What You Need to Know Before Trading 8.10.22

By Mark O’Brien, Senior Broker

Financials:

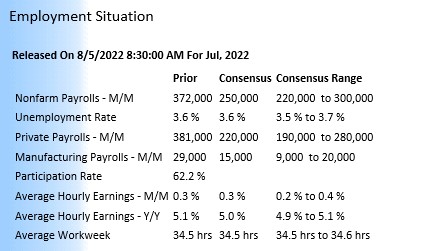

Keep an eye out for the Labor Department’s release of this month’s Consumer Price Index tomorrow and the Producer Price Index on Thursday. Both will be looked at as guidance for the Federal Reserve as it approaches its September 20-21 meeting, on the heels of back-to-back 75-basis point rate hikes at their last two respective meetings. Economists polled by Reuters are forecasting a ±8.7% year-over-year CPI headline reading, down slightly from the 9.1% jump in June.

Roughly during that same period, several commodity prices have fallen dramatically. Sept. corn futures have dropped ±24% over the past three months; July wheat prices have fallen by ±27%, and soybean prices are down by ±14%.

Crude oil – trading as low a s $88/barrel last week – is now below price levels prior to Russia’s invasion of Ukraine. Prices paid at the pump nationally have fallen as well, approaching an average of $4 per gallon in the U.S. compared to a peak of over $5 per gallon in June.

Softs:

Big news regarding lumber futures! Yesterday, the CME Group introduced revamped lumber futures and options. These are not newly offered alternative/mini futures contracts and options, but a complete remodel of the existing ones. The contracts and options kept the same symbols, but the leverage was reduced to 1/4 the prior specifications: 27,500 board feet, down from 110,000. Now, a $1.00 move is equal to $27.50, down from $110.00.

The contracts’ minimum tic size increased from $0.10 ($11) to $0.50 ($13.75).

Trading hours: Mon. – Fri.: 9:00 A.M. – 3:05 P.M., Central Time.

Contract settlement remains physically delivered.

Please contact our professional staff for more details.

Plan your trade and trade your plan!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

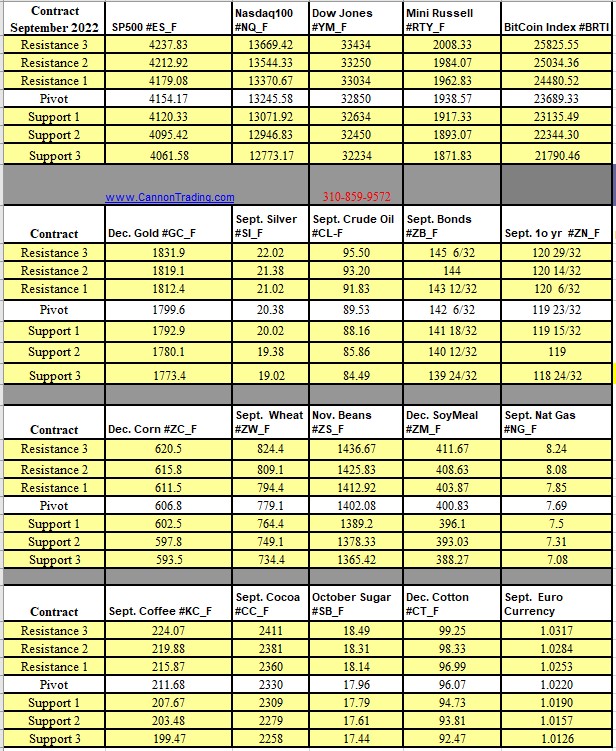

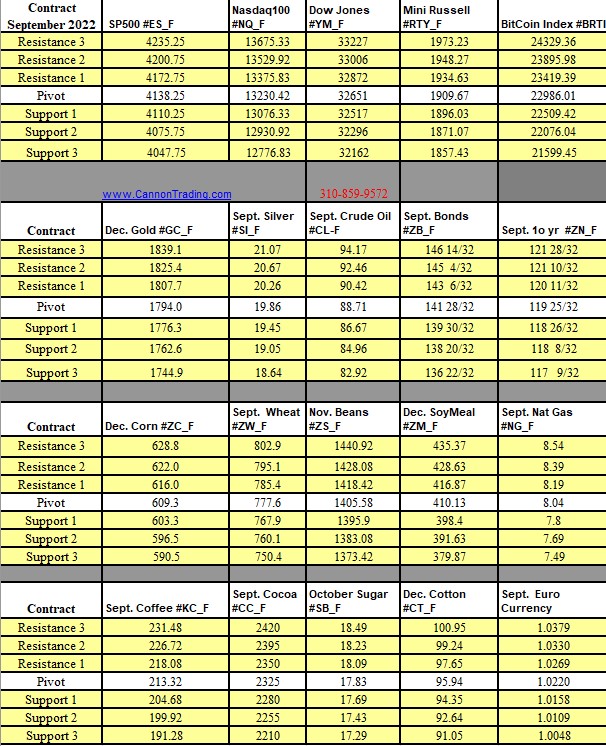

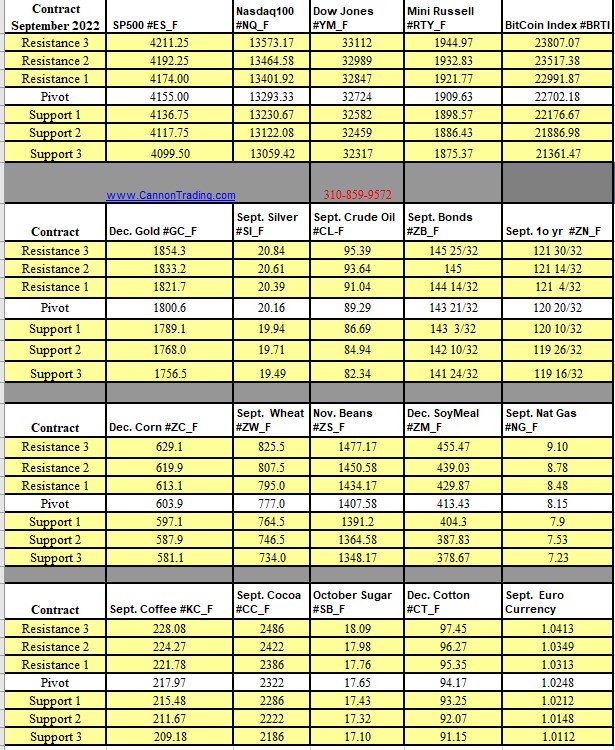

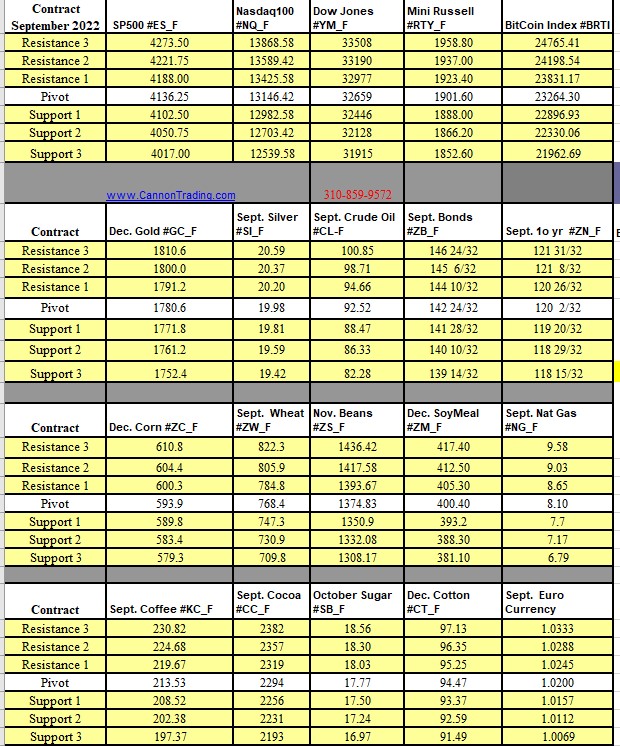

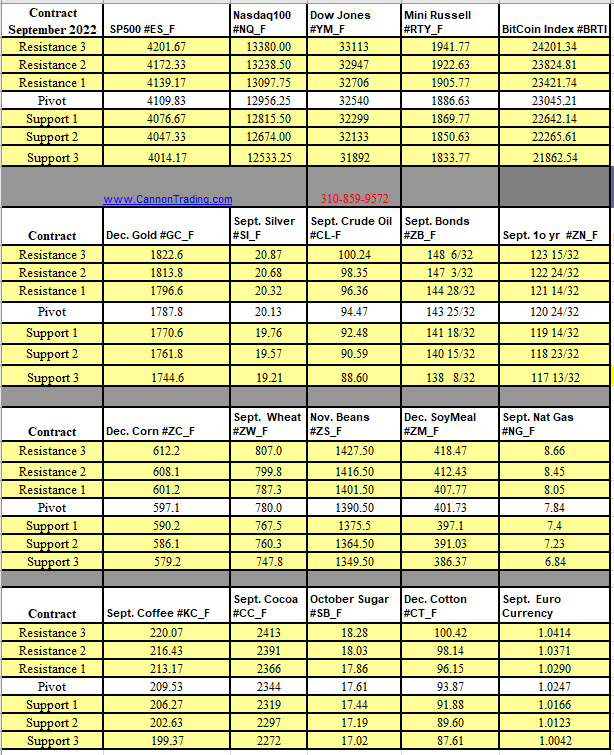

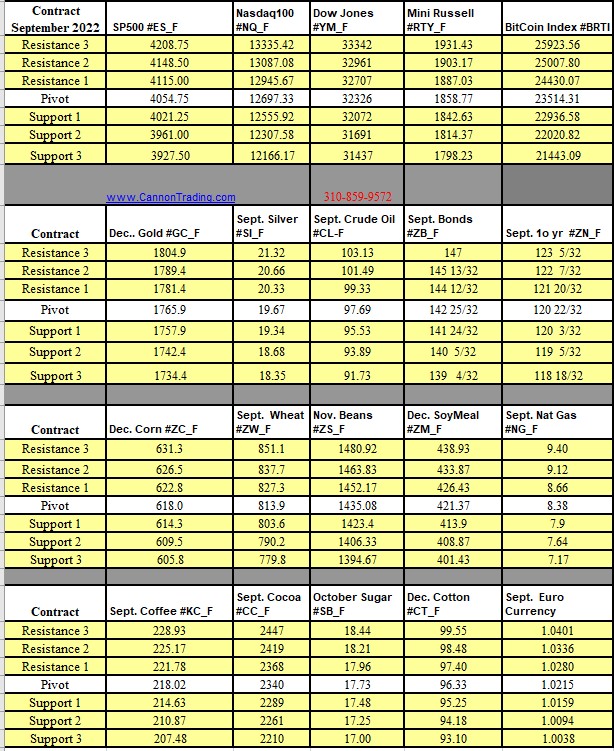

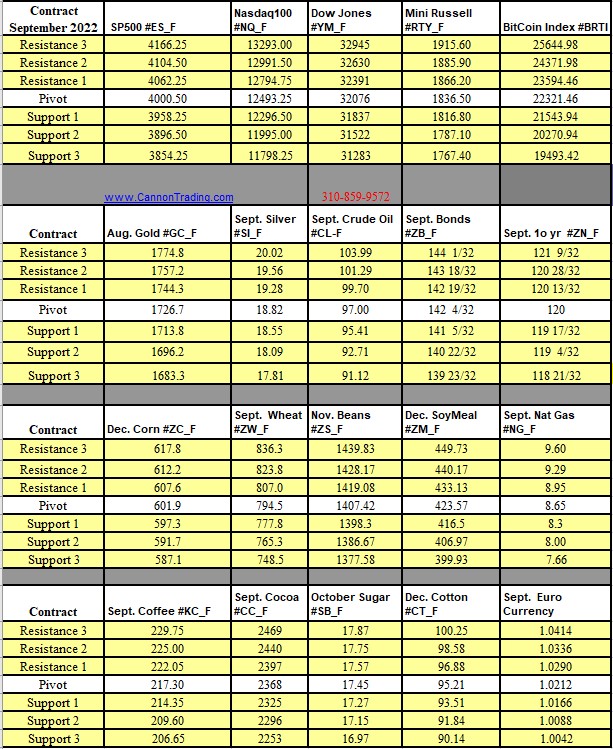

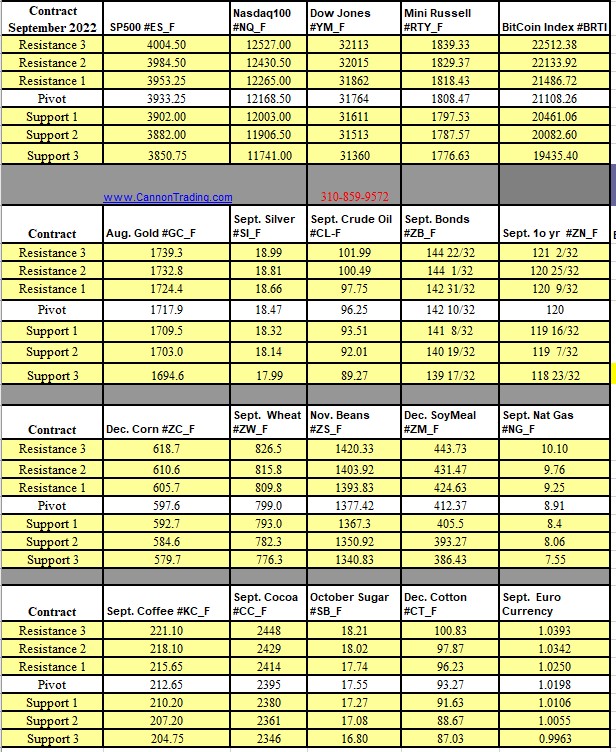

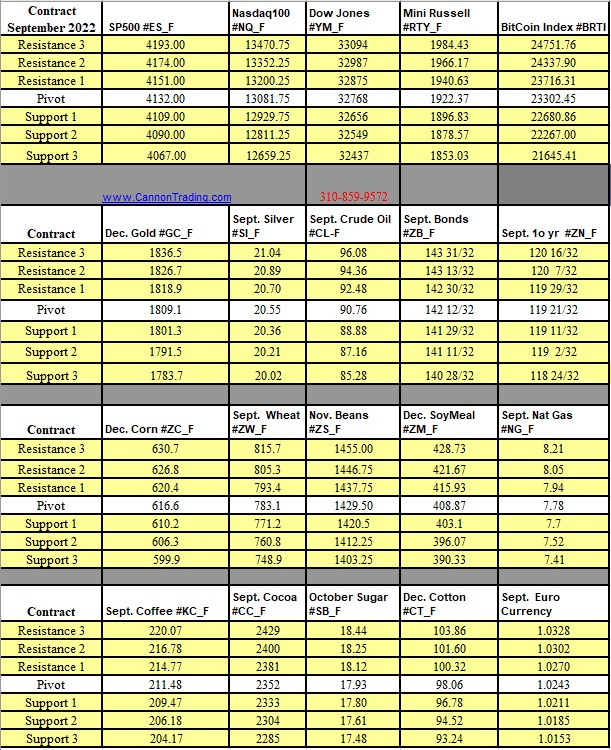

Futures Trading Levels

08-10-2022

Improve Your Trading Skills

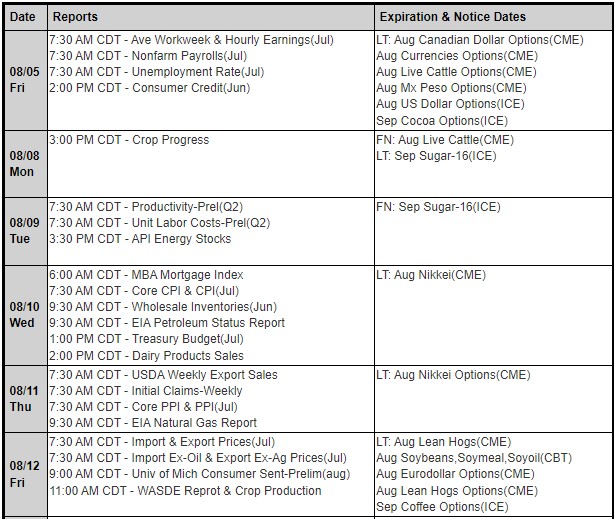

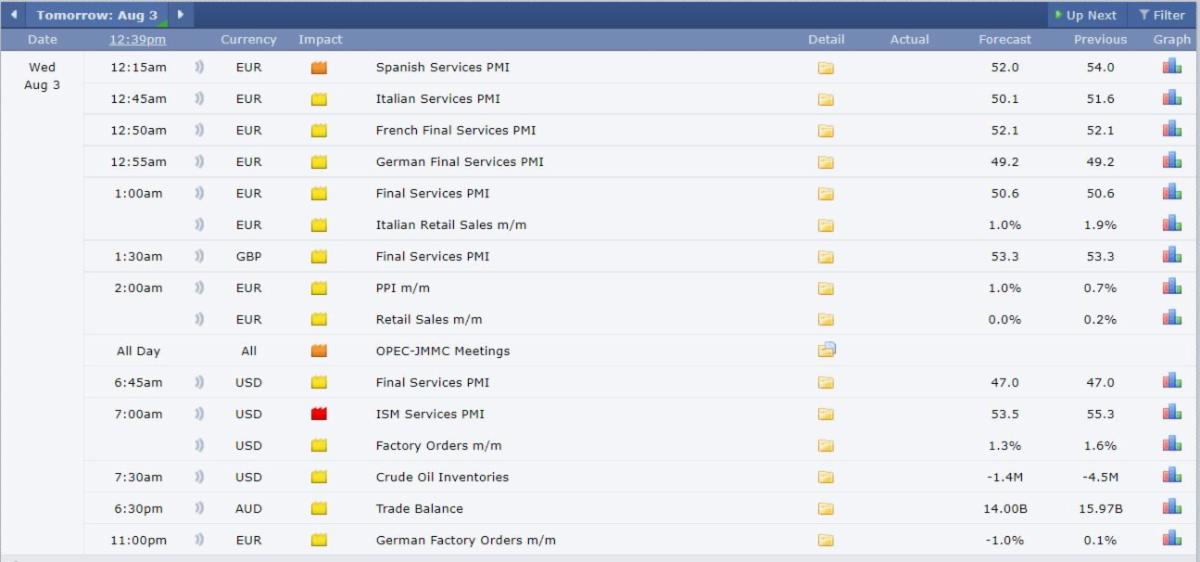

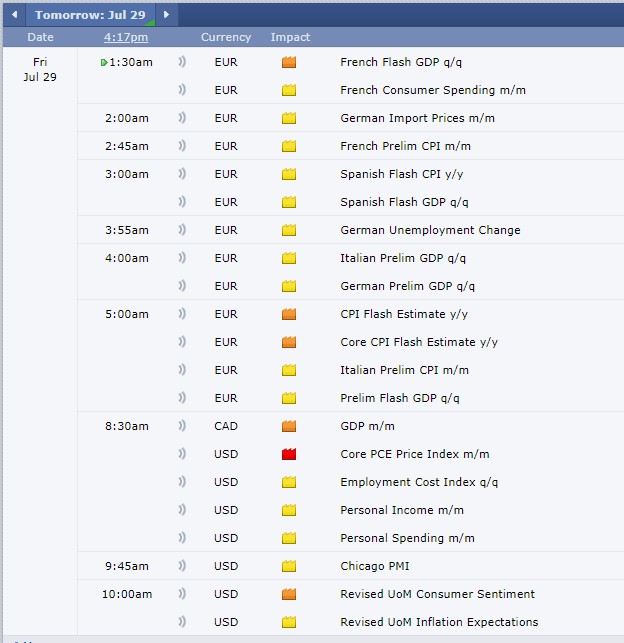

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.