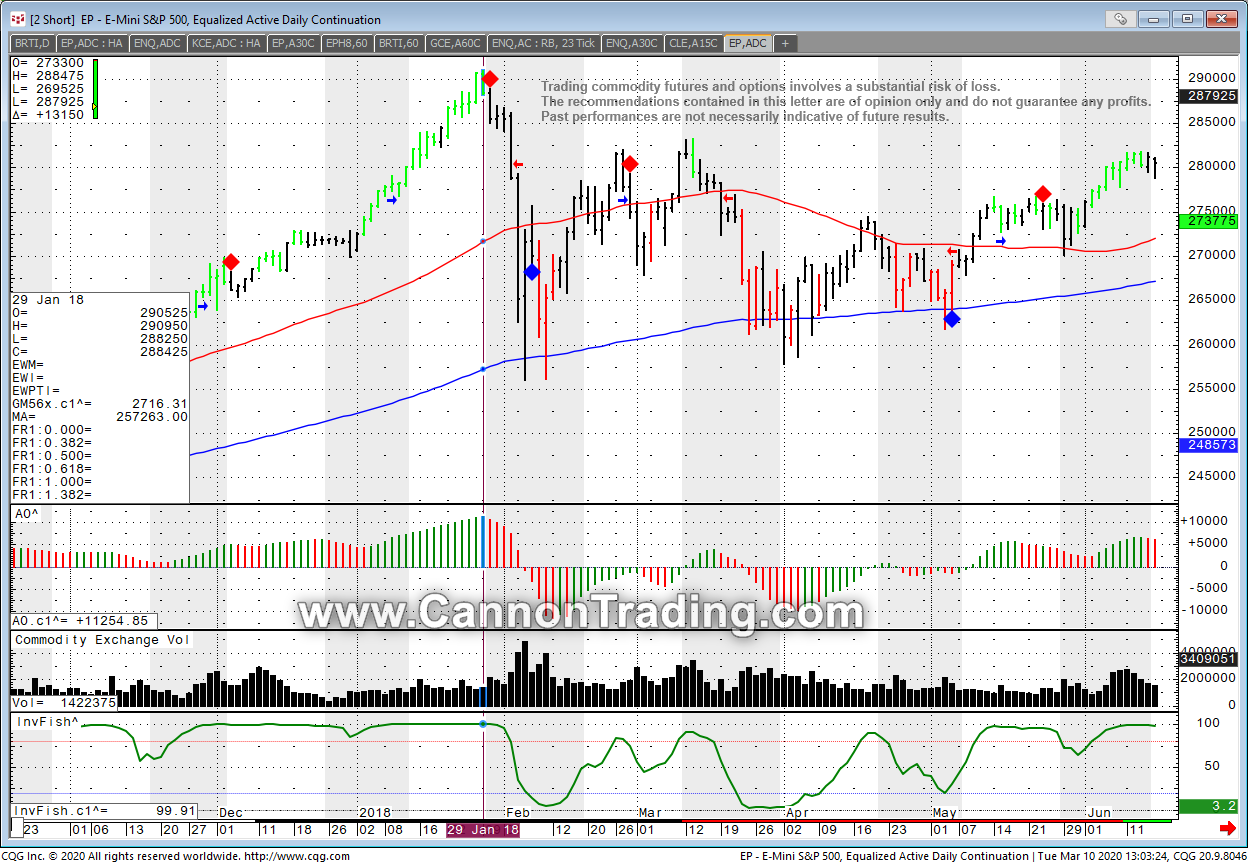

Comparing Market Volatility to 2018, ES Daily Chart & Trading Levels 3.11.2020

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Dear Traders,

- Take a look at the below chart from Feb. 2018 of the mini SP, last time I remember volatility close to what we are seeing ( FYI the VIX high back then was close to 30…we saw VIX trading over 50 this time around) and you will see that the moves are not a straight line….don’t get over excited if you are long and market bounced your way or vise versa if you are short and the market is limit down….this volatility will play both sides and in MY OPINION this is not a market to just buy and hold using futures….You need to be able to react and adjust positions according to market action and sentiment.

- Learn to reduce trading size. Perhaps trade smaller contracts like the micros.

- Understand that loses are part of trading and this is definitely not a good time to “fight the markets”.

- Focus more on risk management and ways to protect certain positions as needed.

- Survive to trade another day.

- Tomorrow I am going to look at some charts from 2008…..

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

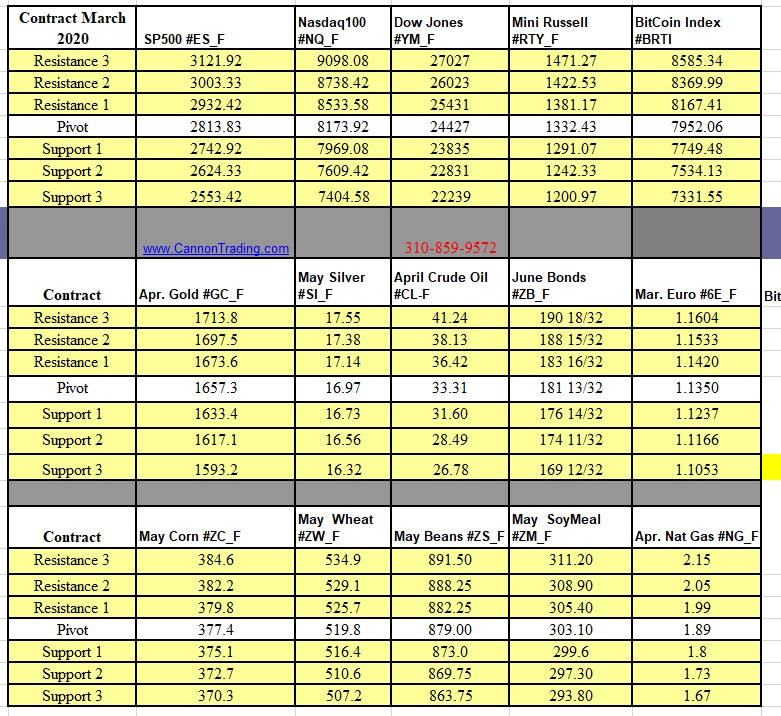

Futures Trading Levels

03-11-2020

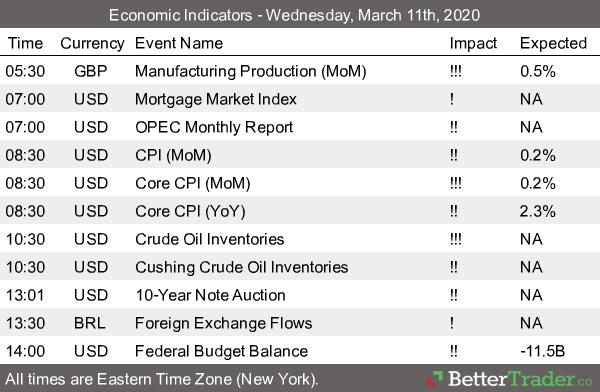

Economic Reports, source:

Order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.