Cycle Detrending: Can you use Cycles to fortify your trading acumen?

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Cycle Detrending: Can you use Cycles to fortify your trading acumen?

by John Thorpe, Senior Broker

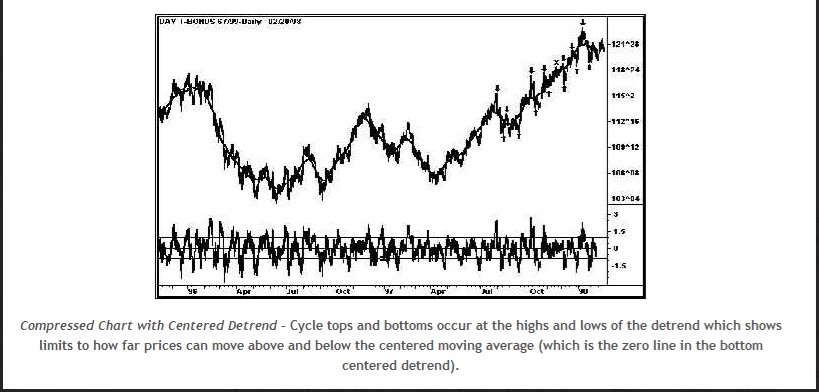

I have accumulated a small library of important works in the study of futures trading over the years so instead of writing about the week ahead as I normally do on Mondays, I thought I would change pace ( I was enjoying a long weekend out of town ) so today, based on the work of Walt Bressert and The Foundation for the study of Cycles (Cycles.org) ,Jake Bernstein and others, I thought it would be important to briefly discuss another layer of technical analysis we all could use when trading becomes too myopic. The study of Cycles, simply put Cycle study is dedicated to the study of recurring patterns in the economy, markets, natural sciences and the Arts. We are not looking to trade the big bottoms and tops that occur as the trend reverses, but the bottoms and tops of the shorter-term cycles occurring in the direction of TREND. One tool to identify the cycles within a trend is called “Centered Detrending” With “CD” you can visibly observe cycle bottoms and tops. Because this takes the mystery out of cycles you can look back over a considerable amount of time(History) and see the consistency and tradability of cycles. Most trading cycles in the futures markets tend to cluster between 18 and 22 bars. What we want to do is CD the chart and calculate a moving average the same length as the potential trading cycle. But instead of plotting the Moving Avg. (MA) from the last day it should be centered in the middle of the cycle; for instance if it is a 20 day MA, move it back 10 days from the most recent close. this will show you a linear representation of the cycles relative to price movement.

You are half way home now, since this will only show historical cycles it can’t be used for real-time trading. You now will need an Oscillator to overlay. To use an oscillator to identify cycle tops and bottoms look for three characteristics: (there are a number of oscillators on your trading platform, play around with a few)

- The oscillator turns when prices turn

- The oscillator does not “wiggle” much at cycle tops and bottoms

- The oscillator has amplitude moves that take it to the extremes of an allowable range as the cycles bottom and top.. I hope this gives you a different perspective to learn best how to trade a trend. My compliments to the decades of analysis put out there by Bressert, Bernstein , Edward Dewey Chief Economist for the Hoover admins Dept. of Commerce.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

08-17-2023

Improve Your Trading Skills

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.