Adaptive Trading & Futures Support and Resistance Levels 3.24.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

Adjust Your Trading to the Markets

By Mark O’Brien

For the last month, our blogs have continually bore a resemblance to a war correspondence, connecting the events in Ukraine to large moves in commodities prices. Other “traditional” market movers such as the designs and actions of the Federal Reserve, monthly economic reports – on unemployment, housing starts, consumer confidence, etc. – the all-important U.S. Dept. of Agriculture’s world supply/demand crop reports, weekly reports on crude oil, refined products and natural gas storage and supplies, all have taken a somewhat back seat to the impact war has had on commodities. We hear of commodities being “war priced” at recent lows (stocks, the U.S. dollar) and highs (energies, precious metals, grains), or trading at a “war premium,” with guidance that any cessation in hostilities could lead to substantial price breaks.

Another continual theme to this blog will be to encourage you to take this environment in which we are now trading into account and be extra-mindful of the heightened potential risks in the market(s), particularly those that trade overnight – which includes just about everything except livestock. If you’re taking a directional approach to trading, consider using options as protection of your futures positions. Consider futures spreads. Consider limited-risk options spreads.

|

|

If you are looking for other reference material please contact your Cannon Broker for lists of solid, informative and helpful trading tomes

|

|

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

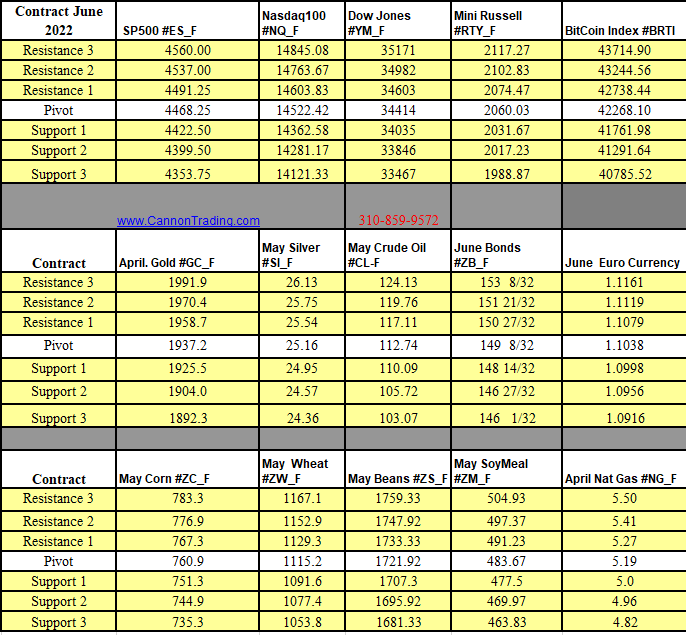

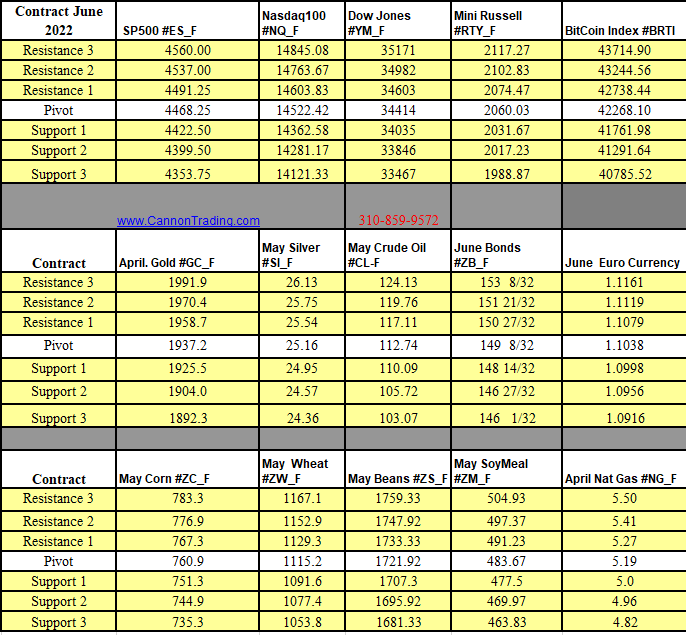

Futures Trading Levels

03-24-2022

Improve Your Trading Skills

Economic Reports, Source:

http://BetterTrader.Co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | futures trading education