Get Staying Power in Volatile Markets & Support and Resistance Levels 5.05.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

Basic and Effective Strategies for Trading in Volatile Market Conditions

By Mark O’Brien, Senior Broker

It’s a well-known saying – attributed to John Maynard Keynes: “Markets can stay irrational longer than you can stay solvent.” Two conclusions you could derive from Keynes’ observation: 1.) timing any market is not practicable and 2.) using leverage in volatile markets calls for genuine caution.

We are in the midst of a remarkable display of volatility in nearly every commodity asset class and futures traders can find entering trades a formidable endeavor. The question of where to place protective stop orders becomes more of an informed guess than before these recent months.

But this should not deter traders from entering markets, because there are numerous strategies – by and large incorporating options – that can allow your trades to withstand persistent up-and-down price action.

One of the simplest and more common strategies for futures traders is the incorporation of a purchased

call or put option against an associated short or long futures position. Depending on the option’s strike price and expiration date, the maximum risk to an adverse move in the market can be precisely calculated. In addition, the risk to an adverse move in the market during the option’s lifespan up to its expiration date – based on the futures contract’s price – can also be very closely calculated. At the same time, the position’s profitability can also be determined as a result of favorable market movement – over time and price.

This strategy has the important advantage of limited risk and price tolerability during adverse moves in the market that stop orders do not provide. The trade-off comes at the cost of the purchased option and its overall loss in value as a result of time decay during its lifespan as well as its loss in value incurred during a favorable market move for the futures contract.

Contact your Cannon Trading broker for additional information on this strategy and assistance in calculating a particular long option/opposing futures position to see if it relates to your trade style’s risk considerations.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

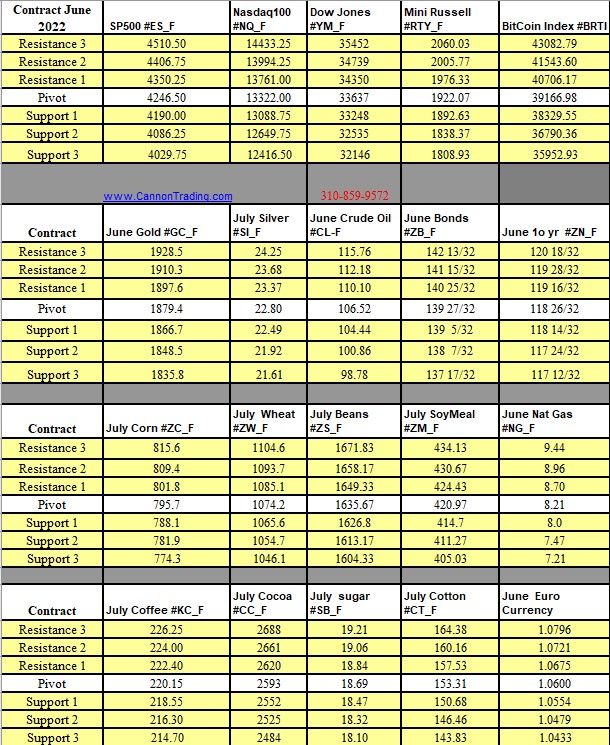

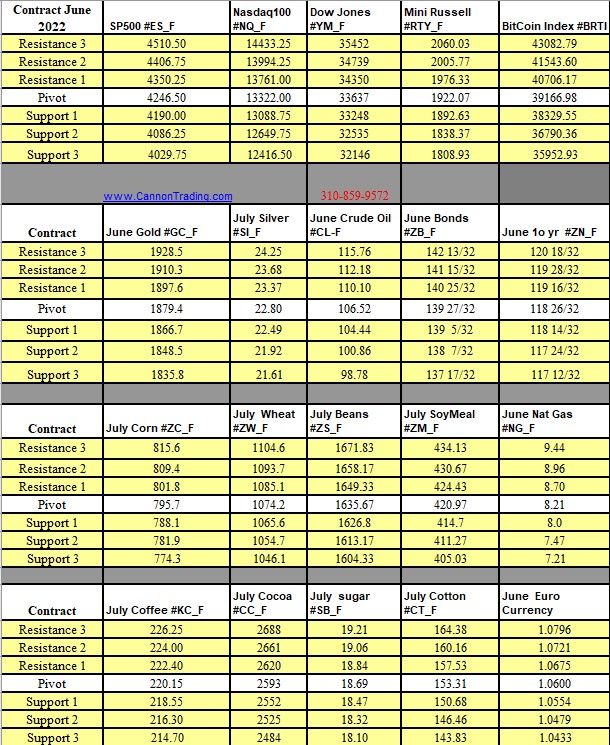

Futures Trading Levels

05-05-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | futures trading education