Read more about trading futures with Cannon Trading Company here.

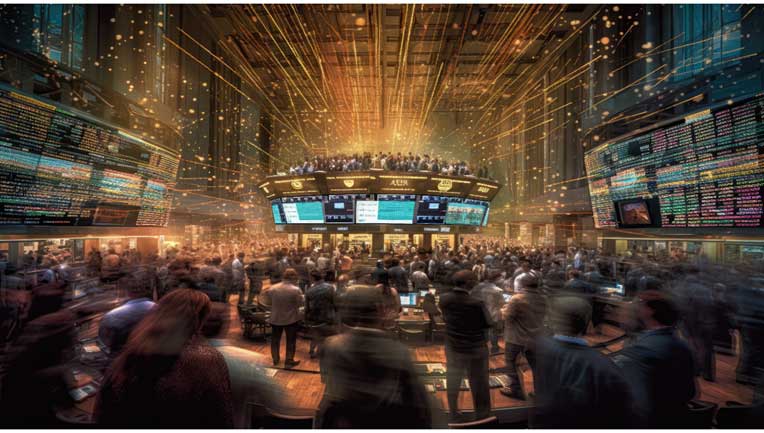

Futures trading, a cornerstone of the global financial markets, has a rich history and plays a pivotal role in today’s economic landscape. This comprehensive exploration of futures trading delves into its historical roots, the compelling reasons to engage in it, the contemporary futures market, and the emerging influence of Artificial Intelligence (AI) in futures trading.

The History of Futures Trading

Futures trading, although complex in its modern form, has roots dating back to ancient civilizations. It evolved from simple agreements among farmers and merchants to secure future prices for agricultural produce. The concept of trading future contracts began in 17th-century Japan with the creation of rice futures. However, the formalization of futures trading came much later.

- The Emergence of Futures Markets: The 19th century saw the establishment of formal futures markets in the United States. Chicago emerged as a hub for futures trading, primarily in agricultural commodities such as wheat and corn. This period marked the birth of organized futures exchanges, with the Chicago Board of Trade (CBOT) founded in 1848 and the Chicago Mercantile Exchange (CME) in 1898.

- Commodities and Beyond: Initially centered around agricultural commodities, futures trading expanded to include metals, energy products, currencies, and financial instruments. The ability to hedge against price fluctuations made futures trading attractive to a broader range of participants.

Why Trade Futures

Trading futures offers several compelling reasons, attracting a diverse group of participants, from individual traders to institutions. Here are some key motivations:

- Risk Management and Hedging: One of the primary purposes of futures trading is risk mitigation. Producers, consumers, and investors use futures contracts to hedge against adverse price movements. For instance, a wheat farmer can lock in a future selling price to protect against price declines.

- Liquidity and Leverage: Futures markets are highly liquid, making it easy to enter and exit positions. Moreover, traders can access substantial leverage, amplifying their trading capital and profit potential.

- Diversification: Futures markets encompass a wide range of assets, from agricultural commodities like soybeans to financial instruments like stock index futures. This diversity allows traders to build diversified portfolios and spread risk.

- Speculation: Futures trading is not limited to hedgers; speculators play a vital role too. They seek to profit from price fluctuations by taking positions based on market analysis and predictions.

- 24-Hour Trading: Unlike traditional stock markets, futures markets operate around the clock, providing opportunities for global traders to react to news and events at any time.

Futures Trading in the Current Era

The landscape of futures trading has evolved significantly in the modern era, reflecting advances in technology, changes in market dynamics, and shifts in economic priorities.

- Technology and Electronic Trading: The advent of electronic trading platforms has revolutionized futures markets. It has democratized access, reduced transaction costs, and increased market efficiency. Traders can execute orders with ease, and real-time data and analysis tools are readily available.

- Financialization: Futures markets have seen increased financialization, with financial institutions and investment funds actively participating. This has led to higher trading volumes and greater market complexity.

- Globalization: Futures markets have become interconnected on a global scale. Investors can trade futures contracts on assets from different countries and regions, offering enhanced diversification opportunities.

- Commodity Super Cycle: Periods of commodity super cycles have influenced futures markets. These cycles are characterized by extended periods of rising commodity prices, often driven by factors like emerging market demand and supply constraints.

- Algorithmic Trading: Algorithms and high-frequency trading have become prevalent in futures markets. They execute trades at lightning speed, seeking to capitalize on small price differentials.

Futures Trading with AI

As technology continues to advance, AI is becoming increasingly integrated into futures trading. Here’s how AI is impacting the futures market:

- Algorithmic Strategies: AI-driven algorithms are used to develop trading strategies that can analyze vast amounts of data, identify patterns, and execute trades with precision. Machine learning models adapt to changing market conditions, making them effective in dynamic futures markets.

- Risk Management: AI tools are employed for risk assessment and management. AI can assess market conditions in real-time and automatically execute risk mitigation measures, such as stop-loss orders, to protect traders’ capital.

- Predictive Analytics: AI algorithms can predict market movements based on historical data and current events. This aids traders in making informed decisions and optimizing their positions.

- Market Sentiment Analysis: AI-powered sentiment analysis tools scour news and social media to gauge market sentiment. Traders can use this information to anticipate market movements and respond accordingly.

- Automated Trading: AI enables fully automated trading, where algorithms execute trades without human intervention. This approach is particularly popular in high-frequency trading strategies.

- Portfolio Optimization: AI can assist in portfolio management by optimizing asset allocation and risk management strategies to maximize returns while minimizing risk.

Futures trading has come a long way from its humble origins as a means for farmers and merchants to secure future prices. Today, it encompasses a wide range of assets, from agricultural commodities to financial instruments, and serves diverse purposes, including hedging, speculation, and portfolio diversification.

In the current era, electronic trading, financialization, globalization, and algorithmic strategies have transformed futures markets. AI, with its ability to analyze vast amounts of data, adapt to changing market conditions, and execute trades with precision, is poised to play a significant role in the future of futures trading. As technology continues to advance, traders and investors are likely to leverage AI to gain a competitive edge in the ever-evolving world of futures trading.

Futures trading remains a vital component of the global financial system, offering opportunities for risk management, profit generation, and portfolio diversification. With AI on the horizon, the future of futures trading holds promise for both individual traders and institutional participants looking to navigate the complex world of commodities and financial futures.

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with Cannon Trading Company today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.