The recent volatility is of historical proportions!

AND Tomorrow is Friday the 13th???

I have a few points to make:

- Take a look at the below chart from 2008 of the mini SP, last time I remember volatility close to what we are seeing and you will see that the moves are not a straight line….don’t get over excited if you are long and market bounced your way or vise versa if you are short and the market is limit down….this volatility will play both sides and in MY OPINION this is not a market to just buy and hold using futures….You need to be able to react and adjust positions according to market action and sentiment.

- By no means am I trying to imply that we can see a 50% correction like we saw back then BUT have respect for the market and the price action and DON’T try to predict tops and bottoms….

- Learn to reduce trading size. Perhaps trade smaller contracts like the micros.

- Understand that loses are part of trading and this is definitely not a good time to “fight the markets”.

- Focus more on risk management and ways to protect certain positions as needed.

- Survive to trade another day.

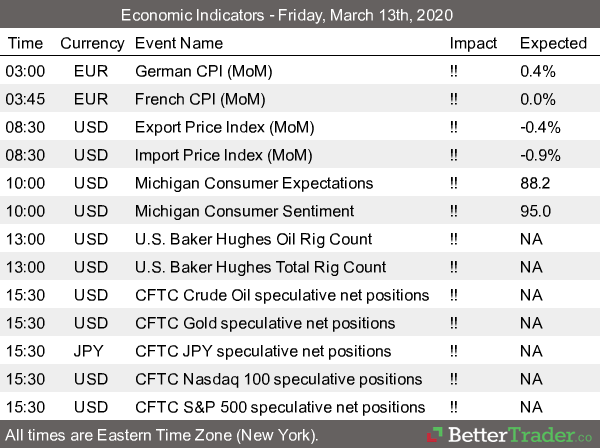

Overnight limit, can’t trade below but can trade above.

-5%

Intra day

-7% Trading Halt 15 mins

-13% Trading Halt 15 mins

-20% Closed for rest of day

Some quotes WORTH READING:

As a person who is either trading, or thinking about trading, the first question you must ask yourself is why you want to trade in the first place? Is it for lifestyle, is it for money to help with cash flow, is it for income to live off, is it because you want to control the way you earn your living and who you are responsible to for earning that living? Do you have a higher purpose than existence and survival in mind when you think of trading? For example do you intend that successful trading will provide you with the means to engage in, and design a living, rather than continuing to follow the teachings of conventional wisdom which suggests that making a living is all about survival from one year to the next without ever really getting ahead and achieving freedom?

Paul Counsel

The single biggest mistake that novice traders make is to think that trading is all about making money and it’s no wonder. It’s not hard to find ad after ad that says something like, “you can earn a living through trading”, or “earn all the income you want” or “leave your job forever and live off all the money you’ve ever wanted.” As your eyes scan these adds they catch words like “freedom”, “luxury”, “lifestyle”, “succeed”, “security”, “choice” and “wealth” that are typed in bold and liberally peppered throughout. They’ve got you hooked now haven’t they? The strength of their emotional pull is extremely powerful.

Paul Counsel

Successful trading has absolutely nothing to do with making money and everything to do with trading successfully. Making money will only ever be a by-product of successful trading. Successful trading is not a by-product of making money. When you attach trading to money and money to emotions and emotions to money you’ll have taken your first loss but you won’t know it yet.

Paul Counsel

Trading has everything to do with personal psychology, rules, systems, discipline, focus and skill. Like anything else that’s skill based, once you start it takes time and practice to become skilful. Ultimately trading is about making decisions between two choices, to buy or sell. As simple as these two choices are the variables that effect the decisions surrounding them can be as complex as the human mind can make them.

Paul Counsel

As a trader your central focus should be on your system. You should know your system inside out, its strengths and weaknesses. Your system should be comprised of a set of rules that ultimately guide you in making either of two decisions, to buy or sell. You should be able to read your system with respect to market conditions and base your trading choices on what your system is telling you.

Paul Counsel

As a trader you must understand that you’re the weakest link in the system because the complexity will reside with you. Good systems are simple. They are nothing more than a series of instructions called trading rules. The primary thought that should be central in your mind is that it’s the system that makes the money, not you. The more skilled you become at reading market conditions and marrying these conditions to your system the better a trader you’ll be.

Paul Counsel

Wealth creation is an uncertain activity for most people and, to do something without certainty of outcome, takes courage. It takes courage to do what the majority is not doing. It takes courage to overcome scepticism and cynicism. It takes courage to deal with fear and overcome fear barriers.

Paul Counsel

Everything in this world involves risk but by far the greatest risk is staying in your comfort zone because this involves the risks of lost opportunities. The secret to risk lies in knowing how to minimise its impacts on you. If you want to be a successful trader you must become passionate about the learning process. You must become totally focused on trading well as opposed to making money. You must learn from someone who can show you how to trade successfully rather than rely on machines and promises of “golden eggs”. You must become absolutely disciplined in the activity of trading.

Paul Counsel