WYNTK for Oct. 11th + Futures Trading Levels 10.11.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

WYNTK for October 11th…

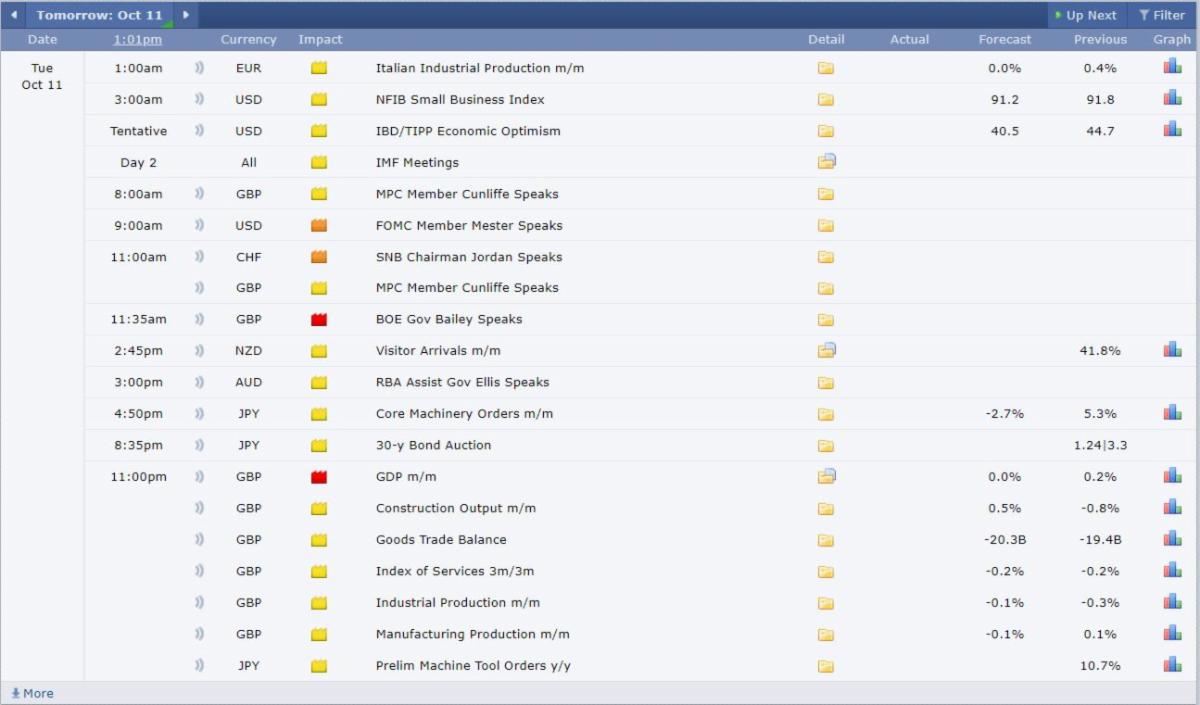

Market Volatility to remain this week. Please mark these times in your trading calendar. I always begin the week with a review of the scheduled economic data releases. This week, the fuel for volatility will be provided by what I consider to be 4 of the top five most impactful, market moving reports highlighting inflationary trends. First, on Wednesday at 7:30 am CDT PPI Final Demand consensus from Econoday.com is :

Producer prices have been cooling, edging 0.1 percent lower at the

headline level in August and rising only 0.2 percent when excluding food

and energy. September’s expectations are up 0.2 percent overall and up

0.3 percent for the core.

FOMC minutes of the most recent Fed Meeting will be released on Wednesday at 1:00PM CDT

This is the big one CPI Thursday 7:30 am CDT consensus from Econoday.com :

Core prices surged 0.6 percent in August with noticeable slowing to 0.4

percent expected for September. Overall prices are expected to rise 0.2

percent after August’s 0.1 percent gain. Annual rates are seen at 8.1

percent overall and 6.5 percent which would compare with 8.3 and 6.3

percent in August.

And finally, released at the same time, Jobless Claims Jobless claims for the October 8 week are expected to come in at 225,000 versus 219,000 in the prior week.

Be careful out there and please reduce position size during periods of likely , higher volatility . As always, plan your trade and trade your plan. Please contact your broker or Cannon Trading with any questions.

Leading Trading Platform for Hedgers, Farmers and Global Traders:

- Custom and Preset Quote Pages

- Charts

- Options

- QT News

- Weather

- QT Audio

- Messaging

- Bids

- Electronic Buy/Sell Grain System

- Order Entry Abilities

- RTD Live-link to Excel

- Producer Profitability Calculator

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

for 10-11-2022

SP500 #ES_FNasdaq100 #NQ_FDow Jones #YM_FMini Russell #RTY_FBitCoin Index #BRTI SP500 Dec. Gold #GC_F Dec. Silver #SI_F Oct. Crude Oil #CL-F Dec. Bonds #ZB_F Dec. 10 yr #ZN_F Dec. Corn #ZC_F Dec. Wheat #ZW_F Nov. Beans #ZS_F Dec. SoyMeal #ZM_F Oct. Nat Gas #NG_F Dec. Coffee #KC_F Dec. Cocoa #CC_F October Sugar #SB_F Dec. Cotton #CT_F Sept. Euro Currency

Improve Your Trading Skills

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.