Selecting the ideal futures broker is one of the most important steps a trader can take. Whether you are brand new to futures trading, or an experienced trader looking to expand your portfolio, the futures broker you choose will undoubtedly be integral to your trading success. It is important to weight your options and select a broker that will meet your needs at a firm that offers you the maximum value for that support.

The first decision you will want to make is whether to hire a Transactional or Relationship-Based Broker. Transactional brokerage firms offer clearing services and of course, access to exchanges. However, transactional firms will not assign you a personal broker and therefore can only offer base level support. It is truly a “one size fits all” approach.

Relationship-based brokers are highly involved in their traders’ progress. These brokers provide one-on-one service to each account, and will do everything in their power to ensure their traders are equipped for success. Relationship-based brokers work with their clients to evaluate their needs, provide them with the proper technology and support for trading, and communicate frequently to reevaluate and renovate accounts for maximum success.

After a trader has determined which of these two types of brokers will most benefit them, the next step is to evaluate how much support the trader will need. There are a few basics to choose from when it comes to broker support, the first is 24-hour vs. business hour support, and the next is access to a support team vs. access to a dedicated futures broker.

Even experienced brokers usually choose a firm that offers access to 24-hour trading support from a dedicated Futures broker. The futures markets run all day, and therefore the need for 24-hour support is probable. However, not all firms offer 24-hour support, and some that do only offer access to a support team, not a dedicated broker. While a support team can be helpful in low-stakes scenarios, it is possible to get caught in a high-stakes situation in which a dedicated broker would be more helpful.

When making the decision between 24-hour and business-hour support, and a support team vs. a dedicated Futures broker, a trader should consider their experience level and how comfortable they would be in a risky market situation on their own.

Another factor a trader should consider when choosing the support level that best meets their trading needs is execution services. Execution is the completion of a buy or sell, and there are many kinds. Some traders prefer self-directed execution through online trading, others prefer Futures broker assistance, still others opt for strategy execution, in which an automated system completes the execution based on a specific guided strategy. There is also newsletter execution, options execution, and managed futures. Some brokerage firms only offer one of these types of execution, others offer two or three, and still other offer all to their clients to pick and choose as they see fit. When selecting a broker, it is important to first determine which of these types of execution will work best for you, and make sure the brokers you are interested in offer them.

Once you have determined a brokerage offers the support level that is right for you, the next thing you will want to consider are the tools offered by the firm the help you with your trading. These include trading technology, research and reports, and access to futures commission merchants that specialize in the aspects of the markets that match your needs.

In today’s markets, having access to the latest and best technology is essential. Fast, stable, and reliable direct market access are the bare minimum features you should look for in a trading platform. While some brokerage firms only provide access to one trading platform, many offer access to a multitude, so that each client can choose the platforms that best suit their needs. It is important to ask a potential Futures broker which platform they believe will work best for you, a good broker will be direct about this. Keep in mind that a broker at a firm with only one trading platform is obligated to sell you on that platform, and not choose something specific to you. A good broker-assistance platform will also give you access to quotes and charts. You may not always need these resources, but they’re great to have around to improve your trading skills.

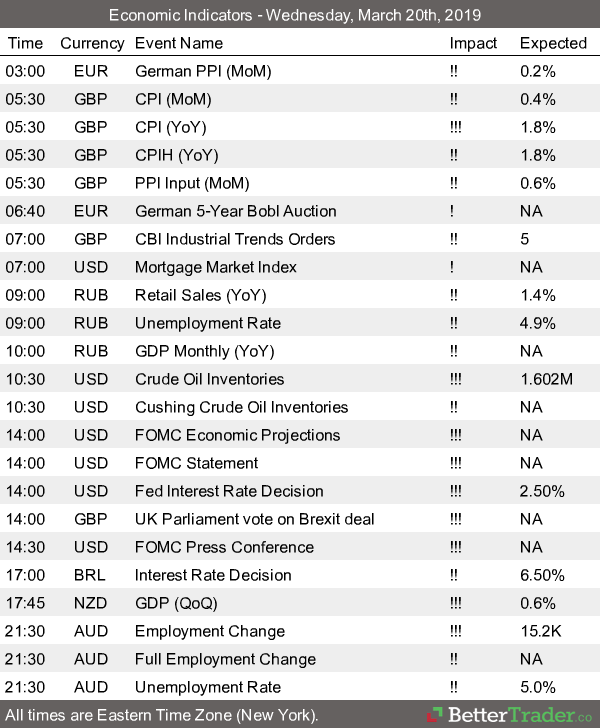

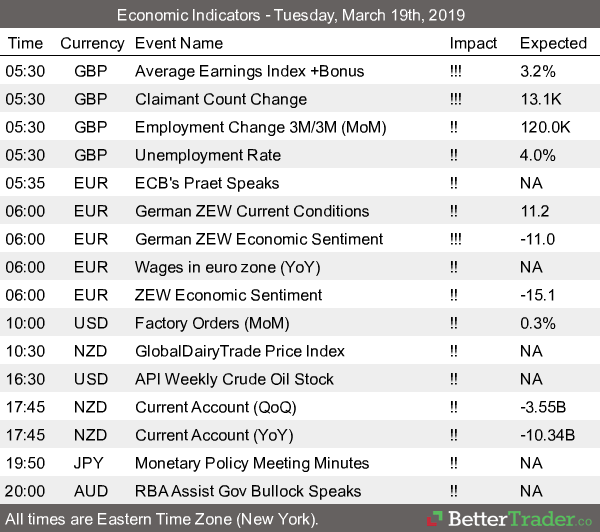

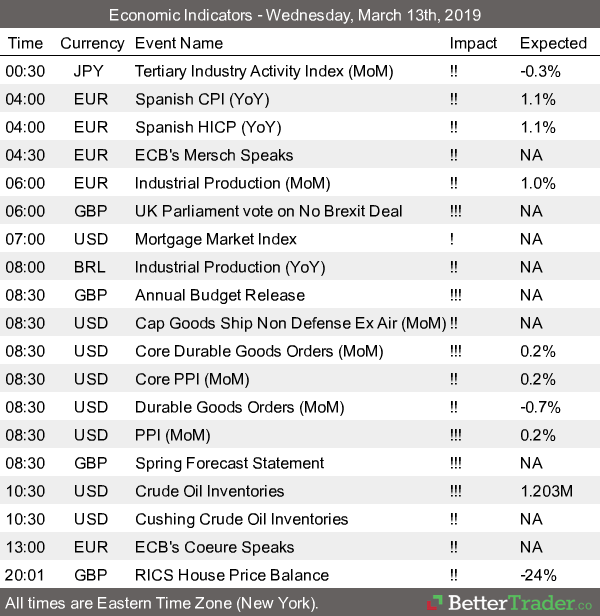

A good brokerage firm will also offer fundamental and technical research and a variety of reports to all of its clients. These include news reports and a calendar of major releases. Traders do not want to be caught without up-to-the-minute information regarding the markets. Brokerage firms worth pursuing will provide this information frequently and in detail.

The final tool that a trader should look for in a brokerage firm is access to a variety of Futures Commissions Merchants (FCMs) that specialize in aspects of the commodity futures markets that are relevant to that trader. Every FCM is different, and none of them specialize in everything, so a broker that offers options is key. You will want to talk to your potential broker about the clearing firms they offer, and what the advantages and disadvantages are of each FCM they offer. A good broker will be honest about the disadvantages of every FCM, that’s why they offer more than one!

Once you have determined that a few firms offer everything you need, it is time to look at value. It is important to have a clear understanding of each brokerage’s commission rates and all additional fees that are charged. Do not be afraid to talk to potential brokers about these rates, and read any material on their website or in contracts thoroughly. Another way to determine the firm with the best value is to look at Margins and Leverage. While the overnight margin will remain the same no matter what broker you choose, some brokers will offer special rates for certain types of trading. A good brokerage will also offer $500 margins to a day trader as long as that privilege is not abused. A transactional firm will allow a trader to use a $500 margin to ruin, but a relationship-based broker firm will insist that traders be safe and smart with their funds.

It is important to remember that low margins and high leverage are not the only factors you should be looking at in a brokerage firm. Ask the brokers how they manage risk, monitor leverage, and what maximum leverage they would recommend to you as a client. Some Futures broker even offer risk controls on your account, to protect you when you have reached a maximum leverage level.

Selecting a futures broker can be a daunting process, but the prepared and inquisitive trader will find an ideal match. Knowing your needs, your experience, your knowledge, and your financial health will help you not only find a brokerage firm that’s right for you, but also help your broker create a trading plan to maximize your success. You don’t need to find the most expensive firm for great results, many excellent firms are also great values. And you also don’t want to go straight to the lowest-cost provider, many bargain basement firms offer little to no guidance to their clients. Take your time selecting a Futures broker, get on the phone, ask questions, be direct and detailed, and find a broker who you trust to get you where you need to go.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.