Why skilled futures brokers matter – They provide expertise, guidance, and support in navigating complex futures markets.

Decades of proven experience – Cannon Trading Company brings a long history of trusted service to futures traders.

Cutting-edge trading platforms – Access advanced technology, including CannonX powered by CQG, for professional-grade execution.

Recognized trust and credibility – 5-star TrustPilot reviews highlight customer satisfaction and reliability.

In the fast-moving world of futures trading, the presence of a skilled broker often makes the difference between long-term success and costly mistakes. Trading futures requires more than just market knowledge; it demands access to advanced platforms, fast execution, leverage, hedging strategies, and—most importantly—expert guidance when systems fail or emergencies arise.

For futures traders, a futures broker isn’t just a service provider—it’s a lifeline. The broker connects traders to the markets, offers valuable tools for risk management, and provides real-time support when technology fails. This article will explore why skilled futures brokers are vital to every futures trader’s experience, focusing on practical aspects like leverage, diversification, and hedging. It will also demonstrate how Cannon Trading Company embodies these traits through its decades of industry expertise, impeccable regulatory reputation, and top-tier trading platforms like CannonX powered by CQG.

Why Skilled Futures Brokers Are Vital for Futures Traders

-

Access to Leverage

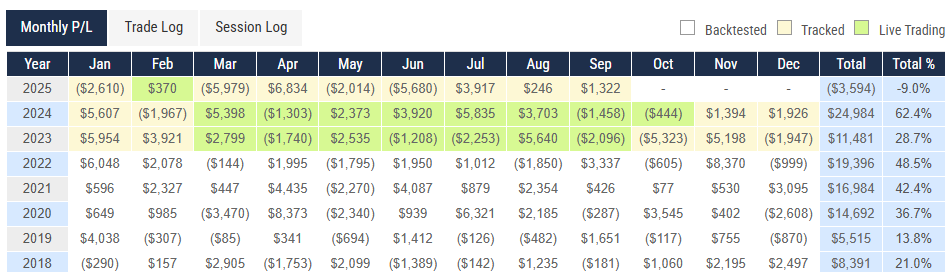

Leverage is one of the most compelling features of futures trading. It allows futures traders to control large contract values with relatively small amounts of margin. A skilled broker ensures traders understand the double-edged nature of leverage—while it amplifies gains, it can also magnify losses.

- Risk education: Brokers help clients assess how much leverage is appropriate for their strategy.

- Margin monitoring: They provide tools and alerts so that futures traders don’t face unexpected margin calls.

- Real-time execution: A broker ensures that leveraged positions are entered and exited quickly, minimizing slippage.

At Cannon Trading Company, brokers work closely with clients to ensure leverage is used responsibly, protecting traders from common pitfalls.

-

Diversification Across Markets

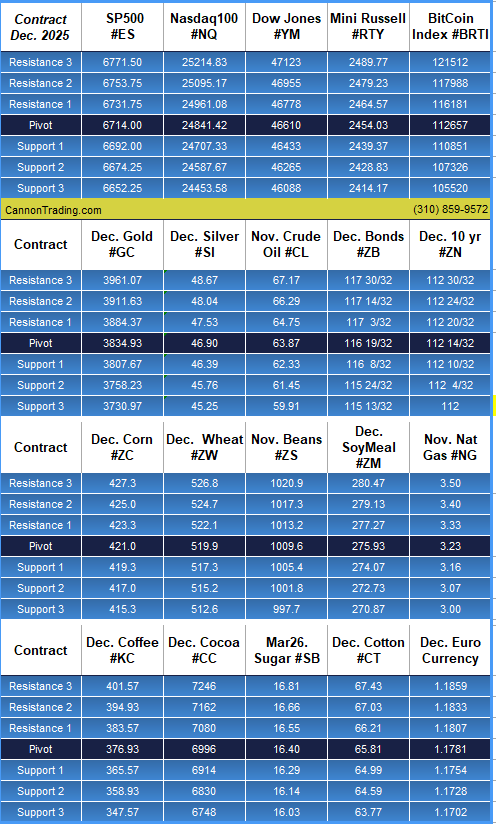

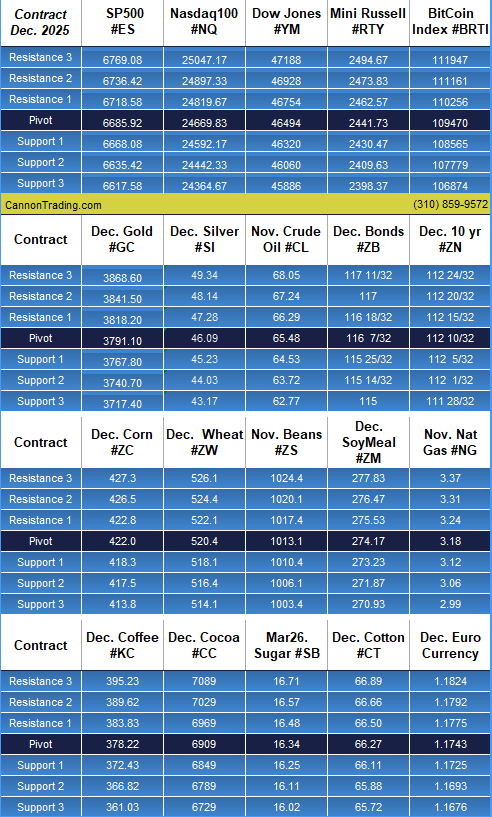

Diversification is another crucial reason a skilled broker matters. Trading futures isn’t limited to one asset class—it spans commodities, currencies, stock indexes, interest rates, and even cryptocurrencies.

- Market access: Brokers open the door to global exchanges, enabling traders to spread risk across different sectors.

- Research support: They provide market insights that help traders identify uncorrelated opportunities.

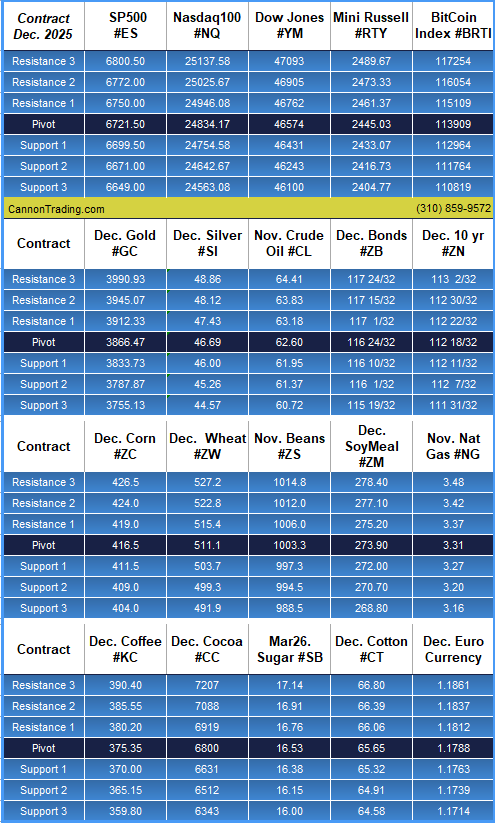

- Platform technology: Advanced platforms like CannonX powered by CQG give futures traders the ability to track multiple asset classes simultaneously.

By offering a wide range of futures contracts, Cannon Trading empowers its clients to diversify intelligently, reducing portfolio volatility.

-

Hedging Strategies

Hedging is a defining feature of futures trading. Farmers, corporations, and financial institutions use futures contracts to protect against adverse price movements. But hedging can be complex, requiring the expertise of a skilled broker.

- Customized strategies: Brokers help tailor hedges to each client’s specific risk exposure.

- Execution speed: Proper hedges must be executed quickly and accurately.

- Guidance: Brokers provide real-world advice on whether a hedge is effective or needs adjustment.

Cannon Trading Company has decades of experience helping businesses and individual futures traders manage risk through effective hedging strategies, demonstrating its role as a trusted partner.

-

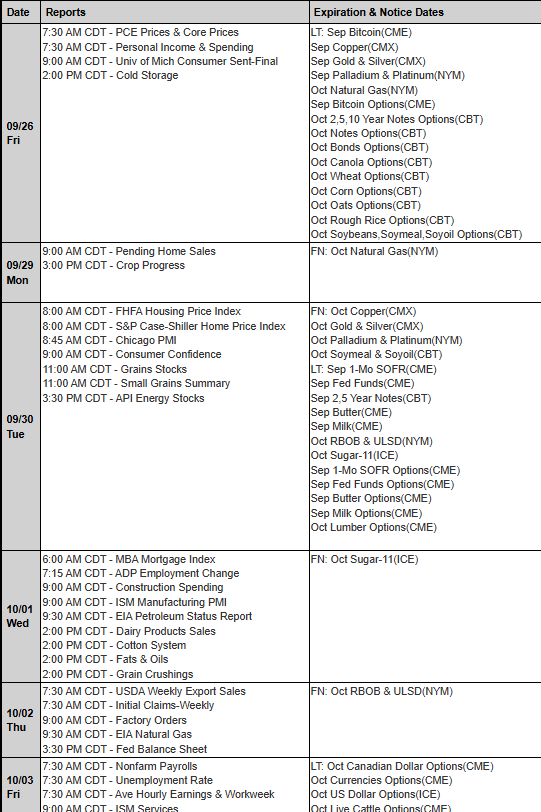

Emergency Support When Systems Fail

No matter how advanced technology becomes, systems can fail. Trading platforms may crash, internet connections may drop, or servers may experience downtime. In these critical moments, futures traders need immediate access to their broker.

- Phone execution: A skilled broker is just one phone call away to enter or exit positions.

- Crisis management: Brokers ensure clients can flatten positions to avoid catastrophic losses.

- Reliability: Traders gain peace of mind knowing they’re never alone in an emergency.

Cannon Trading’s personalized service and accessible team mean traders can rely on fast, human intervention in high-stress moments. This direct support has earned them numerous 5-star TrustPilot ratings.

-

Education and Mentorship

For both beginners and advanced futures traders, education is a cornerstone of success. A skilled broker doesn’t just process trades; they mentor clients on strategies, risk management, and platform use.

- Beginner guidance: Helping new traders understand margin, contract specifications, and order types.

- Advanced support: Assisting experienced traders with algorithmic tools and advanced platform features.

- Educational resources: Many brokers offer webinars, guides, and one-on-one training.

Cannon Trading Company has built its reputation on transparency and education, making sure traders are well-prepared before risking capital.

How Cannon Trading Company Embodies These Traits

Decades of Experience

Founded in 1988, Cannon Trading has decades of expertise in futures trading. This longevity reflects not only its ability to adapt to market changes but also its commitment to integrity and client service.

Reputation with Regulators

Cannon Trading maintains an exemplary record with both federal regulators and independent industry bodies. This compliance gives futures traders confidence that they are working with a trusted and secure partner.

5-Star TrustPilot Ratings

Dozens of satisfied clients have awarded Cannon Trading 5 out of 5 stars on TrustPilot. These reviews often highlight the company’s responsiveness, personalized service, and expert guidance in trading futures.

Advanced Platforms: CannonX Powered by CQG

Technology is at the heart of modern futures trading. Cannon offers a wide selection of platforms, but its flagship CannonX powered by CQG stands out:

- Ultra-low latency execution for high-frequency traders.

- Advanced charting and analytics for in-depth technical analysis.

- Global connectivity to major exchanges, ensuring futures traders never miss an opportunity.

By combining human expertise with cutting-edge technology, Cannon Trading provides a balanced ecosystem for every futures trader.

Related Blog Posts from Cannon Trading Company

To deepen your knowledge, explore these authoritative posts authored by Cannon Trading Company:

Each resource reflects Cannon’s ongoing mission to educate and empower futures traders.

Frequently Asked Questions (FAQ)

- Why is a skilled futures broker important?

A skilled broker ensures proper use of leverage, diversification, hedging strategies, and provides emergency support when systems fail.

- How does Cannon Trading support clients during emergencies?

Cannon brokers are one phone call away, ready to execute trades when platforms or systems fail, giving traders peace of mind.

- What platforms does Cannon Trading offer?

Cannon provides multiple platforms, with CannonX powered by CQG being the flagship choice for serious futures traders.

- What makes Cannon Trading trustworthy?

Decades of industry experience, 5-star TrustPilot reviews, and an exemplary record with regulators showcase Cannon’s reliability.

- Can Cannon Trading help new traders?

Yes, Cannon offers educational resources, personalized support, and mentorship for beginners entering futures trading.

The world of trading futures is both exciting and challenging. Success requires more than market knowledge; it requires the expertise, support, and technology that only a skilled broker can provide. From managing leverage and diversification to ensuring traders have immediate help during emergencies, brokers play an irreplaceable role.

Cannon Trading Company exemplifies all these qualities—backed by decades of experience, a stellar regulatory reputation, 5-star TrustPilot ratings, and advanced platforms like CannonX powered by CQG. For futures traders looking for reliability, education, and execution speed, Cannon stands out as a top choice in the industry.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading