SP500 “Buy Program” & Support and Resistance Levels 4.08.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

Updates:

- CME has launched Aluminum futures! more info available here, contact us if you would like to trade Aluminum futures.

- Would you like to get access to daily research? Access info on what is moving the markets both technically and fundamentally? FREE TRIAL

- Would you like a FREE CONSULTATION? Set up a time to talk with an experienced broker on variety of topics such as trading methods, indicators, concepts, questions on options/spreads/platforms and much more!

Stock Index futures were significantly lower today but bounced sharply off support levels, news sources cited “buy program” – I mentioned this to a client who asked me what the hell does it mean….

My speculation is that large institution had a “resting order” to buy at that levels, perhaps

GTC order , perhaps new order but that was able to absorb all selling pressure and then price went higher, triggered more short covering, fueled intraday buying and helped an impressive intraday reversal.

Two big questions I have:

Am I correct?

What’s next?

My speculation is as long as we can hold today’s lows, higher prices are path of least resistance.

Break below and it is a different ball game…..

I asked my colleague, John Thorpe for his feedback:

Why the buy programs? an over simplification is where we have been.. take a look at that low we got the bounce from.. and April 6th back in collegiate statistics 101 one of the first things we learn are the differences and applications of the Mean, the median and the mode… using the 4450 area this number satisfies the definition of the median and the mode if we begin taking our data points from the beginning of Q1 2021 for at least the last 6 months 4450 is the midpoint. it’s not that hard see why that is a critical area for the current market and potentially why, when the market got down to that level, Buy programs engaged. this is not to say this is a Fed put. what it does align with are the similarities between where the market was back on august , 31st 2021 and on the open 2 11 22. remember when the

ES tested 4200 six times and successfully rallied? a close greater than 4500.00 is the goal and could be the springboard to a significantly higher move and, it may be possible there is a seasonal component too. all markets like to test and retest areas where they have been before. this is no different.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

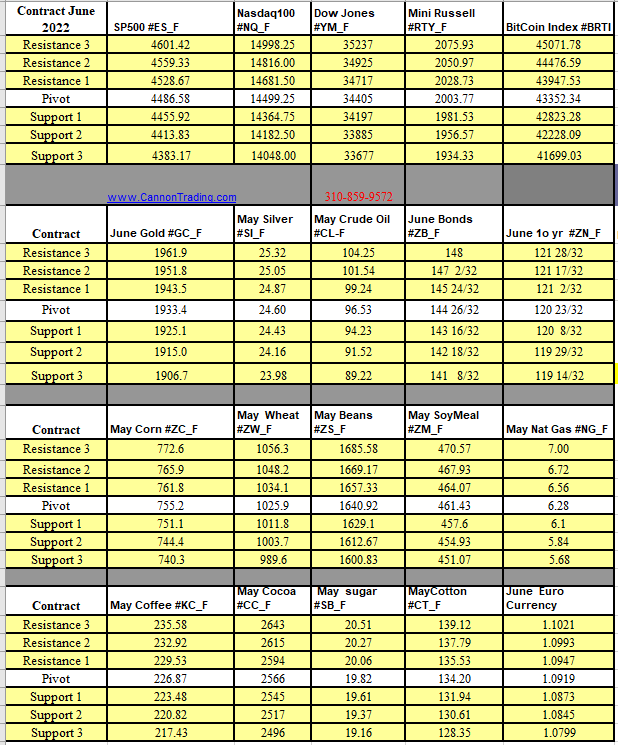

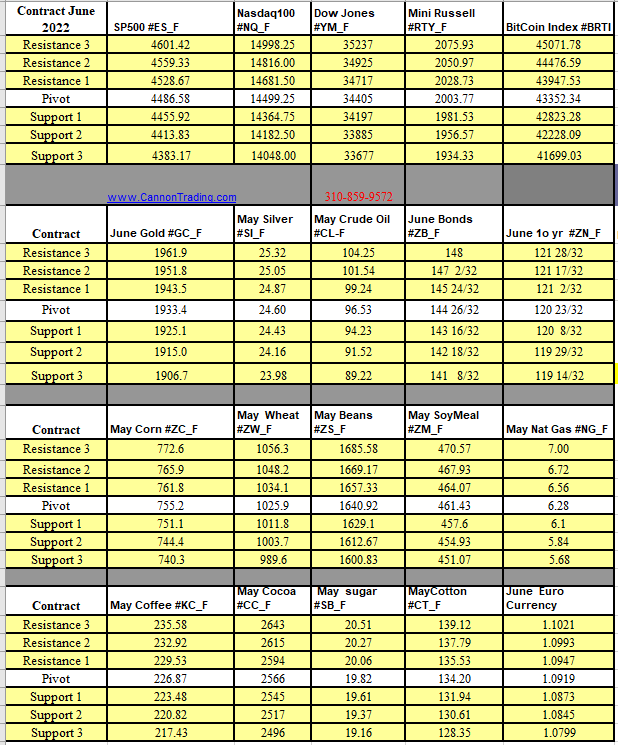

Futures Trading Levels

04-08-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | Index Futures | Indices