Crude Oil Futures Commentary + CL Daily Chart & Trading Levels 4.30.2020

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Tomorrow is also the last trading day of the month.

I noticed that sometimes the last and first trading days of the month will have larger than normal moves.

my guess is that:

1. large funds are positioning themselves or “squaring off books” for accounting purposes.

2. Longer term traders have the full picture of the monthly chart

Lets talk crude oil prices, trading front month crude oil and more:

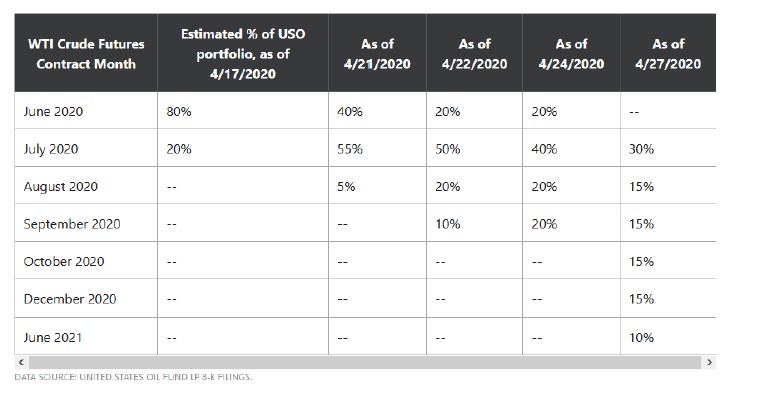

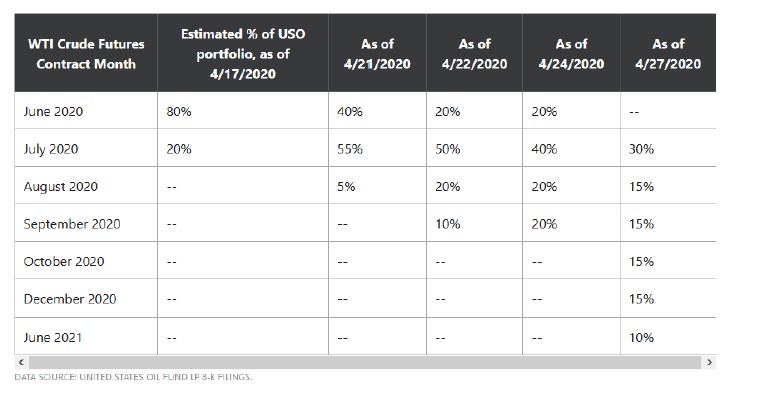

On April 27, the USO announced it was exiting its positions in the current June contracts entirely. That caused the price of those contracts to drop 26.7%. It also announced an intention to invest in contracts as far out as June 2021. Fully 40% of the fund’s portfolio is now going to be for contracts more than three months out.”

The parent company of the United States Oil Fund LP

USO, +4.93%, the largest oil-related exchange-traded fund, on Wednesday announced an eight-for-one reverse stock split. The move comes after USO lost one-third of its value in the most recent week amid a worsening global oil glut. USO, which directly tracks oil futures contracts, had earlier attempted to mitigate losses by stretching out its exposure to later-dated oil futures contracts, but on Tuesday said it would abandon a pre-set strategy and invest in contracts in “any month available.” On Tuesday, USO had to stop creating new fund shares after it reached a pre-determined threshold of exposure to the underlying securities. By reducing the number of USO shares outstanding, USO’s post-split shares will be valued eight times higher than pre-split shares. The step will be completed April 28. USO shares have lost about 78% of their value in the year to date, and many analysts believe retail investors have borne most of those losses in recent weeks.

Will today’s futures market Crude rally last beyond today?

Back on January 8th, 2020, West Texas Crude Oil reached $65.65 per barrel on news that Iran fired more than a dozen ballistic missiles at two Iraqi military bases housing US troops.

Four months later – and for the first time ever – the price of crude oil for May delivery traded below zero, closing on Monday at -$37.63 per barrel. So much has been written about crude oil trading to a negative value, so I won’t waste more space on that, however here are some pointers I like to make:

1. The margins have more than doubled these past few weeks and many clearing houses will even ask for 200% margins if you trade the front month.

2. Volatility is EXTREME, make sure you know what you are doing, know the rules and understand the environment. There is a big difference in the way the front active month trades compared to the back months. I personally recommend NOT trading the front month as I feel the volatility can be EXTREME for 99% of the traders out – just my opinion.

3. If you’ve never taken physical delivery of crude oil and all of a sudden this idea has sprouted in your brain, take heed. Don’t think you can get set up for that scenario in short order – in case June repeats the same behavior. Taking delivery of crude oil requires a rather lengthy set-up process. The minimum account balance required to be in place: $1,000,000 ( with us anyway ). You also will be required to be set up with a licensed storage facility, provide verifiable shipping logistics and be approved by certain FCM’s and the exchange

4. This is the type of trading environment where an

experienced broker can assist you by suggest strategy ideas such as placing hedges, incorporating options, implementing spreads and much more.

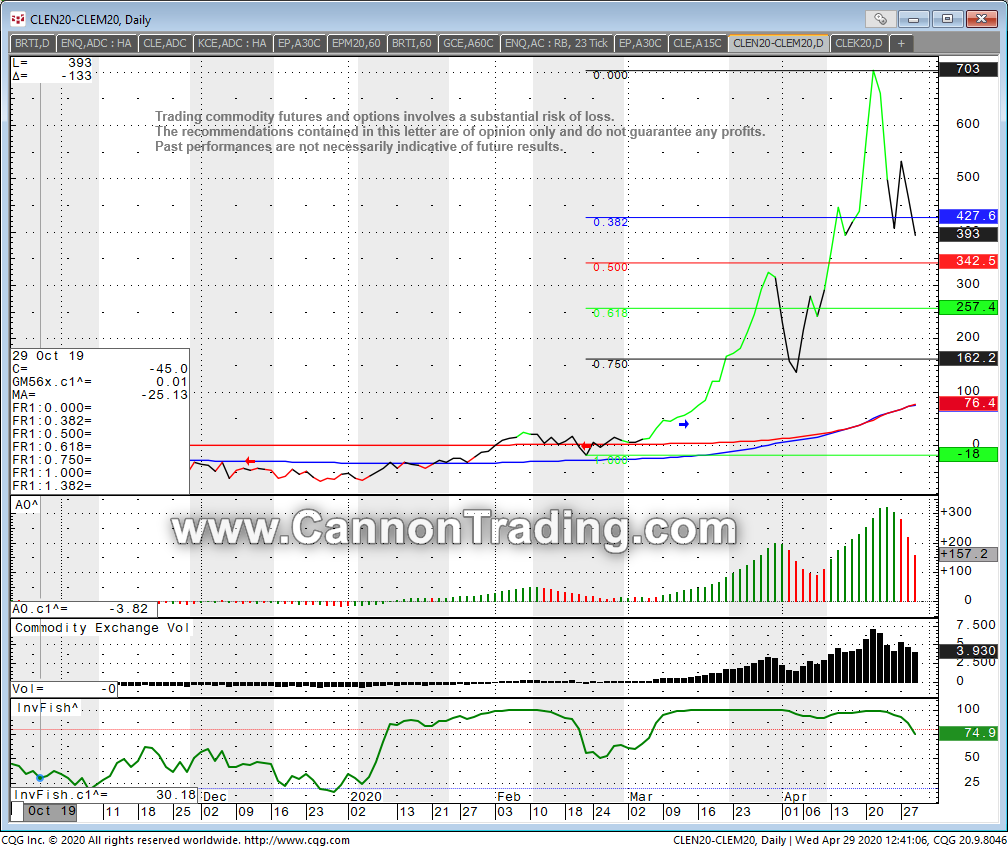

Below you will see the SPREAD chart of the difference between June the current front month and July the next month. It is July price MINUS June price.

Plan your trade, trade your plan and wash your hands often!!

Good Trading

Trading Futures, Options on Futures, Gold Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

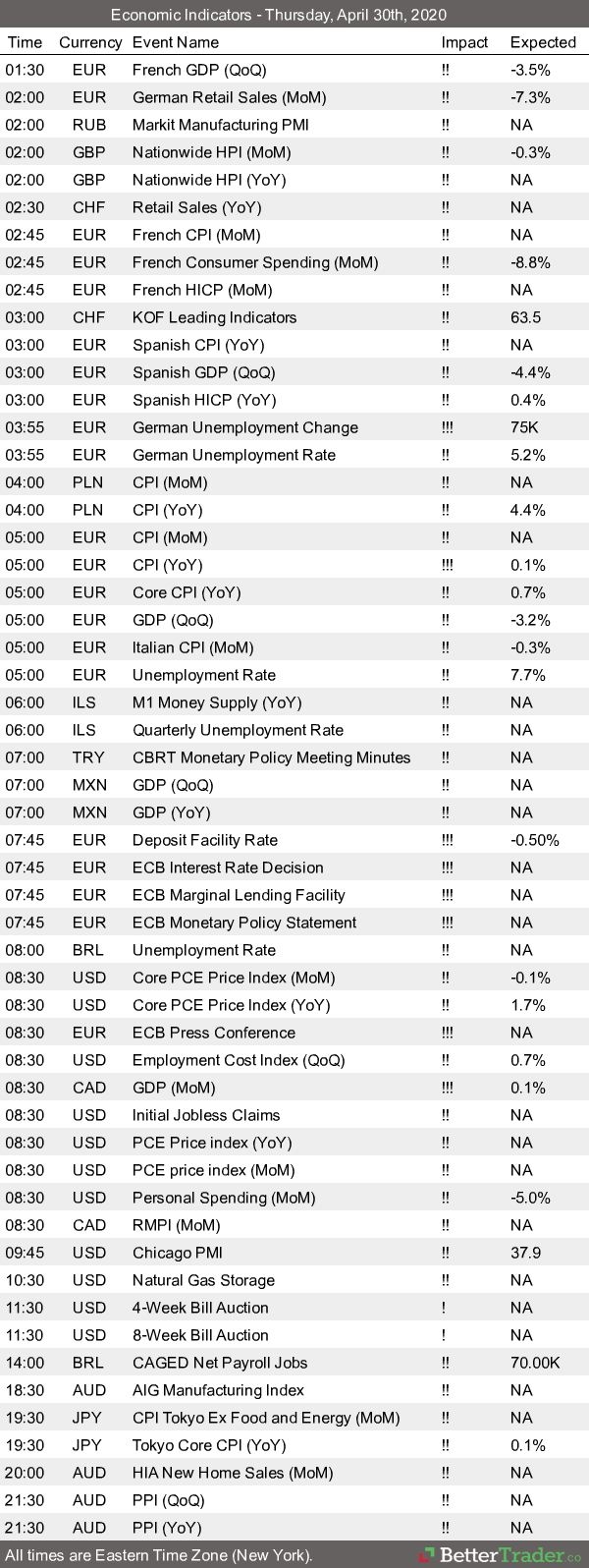

Futures Trading Levels

04-30-2020

Did you know?

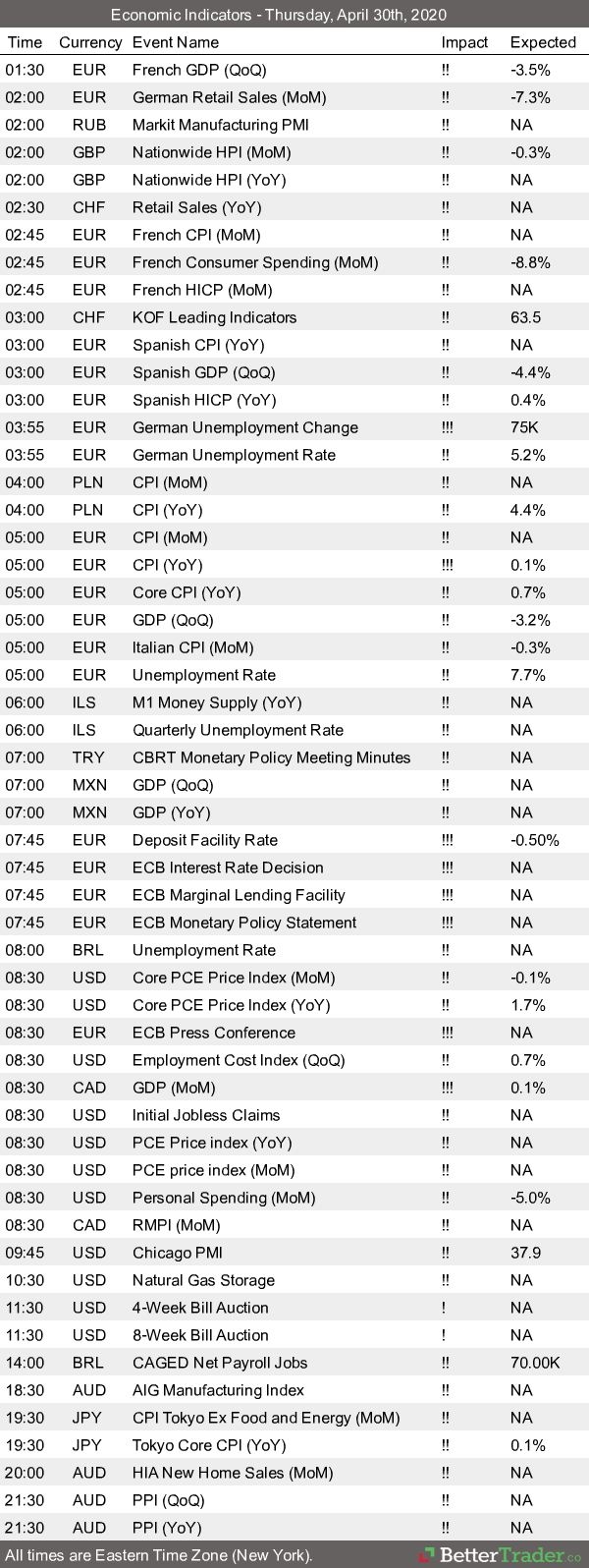

Economic Reports, source:

Order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained.

Posted in: Future Trading News