Futures Trading Levels for June 29th, 2021

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Cannon Futures Daily Blog

Dear Traders,

Starting today, June 28, 2021, CME Group has removed the trading halt between 3:15 and 3:30 p.m. CT on CME Globex for Equity Index products.

This enhancement will allow market participants to access liquidity continuously throughout the trading day and manage event risk that occurs during the trading session with greater ease.

Subject to regulatory review and effective June 28, 2021, CME and CBOT will eliminate the 3:15 p.m. – 3:30 p.m. Central Time (CT) trading halt on CME Globex which currently exists for certain Equity futures and options contracts.

The halt was initially implemented to account for transactions conducted via open outcry in the trading pits and is therefore no longer necessary.

June is almost over and just like that next week is 4th of July and the beginning of what we consider “summer trading”…

Summer trading USUALLY = less volume, narrower ranges but also larger moves on certain reports.

Below is a video I put together a few years ago on trading using overbought and oversold conditions – still very valid in m opinion.

Get Real Time updates and more on our private FB group!

To access a free trial to the ALGOS shown in the chart along with other tools? (Arrows possible buy/sell, diamonds = possible exit/ tighten stops) visit and

sign up for a free trial for 21 days with real-time data.

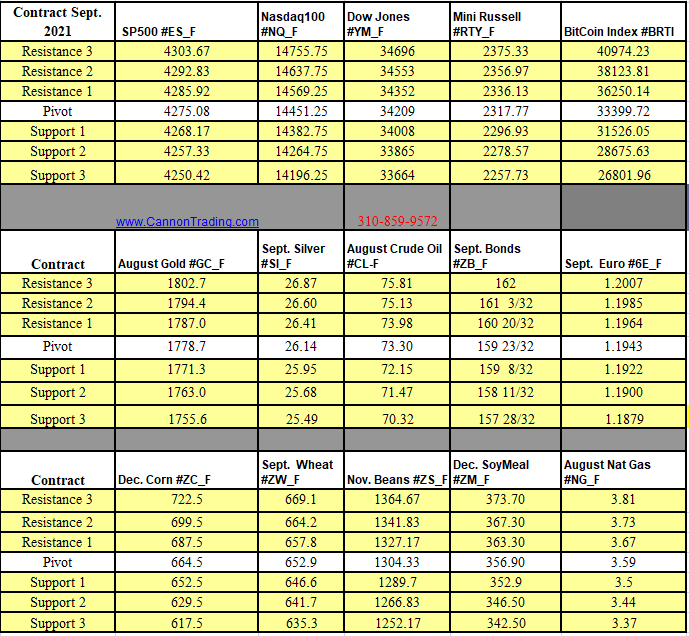

Futures Trading Levels

for June 29th

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading

Tags: Corn > Corn Futures > Futures Spread Trading > Futures Spreads > Grain futures

Posted in: Day Trading | Future Trading News | Futures Broker | Futures Trading | Index Futures