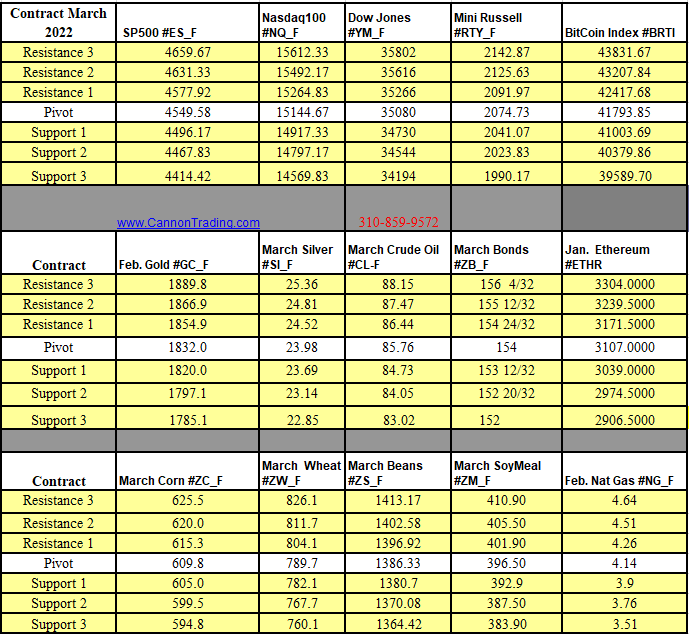

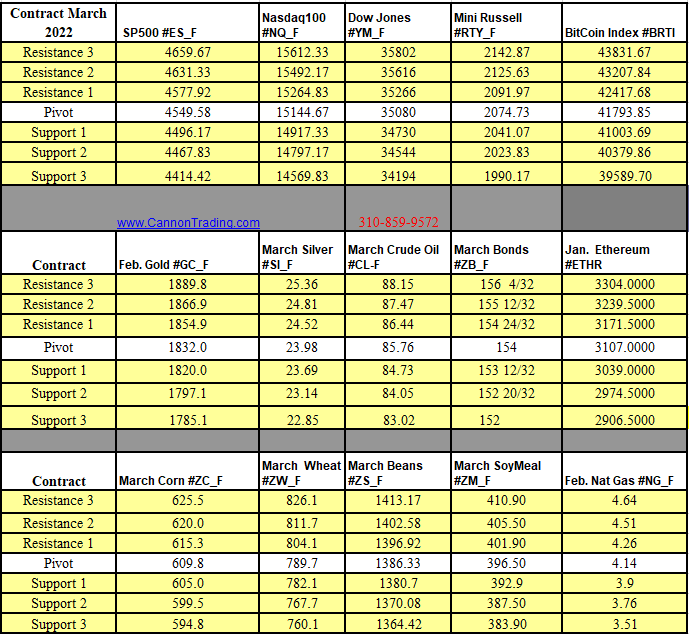

Futures Trading Levels

01-20-2022

Improve Your Trading Skills

Economic Reports, Source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | Index Futures