Futures Trading Levels and Economic Reports for February 7, 2011

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

I personally find more “true market behavior” now days in markets like gold, Euro, crude oil and others versus stock index futures. It seems that quantitative easing (QE) has took out the fear factor from stock index futures….or maybe when traders all think that way that is when market sentiment changes?

I am not sure…in between, if you would like to see what my intraday charts, set ups and signals look like for Crude oil, Euro and mini SP, please sign up at:

Screen shot sample from few weeks ago below ( red diamonds = suggested sell, blue diamonds = suggested buy):

GOOD TRADING!

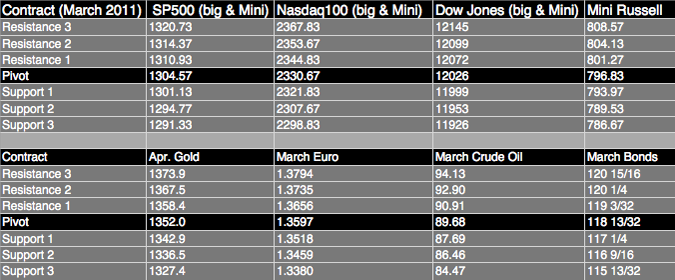

TRADING LEVELS!

Economics Report Source: http://www.forexfactory.com/calendar.php

Monday, February 7, 2011

Consumer Credit m/m

3:00pm USD

Treasury Currency Report

Tentative USD

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Company, Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!