Futures Trading Levels & Economic Reports for July 16th 2010

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

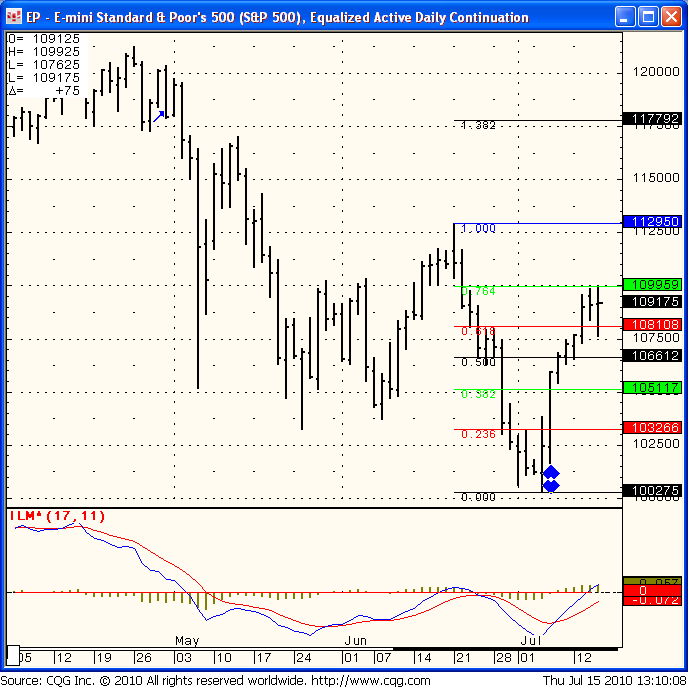

Interesting action today! Not sure what to make of it, there is a case for the bulls and a case for the bears. I am thinking that as a swing trader, one can try to short the market with a stop slightly above the recent highs ( recent high was around 1100 ). Taking the approach that while chances of getting stopped out are higher than normal, the relative risk is smaller than the relative potential reward. On the other hand, bulls may get more confidence going long if market breaks above 1103 or so..

Daily chart for review below.

EP – E Mini Standard & Poor’s 500 (S&P), Equalized Active Daily Continuation

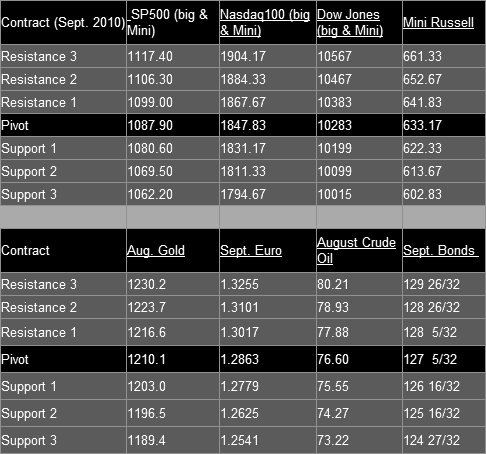

Trading Levels:

This Week’s Calendar from Econoday.Com

Futures Trading Levels for July 15th 2010

All reports are EST time

- Consumer Price Index – 8:30 AM ET

- Treasury International Capital – 9:00 AM ET

- Consumer Sentiment – 9:55 AM ET

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!