Futures Trading Levels and Economic Reports for January 25, 2011

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

I wrote the following last Thursday as SP, NASDAQ and Russell 2000 were selling off a bit:”Last two days we saw the first meaningful price decline in more than a few good weeks.

Still we are not getting a confirmation from the Dow Jones index that this potential

I would like to see for a larger scale sell off. ”

So while I still think stock indices are over valued and due for a correction, I definitely don’t think it is wise to try and “predict tops and bottoms” and in this case it is trying to pick tops.

I rather wait for a good signal along with good risk/ reward set up.

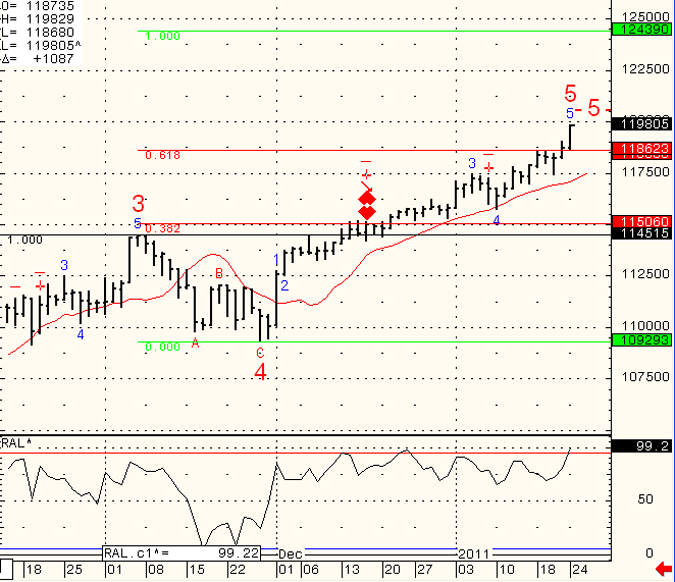

The chart below if of the Dow Jones CASH INDEX (not the futures contract). I would take a shot at a short position if the cash can break below 11,862, otherwise it looks like the Dow may want to work its way towards the 12439. I use this technique of entering certain positions if prices break above or below certain levels as it gives me more confidence in market direction. I call it “Price Confirmation”

Past results are not necessarily indicative of future results.

The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

GOOD TRADING!

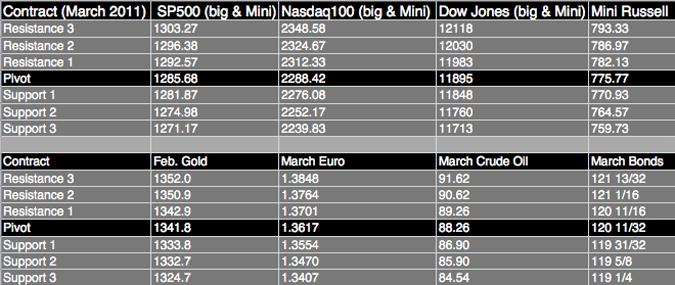

TRADING LEVELS!

Economics Report Source: http://www.forexfactory.com/calendar.php

Tuesday, January 25, 2011

S&P/CS Composite-20 HPI y/y

9:00am USD

CB Consumer Confidence

10:00am USD

HPI m/m

10:00am USD

Richmond Manufacturing Index

10:00am USD

Treasury Currency Report

Tentative USD

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Company, Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!