Trading Tip, New Years Schedule & Futures Trading Levels 12.31.2019

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

_________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Dear Traders,

Wishing all our clients, blog readers and visitors a GREAT 2020.

We hope it is a healthy, successful and happy year to everyone!!

Trading tip for today from our Futures Trading Charts Consultation company:

Entering trades using a STOP order.

Most retail clients I work with will enter trades either at market or using a limit order ( better price than current market price), however, there are times that depending on your trading strategy , entering the trade on a stop order might be better.

Example, you are looking for momentum and making a few ticks and you feel that the current resistance on natural gas is 3.570 and in this hypothetical example the market is trading at 3.550.

You place a buy stop order to enter the market at 3.573 because you want to see the resistance violated and you are looking for possible continuation and follow through if that happens.

If the market does not brake the resistance line in this “educational example”, you dont get in the trade. If it does, then your buy stop will trigger you long at best market price.

Some traders will take this a step further and use a buy stop/limit. example buy stop 3.573 / limit 3.575 meaning fill me if we break 3.573 but no worse than 3.575. In this case you are willing to “miss the trade” but you know what is your predefined slippage.

Futures Trading Videos:

1. Identifying Support And Resistance Using A Line Chart.

2. Finding Levels of Support Resistance

3. Day Trading crude oil futures using fear and greed….

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

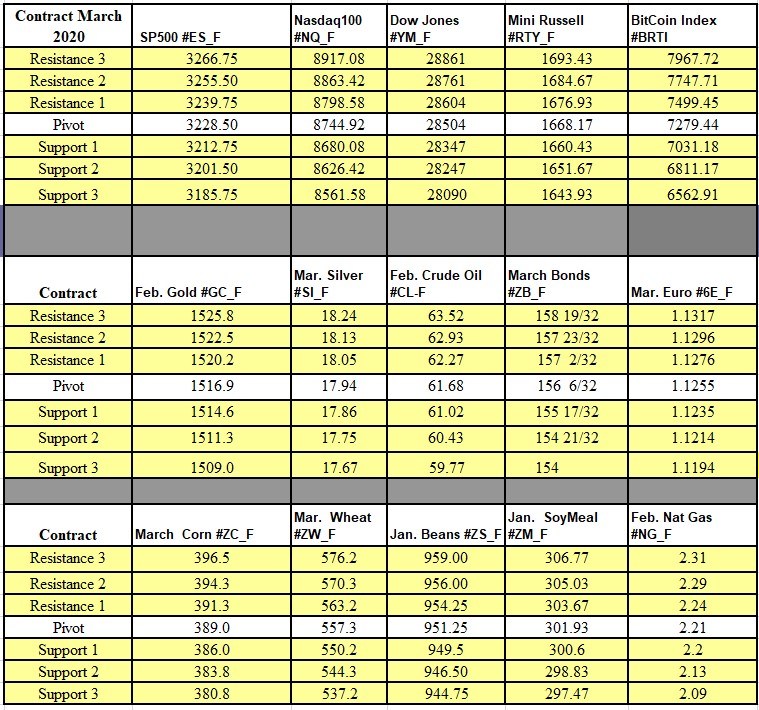

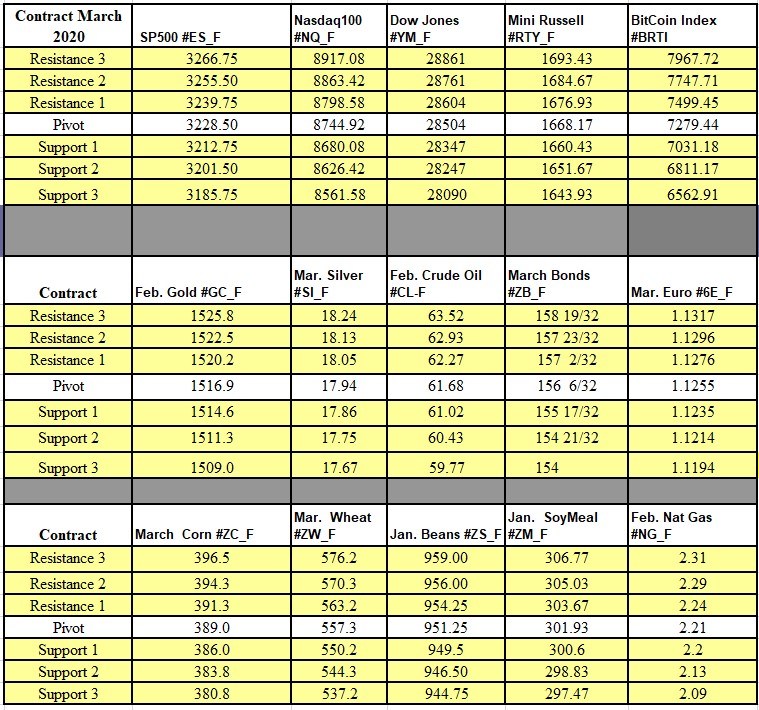

Futures Trading Levels

12-31-2019

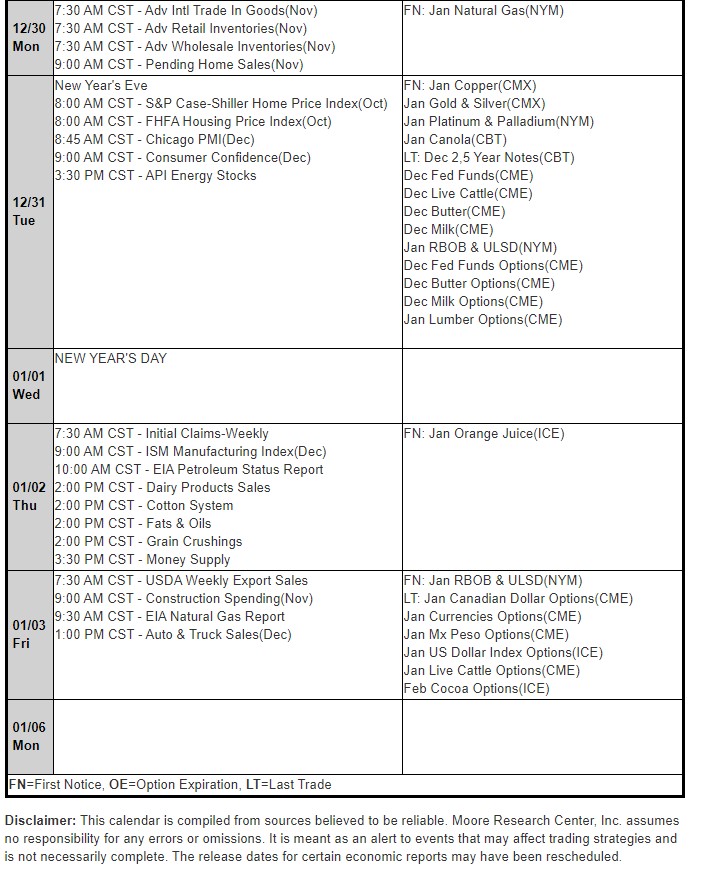

Economic Reports, source:

www.mrci.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News