What You Need to Know if you are Trading Futures on Aug 31st 2023

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

What you need to know before trading futures tomorrow – Aug 31st 2023

by Mark O’Brien, Senior Broker

General:

Once again, we’re a couple of days away from the Labor Dept.’s release of its monthly Non-farm payrolls report – widely considered one of the most important and influential measures of the U.S. economy. The report is released at 7:30 A.M., Central Time on the first Friday of the month.

The annual Jackson Hole Symposium concluded last week and Federal Reserve Chair Jerome Powell declared further interest rate increases are not off the table. Even with higher loan rates making it harder to afford a car or a home or for businesses to finance expansion the economy is still growing. Core inflation (excluding volatile food and energy prices) remains elevated, consumers keep spending briskly and hiring continues with the U.S. employment rate still around 50-year lows. Chair Powell hewed to the Fed’s commitment to data dependance: the Central Bank “will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data.”

Softs:

Five trading sessions and a ±two-cent ($2,240) move up later, March ’24 sugar futures are once again threatening to break above 26 cents / lb., matching sugar’s 10-yr. highs. And life-of-contract highs for the March ’24 contract.

After a brief let-up including a weighty single-day ±24-cent ($3,600) intraday drop from its highs on Aug. 17th, Nov. orange juice rebounded and closed today at a new all-time high of $3.29.20 per pound.

Labor day is almost here, see modified trading schedule HERE

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

08-31-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Improve Your Trading Skills

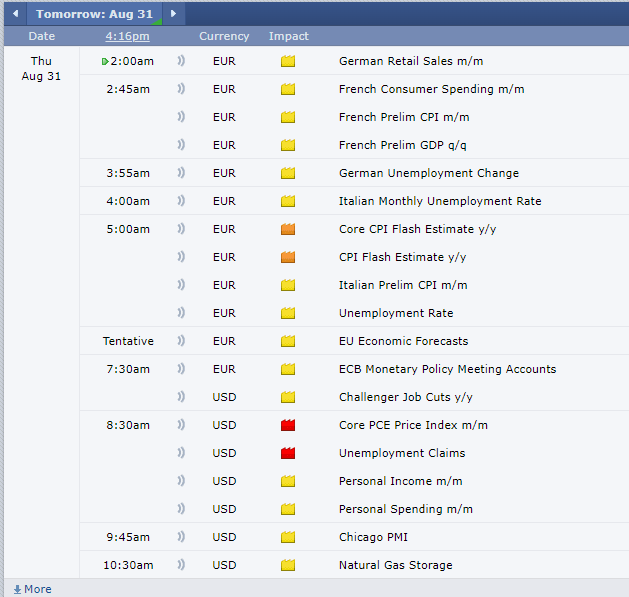

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.