Quick Recap of a Volatile Week so Far & Trading Levels 4.28.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

Quick Recap of a Volatile Week so Far

by Mark O’Brien – Cannon Trading

So far this week, major stock indexes and benchmark interest rate sensitive instruments continued their erratic behavior.

Monday night (China’s Tuesday daytime): the Shanghai Composite index fell 5.1%, its worst selloff in more than two years. The yuan hit its lowest level since late 2020.

Investors are worried that the strict policies China has implemented to combat its most recent Covid-19 will add to the pressures weighing on China’s economic growth and further disrupt global supply chains.

Tuesday: U.S. stock indexes followed China’s with the

S&P 500 closing down ±120 points, or 2.8%. The

Dow Jones Industrial Average declined ±809 points, or 2.4%. The

Nasdaq Composite lost ±514 points, a ±4% pull-back its largest one-day percentage decline since September 2020.

Fears about a resurgence of Covid-19 cases in China, and global inflation are weighing on companies and consumers. The Federal Reserve’s indications that it will quickly tighten monetary policy are threatening to drag on growth.

Wednesday: Federal Reserve governor Lael Brainard won Senate confirmation Tuesday to become the central bank’s vice chairwoman and top adviser to Chairman Jerome Powell.

Fed watchers believe Ms. Brainard’s promotion isn’t likely to change the central bank’s near-term interest-rate policy plans because she has already been serving as a top lieutenant to Mr. Powell.

The yield on the

10-year U.S. Treasury note closed at 2.773%, close to its highest level since 2018. Investors have sold bonds in anticipation of higher interest rates.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

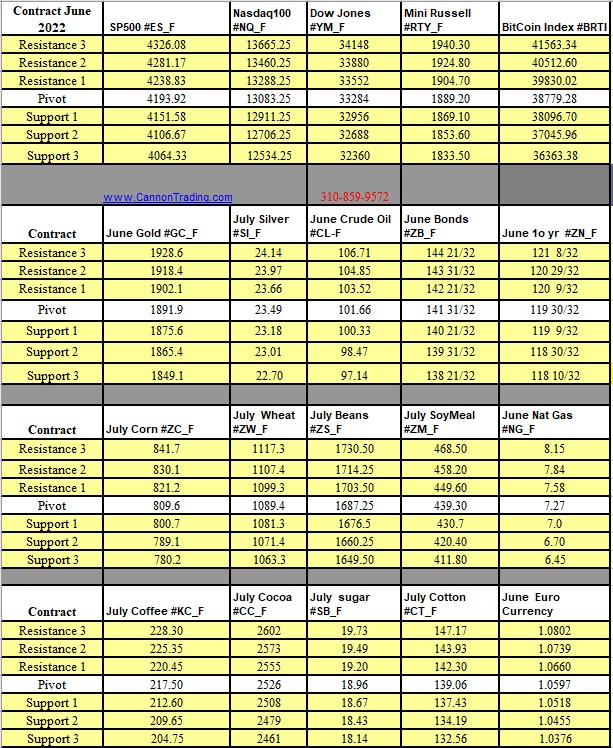

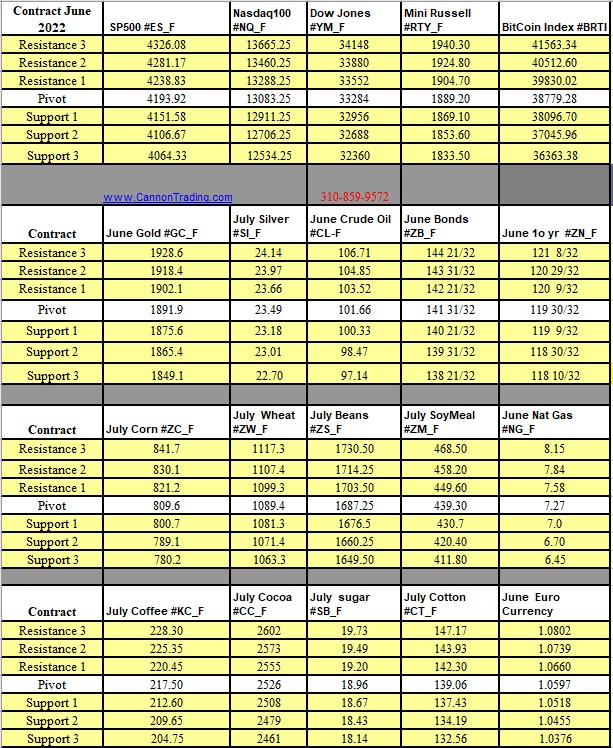

Futures Trading Levels

04-28-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News