Trading Levels for July 13th – PPI and the Bigger Picture

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Bigger Picture

By Mark O’Brien, Senior Broker

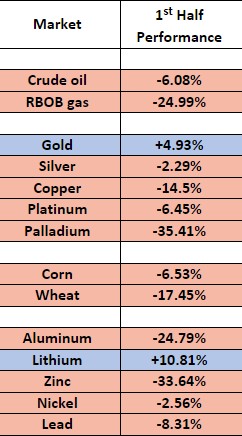

Taking a look at a relatively bigger picture of the world’s growth – or lack thereof – below you’ll find a list of natural resource commodities and their performance over the first half of the year.

The list is certainly metals-centric and no softs (cocoa, sugar, cotton, coffee, orange juice) or livestock were included. Nevertheless, it illustrates the broad theme of the global economy, in which the world’s leading demand engine – China – has experienced at best a sputtering recovery after nearly three years of pandemic-related falloff.

Notice just two: lithium and gold were the only ones heading into the second half of 2023 with positive returns.

Noteworthy is gold’s hold on to positive returns attributable to the relatively stable U.S. dollar and steady demand by the world’s central banks, which is likely to persist as long as the risk of recession remains for the big players – China, Europe and the U.S. – and high-quality, liquid assets remain desirable. Compare gold to crude oil, which despite output cuts by OPEC+ countries and forecasts for demand to continue outpacing supply into 2024, has stayed negatively impacted by stalled economies.

Plan your trade and trade your plan.

Watch video below on ways to project exits on trades.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

for 07-13-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.