DJIA Index Futures

DJIA index futures, commonly referred to as Dow Jones futures, are derivatives contracts that represent a portion of the Dow Jones Industrial Average. These contracts allow traders to speculate on or hedge against future movements in the Dow Jones Industrial Average Index Futures. As a benchmark index that includes 30 blue-chip U.S. companies, the DJIA provides vital insight into market sentiment, economic performance, and investor behavior.

Dow industrial futures are crucial tools for institutional investors, hedge funds, and retail traders alike. They offer a way to gain exposure to the U.S. stock market without buying individual equities. Whether traders are looking to capitalize on short-term market swings or hedge long-term equity portfolios, DJIA index futures play a central role in any modern trading strategy.

Try a FREE Demo!

Structure and Functionality of DJIA Index Futures

Each dow jones futures contract is tied to the value of the DJIA. These contracts trade on major futures exchanges like the CME Group and are available nearly 24 hours a day. This global accessibility provides traders with unparalleled flexibility and an opportunity to react to market-moving news at any time.

There are various contract sizes, including the E-mini Dow and Micro E-mini Dow, tailored for different trader profiles. These futures are marked-to-market daily, ensuring transparency and minimizing credit risk.

Using dow jones index future contracts, traders can employ strategies ranging from simple directional trades to complex arbitrage and spread positions. Additionally, these contracts are leveraged, allowing traders to control a large notional value with relatively small capital.

The Economic Landscape: 2025 So Far

To understand what lies ahead for dow jones industrial average index futures in the second half of 2025, it’s essential to first assess the macroeconomic landscape established in the first trimester of the year.

Key Trends in Early 2025:

- Federal Reserve Policy: The Fed maintained a balanced stance in Q1, holding interest rates steady after a cycle of hikes in 2023 and minor cuts in late 2024. Inflation has continued to moderate.

- Geopolitical Developments: Continued tensions in global trade, especially involving the U.S., China, and emerging markets, have influenced investor sentiment.

- Technology Leadership: Tech companies, many of which are not DJIA components, have continued to lead growth. However, the industrial sector – core to the DJIA – has seen a rebound due to increased infrastructure spending and capital investment.

With these dynamics in mind, traders and futures brokers USA are paying close attention to how DJIA index futures might perform moving forward.

DJIA Index Futures: Outlook for the Second and Third Trimesters of 2025

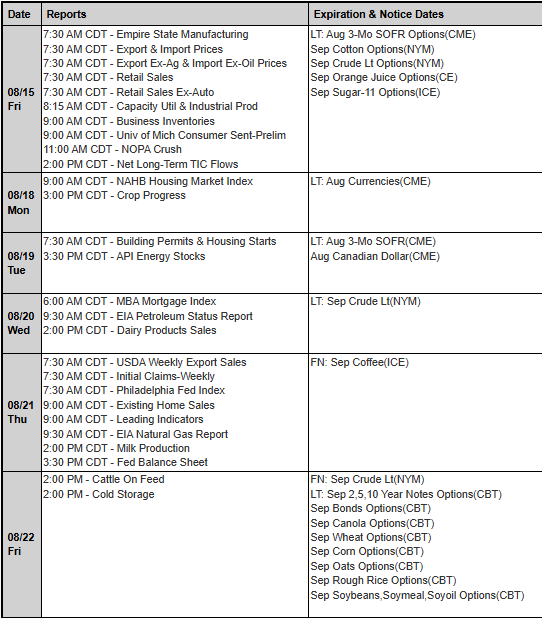

Economic Indicators to Watch

- GDP Growth: Forecasts suggest a steady but unspectacular growth trajectory. This steady climb bodes well for dow jones industrial index futures, which benefit from optimism in traditional industrial sectors.

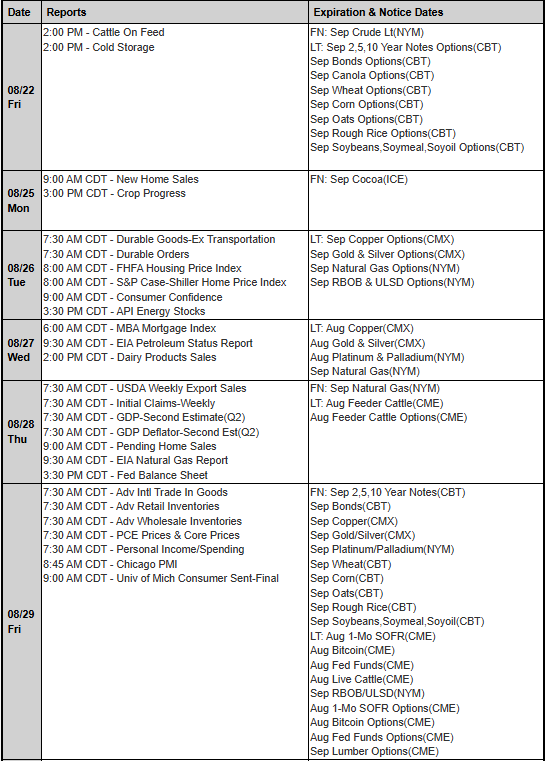

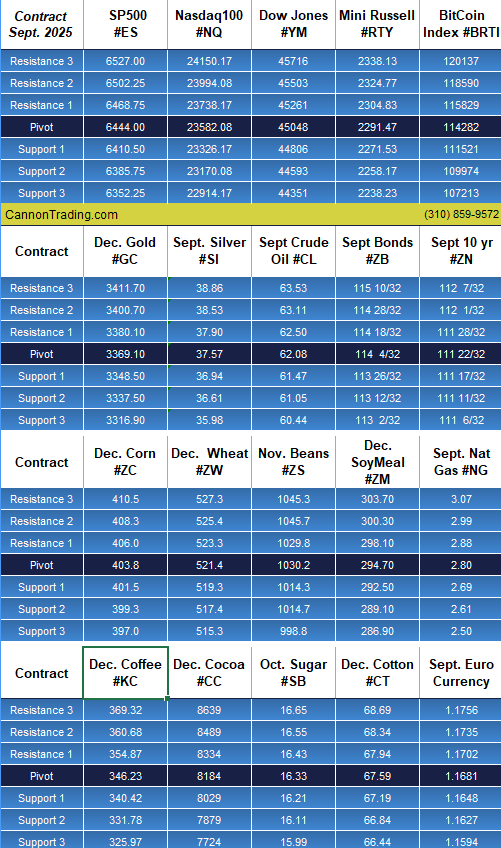

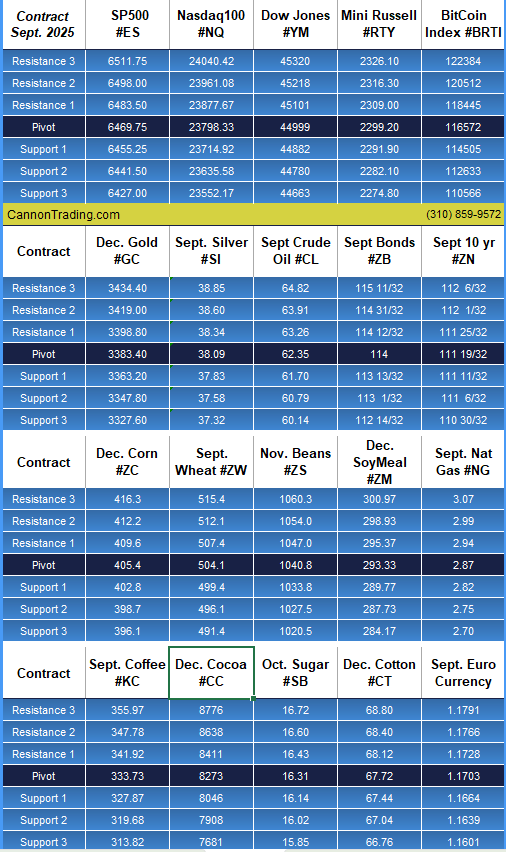

- Inflation: While largely under control, unexpected inflation surges could reignite volatility. Traders using futures brokers to monitor CPI, PPI, and energy prices will be better positioned.

- Employment: Job growth in construction, manufacturing, and logistics—key DJIA sectors—is expected to continue through the summer and fall.

Sector Rotation in Play

As interest rates stabilize, investors may rotate away from overvalued tech stocks into more stable, dividend-paying stocks—a trend beneficial to DJIA index futures. With the DJIA heavily weighted toward industrials, financials, and consumer staples, these rotations are pivotal.

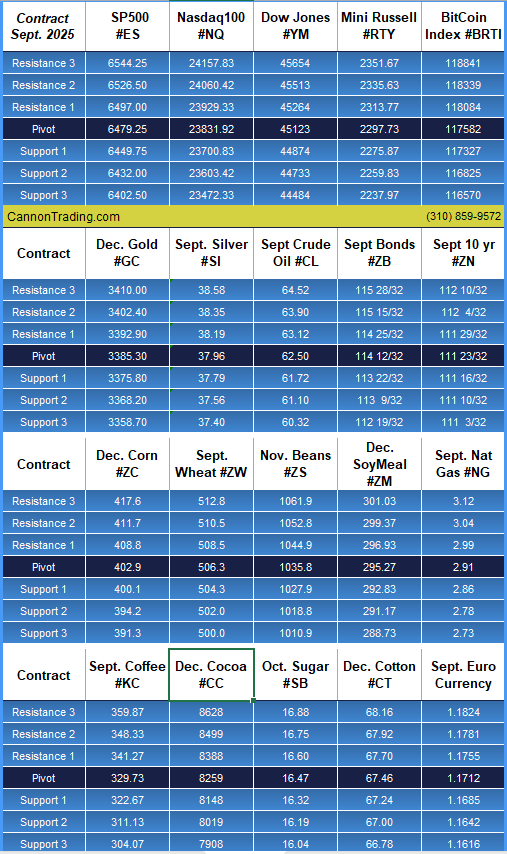

Expected Movements

Between July and December 2025, traders can anticipate:

- Short-term spikes driven by earnings reports, geopolitical events, and Fed comments.

- Medium-term trends reflecting fiscal policy changes and economic resilience.

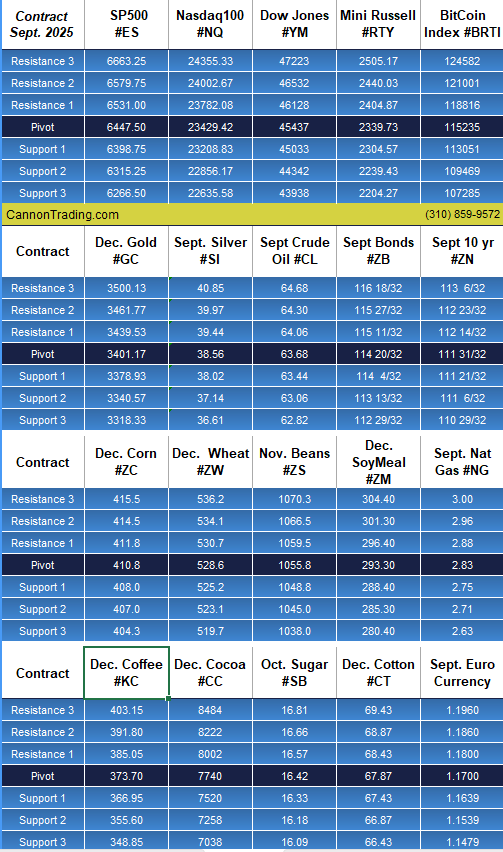

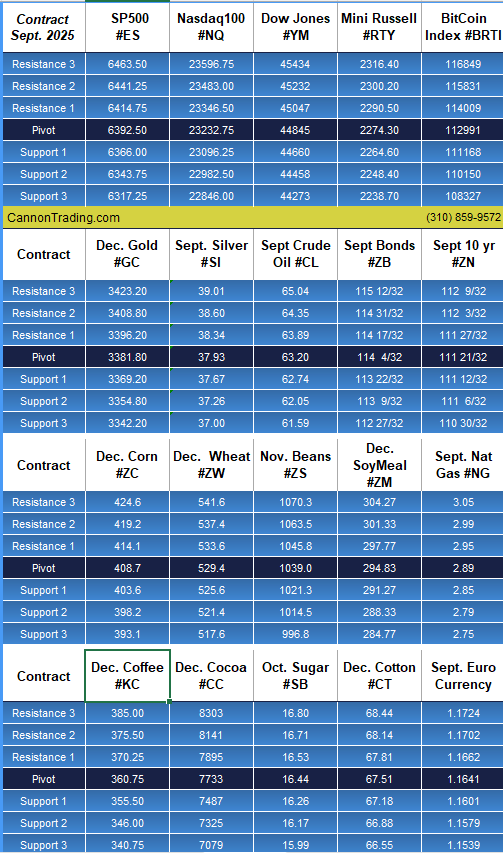

- Opportunities for spread trading between Dow Jones futures and S&P or Nasdaq futures as relative performance varies.

With these conditions, trading futures in the DJIA space will demand sharp tools, expert guidance, and reliable platforms—areas where Cannon Trading Company excels.

Cannon Trading Company: A Partner in DJIA Futures Success

Trust and Reputation

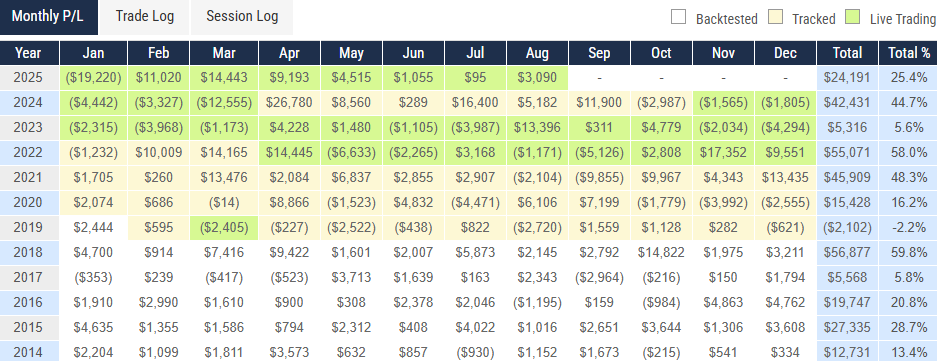

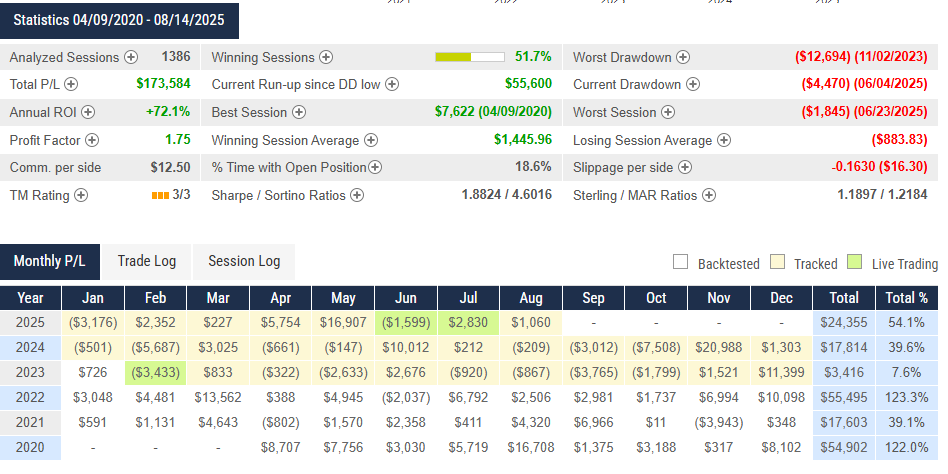

With decades of experience in the futures industry, Cannon Trading Company has become a beacon for traders seeking reliability, transparency, and performance. As one of the best futures brokers, Cannon has earned a 5 out of 5-star rating on TrustPilot—a testament to their dedication to client satisfaction and industry excellence.

Cannon is also well-regarded by both federal and independent futures industry regulators, consistently maintaining an exemplary compliance record. This is a vital consideration for traders navigating the complex world of futures brokers USA.

Advanced Futures Platforms: The Power of Choice

Cannon offers access to a wide selection of top-performing futures trading platforms, including industry leaders like:

These platforms provide the analytical tools, charting capabilities, and order execution speed necessary for success in DJIA index futures trading.

Particularly, CannonX—a proprietary platform powered by CQG—is built for speed, precision, and reliability. With direct exchange connectivity and deep liquidity access, it gives traders the edge they need to profit from fast-moving Dow Jones industrial index futures.

Try a FREE Demo!

Personalized Broker Support

Unlike many faceless firms, Cannon prides itself on offering personalized service. Whether you’re a new trader seeking basic insights or an institutional client executing sophisticated strategies, Cannon’s team of seasoned professionals ensures you have the resources and information you need to make informed decisions.

This kind of support is what separates Cannon from many future brokers in the market. Their ability to combine technological excellence with human expertise makes them an undeniable asset for anyone trading dow jones index future contracts.

Risk Management and Strategy Support

Trading futures isn’t just about making money—it’s about managing risk effectively. Cannon’s experts regularly provide guidance on:

- Margin requirements

- Stop-loss strategies

- Hedging with options

- Correlation with other indices

These insights are especially important in volatile periods, such as those expected in the second and third trimesters of 2025.

Furthermore, Cannon’s educational content, daily newsletters, and client webinars ensure that both novice and advanced traders stay informed. This educational focus reflects their commitment to transparency, a rare trait among even the best futures brokers.

Why Traders Choose Cannon for Dow Jones Futures

Let’s summarize why Cannon Trading Company is the go-to futures broker for dow jones industrial average index futures:

- Regulatory Excellence: Recognized by futures brokers USA watchdogs and independent compliance bodies.

- Client Reviews: Hundreds of 5-star TrustPilot reviews highlight customer satisfaction and loyalty.

- Platform Variety: A powerful lineup of trading tools, especially CannonX powered by CQG, built for precision in DJIA index futures trading.

- Educational Leadership: Access to market commentary, strategy sessions, and real-time updates.

- Decades of Experience: Proven resilience through bull and bear markets, recessions, and bubbles.

- Professional Service: Not just a platform provider, but a strategic partner with true broker expertise.

In an environment where market volatility can create both risk and reward, traders need a futures partner that can match their pace, their ambition, and their standards. Cannon Trading Company has consistently risen to that challenge.

Looking Ahead: Opportunities and Challenges

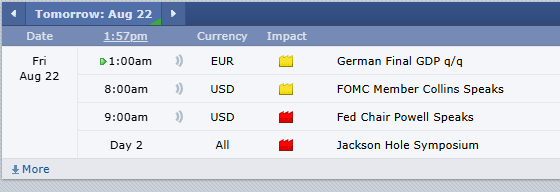

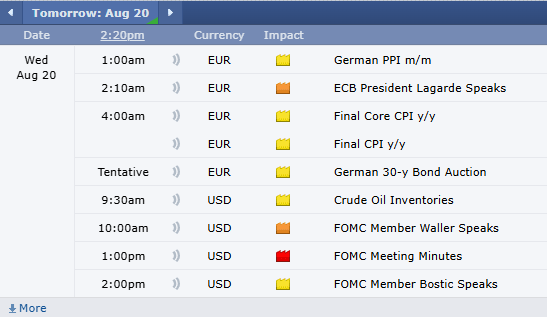

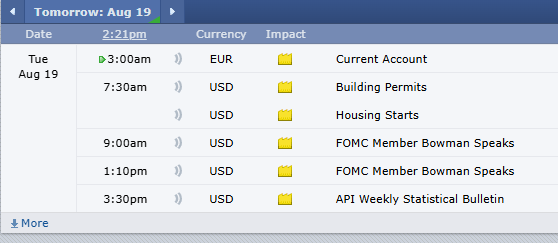

The months ahead are likely to offer considerable trading opportunities in the dow jones futures market. Key events to monitor include:

- Q2 and Q3 corporate earnings

- Government infrastructure contracts impacting industrials

- Shifts in Fed policy or inflationary pressure

- Political developments as election season intensifies

While no outcome is guaranteed, one thing is certain: traders positioned with reliable platforms, informed strategy, and robust support systems are best placed to succeed.

And Cannon Trading Company delivers on all three fronts.

The Future of Dow Jones Index Futures Trading Is Now

The dow jones industrial index futures market is poised for dynamic movement through the remainder of 2025. With market fundamentals, political volatility, and sector rotations all in play, there is no better time to sharpen your strategy, tighten your risk controls, and engage with one of the best futures brokers in the country.

For traders seeking top-tier service, unmatched platform access, and expert guidance, Cannon Trading Company is the clear choice. Their track record, 5-star TrustPilot reputation, and regulator-endorsed professionalism place them at the top of any list of futures brokers USA.

Whether you’re looking to speculate on the next big move in the dow jones index future or hedge long-term equity exposure, Cannon Trading stands ready to help you capitalize on every opportunity.

Try a FREE Demo!

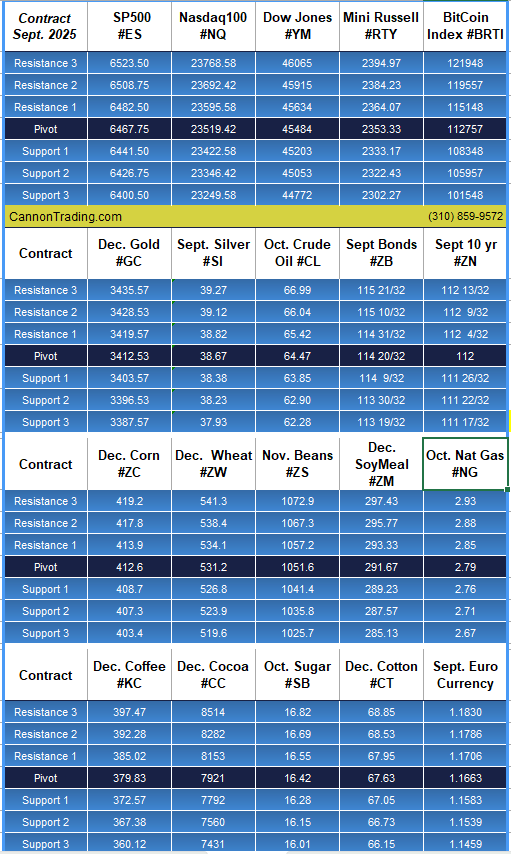

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading