In this session, we’ll take a look at QT Market Center, a leading trading platform used by hedgers and professional traders world wide.

When: Tomorrow ( Thursday Apr. 6th) at 2 PM Central Time

Mark Bucaro, an ex floor trader will share some of the features and tools QT offers and how you can possibly use it to help your trading.

In this webinar you will learn and see live examples:

• Proprietary Price Counts Price Forecasting Tool

• Realtime Agricultural/Livestock/Ethanol-Energy News, Weather, Audio Charts, & Quotes and more all from one platform – Desktop, Tablet, Smartphone Accessible

• Daily Chart of the Day Subscription with Price Counts Price Forecasting Levels Included

• Profitability Cost Calculator – Input your costs and get your profitability results in seconds

• Web based Platform Access, Desktop (Smartphone & Tablet Access included Free) from virtually anywhere there is an internet connection

• Cost Effective, Reliable and Fast

• Reduced Live and Snapshot Quotes Fee Cost Options Available

• Realtime Live Streaming Agricultural & World Weather Audio Market Commentary Updates (accessible from Desktop, Tablet & Smartphone when out in the field)

• Access Current and 11+ years of Archived USDA Reports,

SPACE is LIMITED, so reserve your space now!

Heads up everyone, a bit of a different Good Friday schedule than years past.

Good Friday was the one holiday all commodity brokers loved as almost all markets were completely closed. With NFP out this Friday, the CME will have a few markets open to allow for risk management. Equities will remain open until 8:15 AM central Friday. Currencies & rates until 10:15 AM central.

Please see full list below. Happy Easter/ Passover to all.

Good Friday Hours for this Friday Below:

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

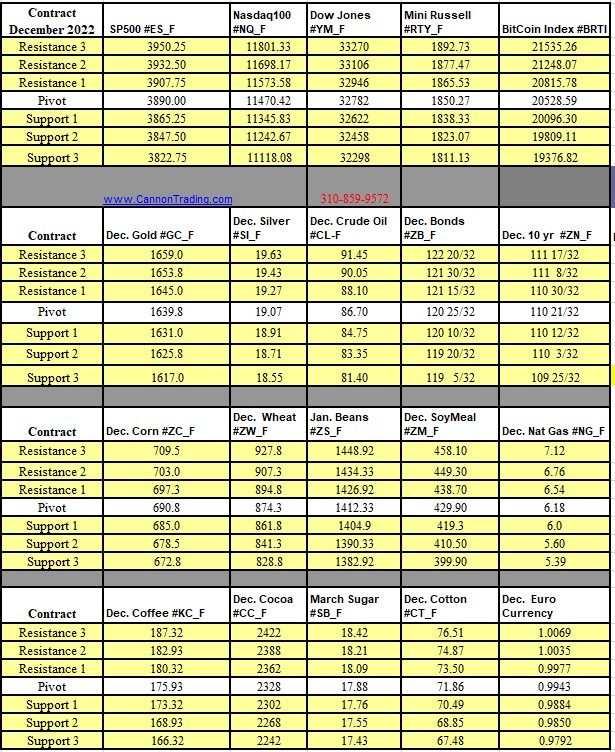

Futures Trading Levels

for 04-06-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

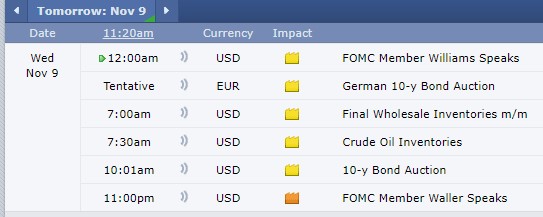

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.