Get Real Time updates and more on our private FB group!

Margin Requirements are your Ally

By Mark O’Brien, Senior Broker

As a rule, all futures contracts come with financial requirements in order to trade them. These requirements come in the form of margin. For the vast majority of traders – speculators – there are three types: 1.) the initial margin requirement, 2.) the maintenance margin requirement and 3.) the day trading margin requirement. The first two are established by the futures exchange on which a particular futures contract is traded. The initial margin requirement is the amount of cash you must have to initiate a position in the market. The maintenance margin requirement – typically 80-90% of the initial margin requirement – is the amount of money required to maintain the position your account. Day trading margin requirements are set by individual clearing firms and/or brokerage firms and are fractionally lower than a contract’s initial margin requirement, sometimes ±80% below the initial margin requirement.

While all these are designated as requirements, traders should also look at them as guardrails or markers that serve not just to notify you of the potential risk in the market you’re about to trade, but also to give you an idea of the risk to your account you should anticipate once you’re in the trade. Be prepared. In the event the market(s) you’re trading cause an adverse drop in your account’s balance – below the maintenance margin requirement of your position – and a margin call occurs, yes it’s an unfavorable outcome, but it’s also a genuine alert that you need to take action. It’s time to either offset part or all of the position or deposit more money (enough to bring your account back above the initial margin requirement) to keep the position. Treat margin requirements more as words to the wise rather than handcuffs. Trade with the thought that margin requirements are your friend.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

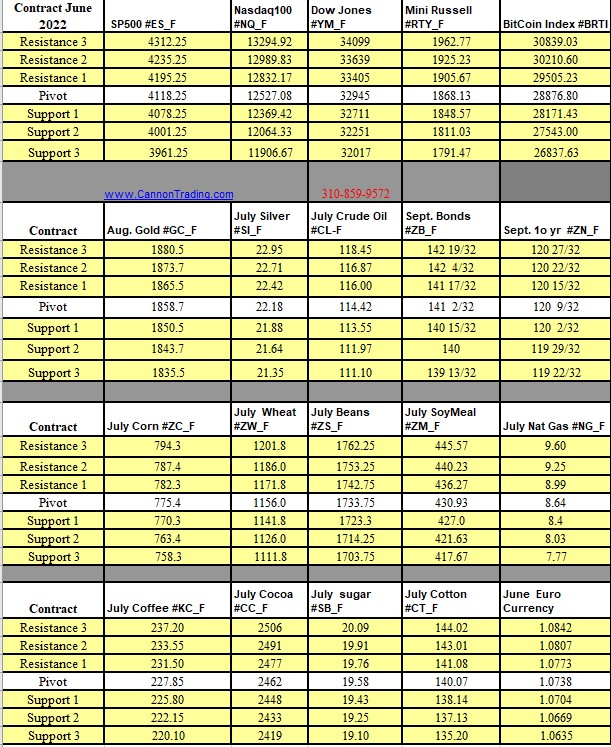

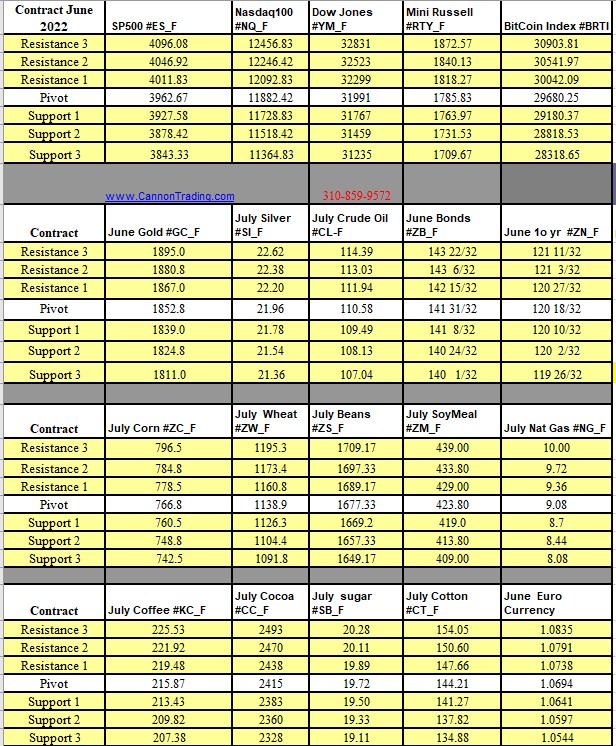

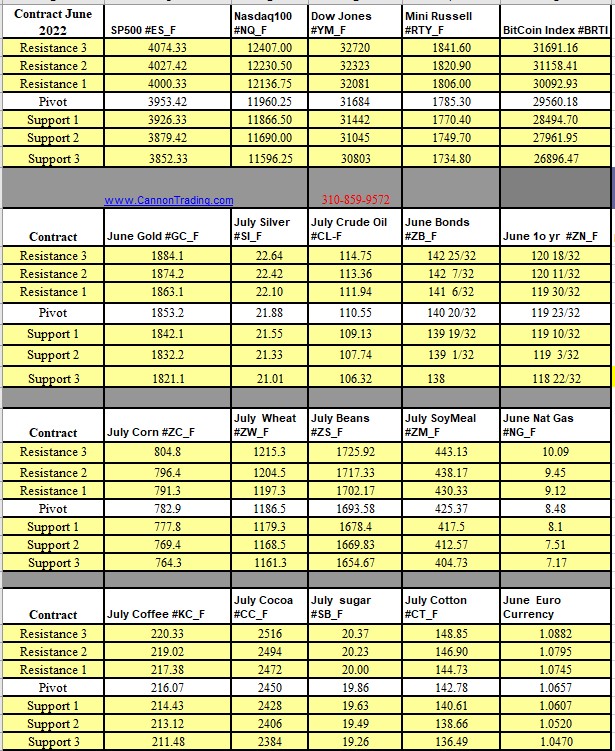

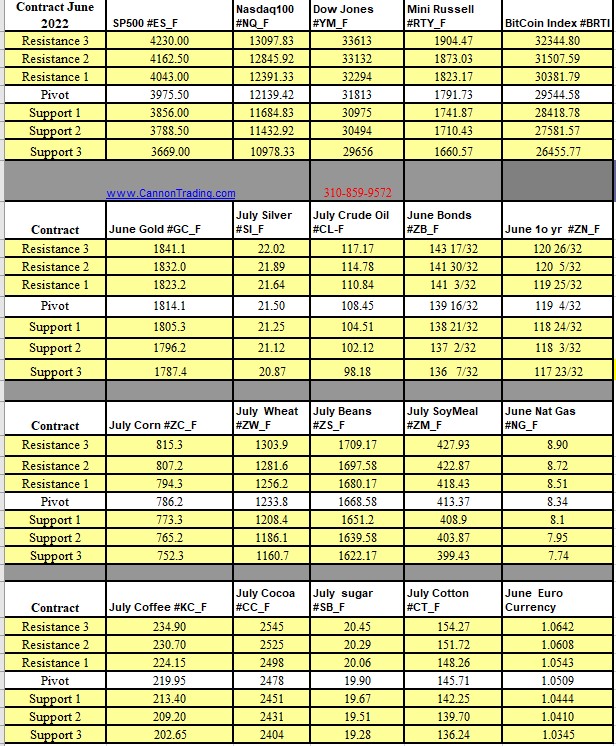

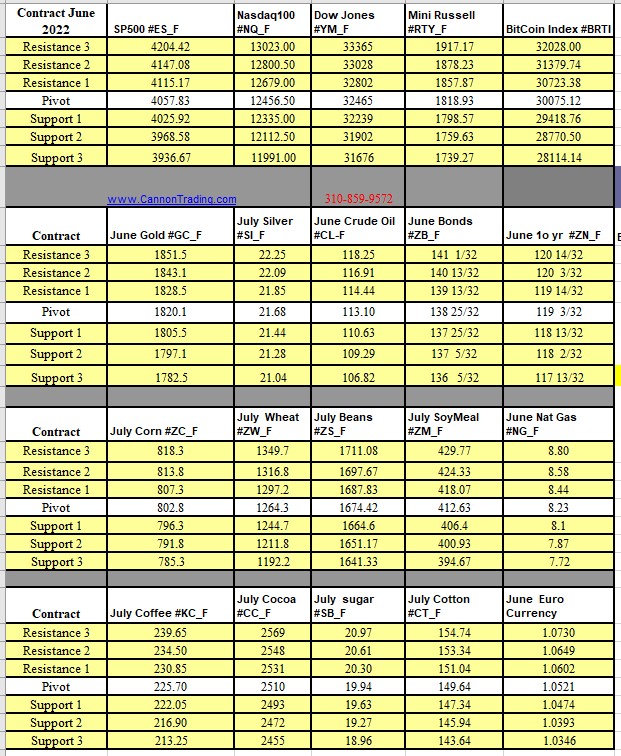

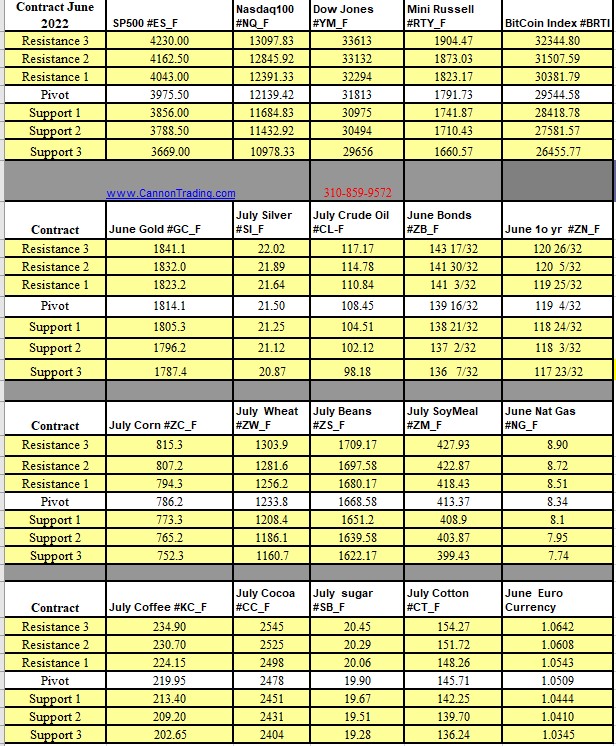

Futures Trading Levels

05-19-2022

Improve Your Trading Skills

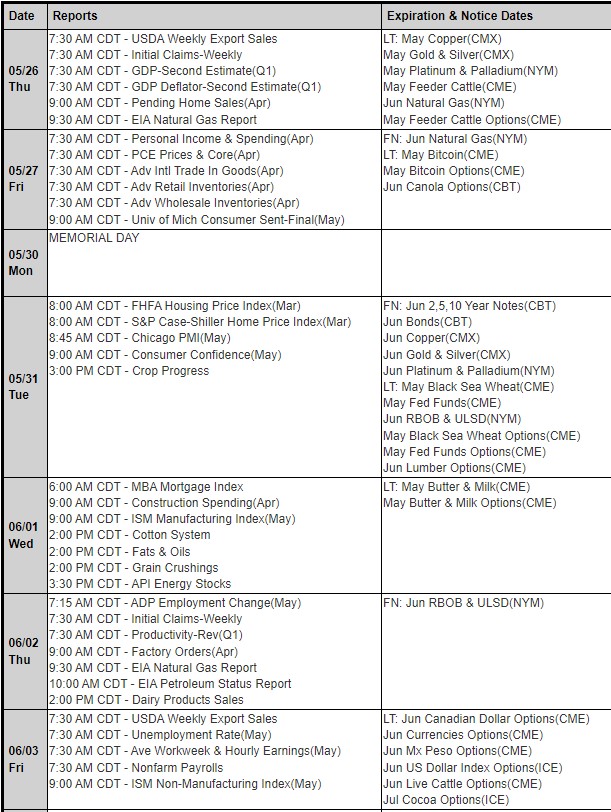

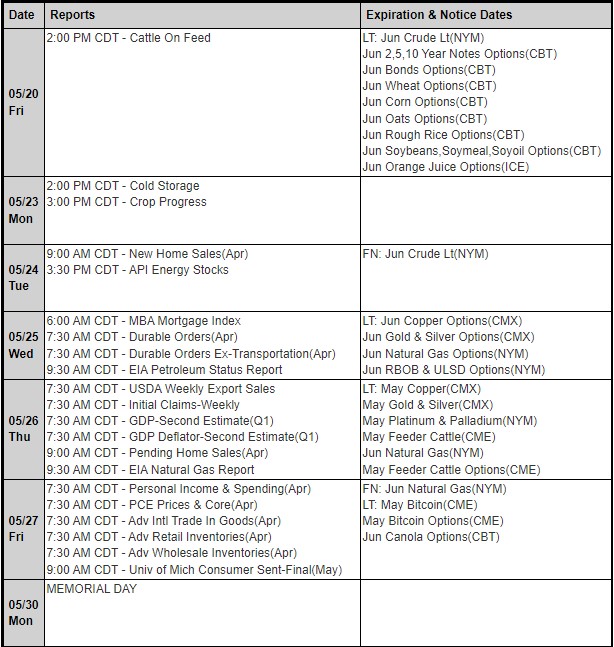

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.