Size does Matter & Support and Resistance Levels 3.08.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

Size does Matter

By John Thorpe, Senior Broker

Recently the margins have increased for Wheat and Gold futures as well as the stock indices for good reason. Geopolitical risk has put these markets on notice that the margins, already low, were not sufficient to protect clients and firms from the extreme price action these commodities have been experiencing.

The intraday moves have been nothing short of jaw dropping; with opportunity comes risk.

(all indices roll from March to June this Thursday and Friday)

Did you know there were also other Micro contracts to take advantage of many of these futures contracts outsized price swings? And they are liquid too!

The WTI Contracts overnight margin requirement is now going to be set tonight @ $13,500.00 and most clearing firms would rather not give a break for Day trading margins

The answer to participate in the crude market if the current volatility is too rich for your blood, you may take a look at the Micro’s :

The exchange has increased the margin several times over the past week and today’s increases are here and currently no break for Daytrading..

MORE CME energy margin increases:

You do however, have two smaller sized contracts that are plenty liquid, the QMj22 that is a 500bbl contract and trades in .025 increments 110.025, 110.050, 110.075 and so on.. the margin is ½ the full size contract or $6750.00

And you also have the micro WTI Crude Oil MCLJ22 a 100 bbl contract 1/10 the size that trades in minimum increments like the full size. 100.02,100.03,100.04 and so on.. the margin is 1/10th or 1320.00 per contract The micro’s also give you the ability to trade as many crude contracts incrementally in 100 barrel units.

|

|

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

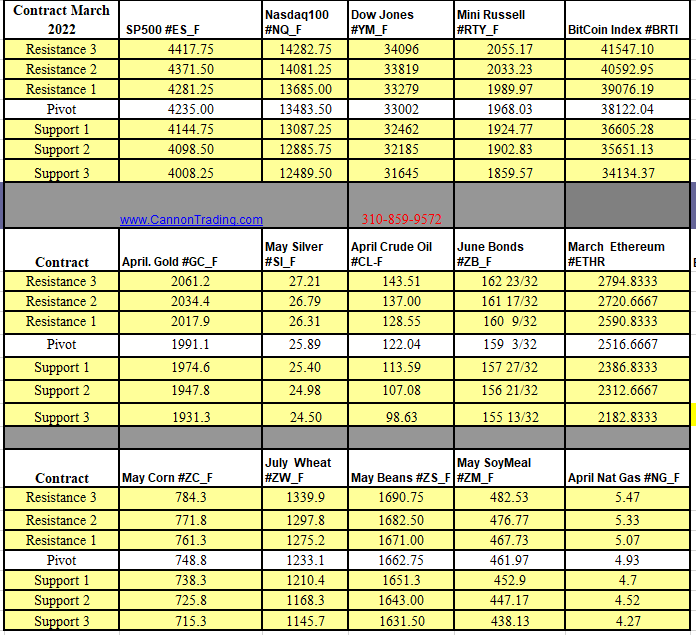

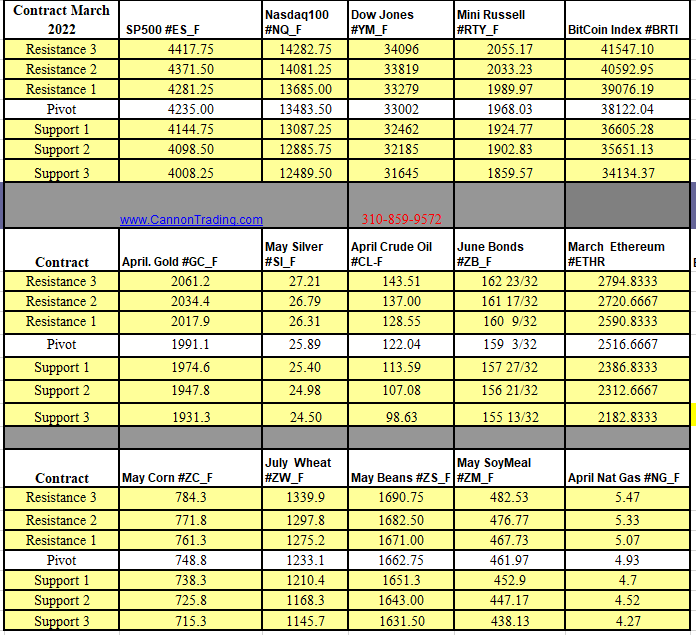

Futures Trading Levels

03-08-2022

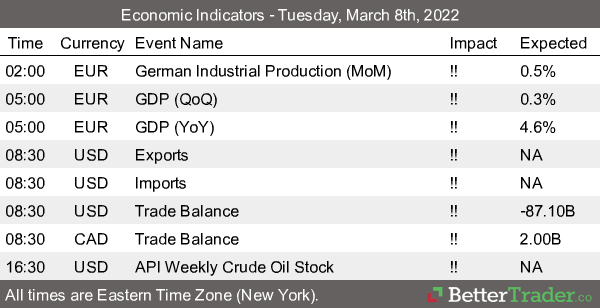

Economic Reports, Source:

http://BetterTrader.Co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Crude Oil | Future Trading News