Inflation & the Markets + Futures Support and Resistance Levels 5.10.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

Inflation & the Commodity Markets

by John Thorpe, Senior Broker

There are a number of characterizations of inflation in the business press and social media some related to the speed of inflation as in Creeping Inflation or Moderate inflation even hyper inflation and may be used as adequate adjectives, but these don’t describe what the causes of inflation are of which there can be many.

This Wednesday , CPI or the Consumer Price Index will be published at 8:30 am EDT an often quoted measure of Inflation but not the one the FRB uses to guide interest rate decisions, they choose to focus on the PCE or the Personal Consumption Expenditures Price Index. The Market will focus on both. If you recall last month the CPI showed the largest monthly advance in 42 years. The consensus from Econoday.com is for an 8.1 % Rate, with a much smaller incremental increase than the previous tally. Heading into that number

Gold prices had been rallying for 3 successive days and experienced a 20 dollar rally continuing the move and added an additional 2 days of inertia before the peak on April 18th and subsequent sell-off , nearly a month later the

Gold market seemingly is telling us that the consensus for CPI will be correct as reflected in weaker gold prices. If you watch the gold market watch the reaction to CPI on Wednesday morning. If CPI is Higher than the consensus and gold rally’s and holds those gains into the 1:30 pm EDT zone, then the recent lows in my view are in.

As for the causes of inflation, today we are in what economists call Demand – Pull inflation. This is when the aggregate demand for goods and services in an economy exceeds the aggregate supply. This concept is associated with full employment when adjusting the supply of goods and services is either not possible, or difficult to achieve in a timely manner. Always have a plan to manage the risk in your trades before you employ your strategy, Plan your trade and Trade your plan

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

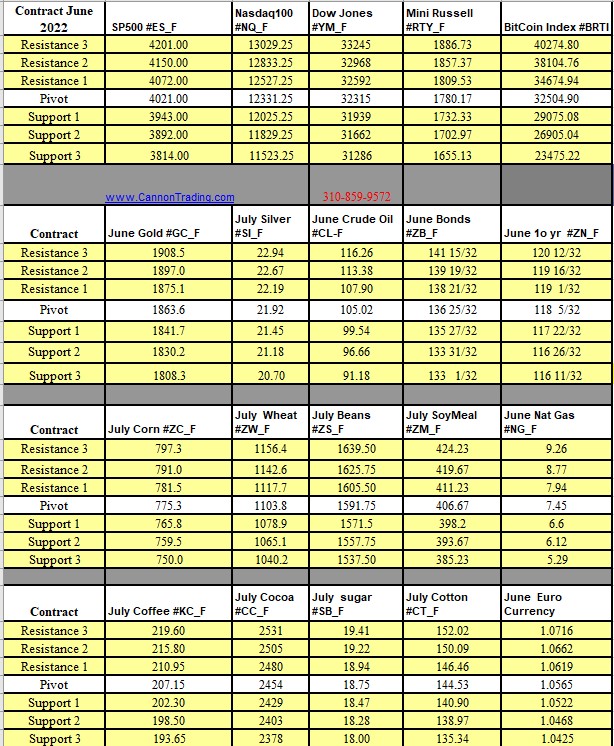

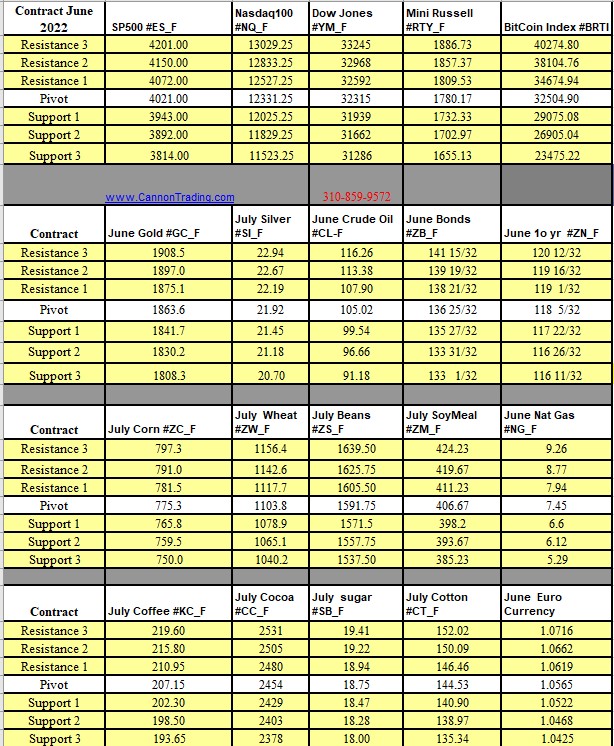

Futures Trading Levels

05-10-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | Gold Futures