Rollover Notice + Futures Trading Levels for 6.09.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

Rollover Notice for U.S. Stock Index and Currency Futures

By Mark O’Brien

Heads up traders! We’re approaching important dates on the trading calendar.

Tomorrow, Thursday, June 9, is roll-over day for stock index futures contracts, i.e., the

E-mini and Micro S&P,

Nasdaq,

Dow Jones and

Russell 2000. Starting tomorrow, the September futures contracts will be the front month contracts. Volume in the June contracts will begin to drop off until their expiration next Friday, June 17th (8:30 A.M., Central Time). At that point, trading in these contracts halts. Stock index futures are CASH SETTLED contracts. If you hold any June futures contracts through 8:30 A.M., Central Time on Friday, June 17th, they will be offset with the cash settlement price, as set by the exchange.

Monday, June 13th is Last Trading Day for June currency futures. It is of the utmost importance for currency traders to exit all June futures contracts by Friday, June 10 and to start trading the September futures. Currency futures are DELIVERABLE contracts. By holding any June futures contracts through the close of Last Trading Day, you will be subject to delivering (short positions) or taking delivery of (long positions) the full notional value of the futures contract. So, unless you’re sitting on 12,500,000 Japanese Yen to give to the exchange, exit that short position.

The month code for September is ‘U.’ Please consider carefully how you place orders when changing over.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

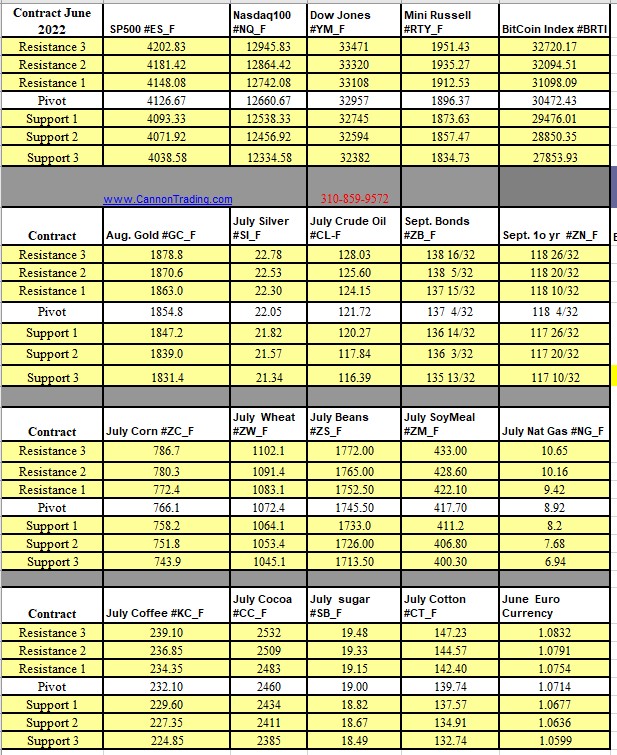

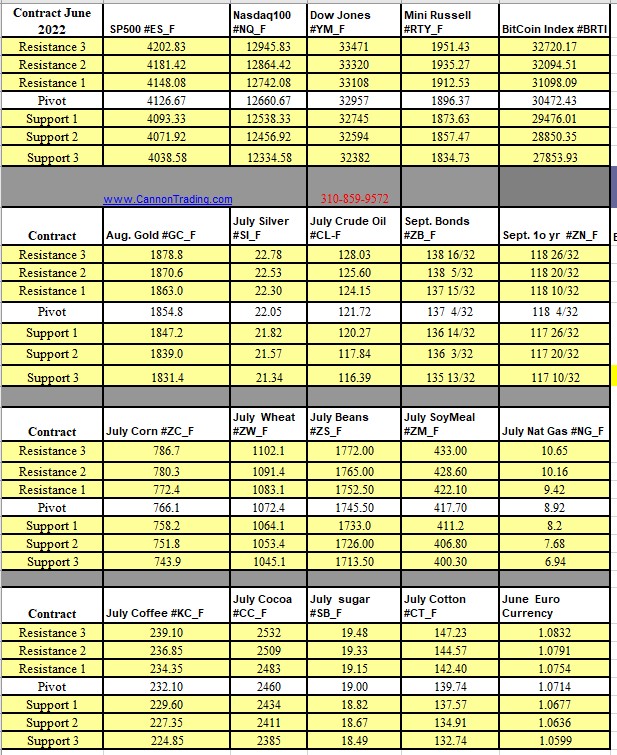

Futures Trading Levels

06-09-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | Indices