In the fast-paced, high-stakes world of futures trading, where precision, timing, and insight spell the difference between profit and peril, the role of a qualified futures broker is not only instrumental—it is indispensable. For seasoned traders and novices alike, the guidance of an experienced, trustworthy broker can determine not just individual trade outcomes but also the overall trajectory of one’s trading career. As trading becomes more technologically advanced and globally interconnected, the need for human expertise, personalized guidance, and reliable support becomes even more essential.

This comprehensive article will delve deep into the inherent, undeniable values of commissioning a qualified, reliable futures broker, outline the key characteristics of successful professionals in this field, evaluate the risks and benefits clients face depending on their broker selection, and spotlight why Cannon Trading Company has become synonymous with trust, longevity, and client-first service in the futures trading industry.

The Core Value of a Futures Broker in Today’s Markets

A futures broker plays a multifaceted role in facilitating and optimizing the futures trading experience. Unlike automated trading systems or impersonal platforms, a qualified futures broker provides individualized insights, robust risk management strategies, technical expertise, and access to essential trading tools.

Navigating Complex Markets

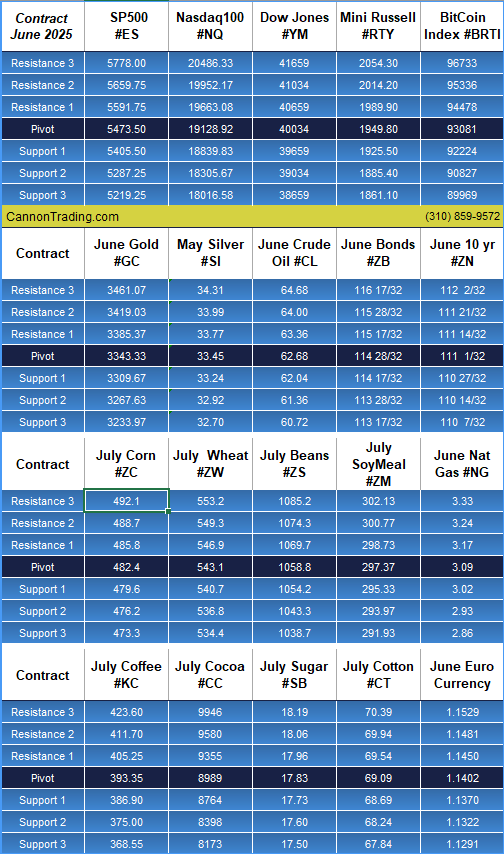

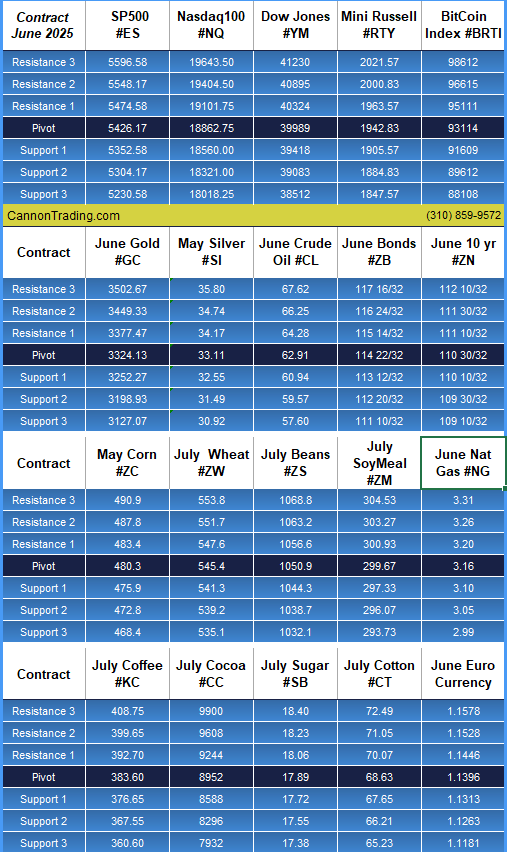

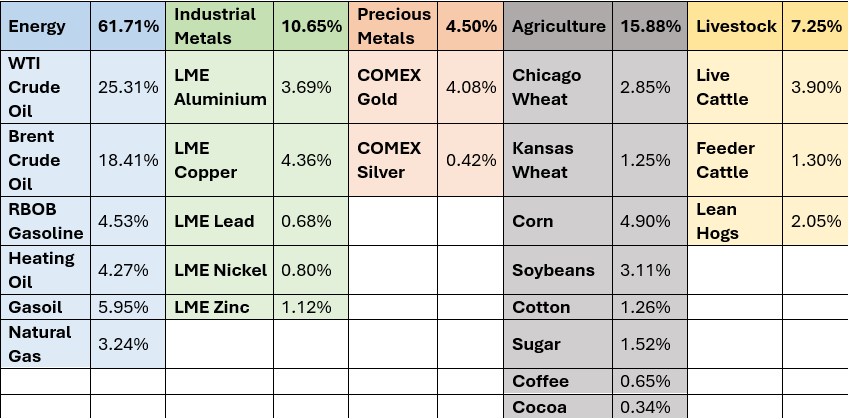

Futures trading involves contracts based on the anticipated future value of commodities, indices, currencies, interest rates, and more. Each contract type comes with its own rules, liquidity profiles, margin requirements, and risk profiles. A competent futures broker is trained to understand these nuances and can help traders make informed decisions.

Strategic Planning and Risk Mitigation

A futures broker can offer traders a strategic advantage by evaluating market conditions, identifying opportunities, and guiding clients toward actionable trades. Importantly, brokers can help tailor risk management strategies to each client’s tolerance and goals—be it through stop-loss placement, diversification, or hedging techniques. This personalized risk governance is invaluable, especially when trading leveraged instruments like futures contracts.

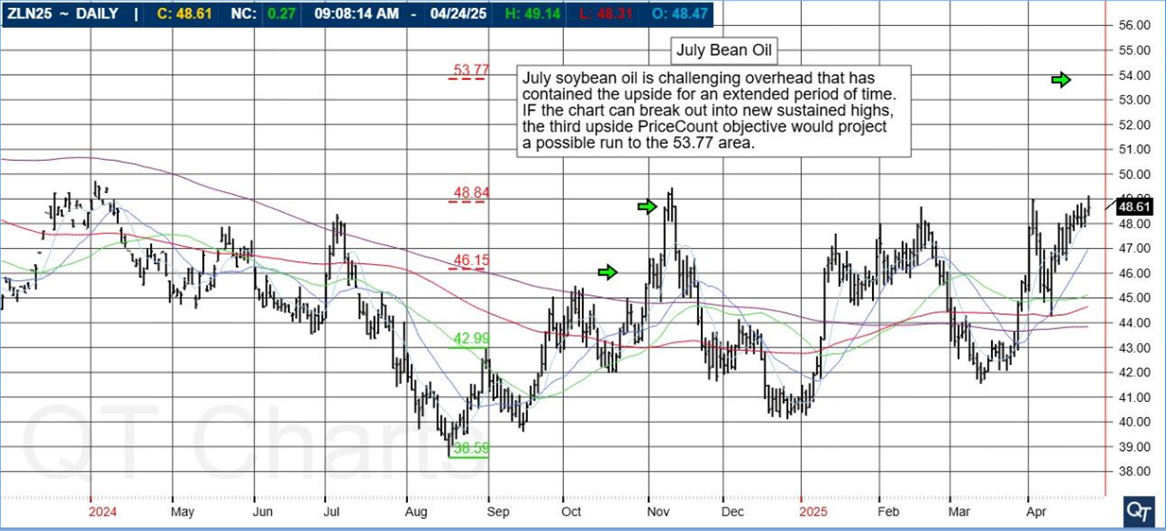

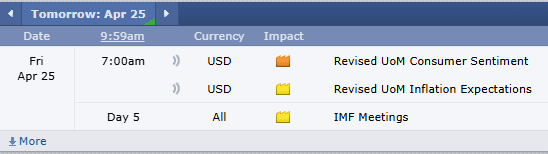

Market Intelligence and Timely Execution

The best futures brokers bring real-time insights to the table, staying abreast of economic data, geopolitical developments, and technical signals that could impact markets. Their expertise can be the linchpin between capitalizing on a trend or suffering an avoidable loss. They also ensure that orders are executed swiftly and precisely—critical in volatile markets where every tick counts.

Traits of Highly Rated, Reliable Futures Brokers

While many claim to offer trading services, only a select few are consistently recognized as top-tier futures brokers. Here are the most common characteristics found in highly reviewed professionals:

- Deep Market Experience

Top futures brokers have typically spent decades navigating the ups and downs of various markets. Their longevity is a testament to their ability to adapt, learn, and consistently add value for clients.

- Transparent Communication

Great brokers explain trading strategies, risks, and fees clearly. They avoid jargon when unnecessary and ensure clients understand every aspect of a trade. Transparency builds trust—the bedrock of any successful broker-client relationship.

- Regulator-Endorsed Integrity

Well-reviewed futures brokers have clean records with regulatory bodies such as the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC). Their reputations are unblemished, underscoring their ethical approach and commitment to compliance.

- Accessibility and Human Interaction

An often-overlooked quality, direct accessibility to a real human broker is increasingly rare in an age dominated by automated customer service. Top brokers maintain a human-first policy, providing clients with quick access to professional advice without robotic intermediaries.

- Versatility in Platform Offerings

Superior futures brokers offer a wide range of trading platforms that cater to various trader profiles—from the technologically advanced to the beginner-friendly. Platform diversity ensures traders can align their tools with their individual preferences and strategies.

Benefits to Clients: A Tangible Edge in Futures Trading

Every trader seeks an edge, and partnering with a top-notch futures broker offers precisely that. Here’s how these inherent values translate into direct benefits:

Increased Profit Potential

By gaining access to timely market insights, analytical support, and strategic guidance, traders can enhance their trading. A great futures broker serves as both a mentor and a partner in profit.

Enhanced Risk Management

Proper risk controls are a hallmark of professional trading. Reliable brokers ensure that each trade aligns with a client’s risk appetite and financial goals. They can help prevent catastrophic losses through sound advice and oversight.

Stress Reduction and Confidence Building

Knowing that a trusted expert is monitoring your trades, is available for consultation, and is proactively looking out for your interests; these facets can bring peace of mind—a crucial psychological advantage in a high-pressure environment.

Accelerated Learning Curve

For new traders, a qualified futures broker can dramatically shorten the learning curve. Their insights, explanations, and mentorship help build foundational knowledge and avoid rookie mistakes.

Risk Considerations in Broker Selection

As beneficial as it is to have a reliable futures broker, the inverse is equally true. Choosing the wrong broker introduces significant risks:

- Slippage and Poor Execution: Inadequate brokers may not prioritize order precision, resulting in potentially costly trade slippage.

- Hidden Fees: Some brokers obscure true trading costs, which can erode profit margins over time.

- Lack of Support: A broker who is unreachable during market turbulence can safebe detrimental to your trading when it’s needed most.

- Compliance Risks: Unregulated or lightly regulated brokers may expose clients to fraud or legal complications.

Therefore, careful vetting of any futures broker is essential before committing capital.

Cannon Trading Company: A Standard-Bearer in Futures Brokerage

With over 35 years of excellence, Cannon Trading Company has established itself as one of the best futures brokers in the industry. The firm has successfully managed to uphold a legacy of trust, performance, and unwavering client commitment.

Human-Centric Service Model

In a time when many firms route clients through layers of automated menus and chatbots, Cannon Trading remains proudly personal. Every client has direct access to seasoned brokers—some with over 25 years of individual experience. No automated answering service stands between a trader and expert advice. This model isn’t just old-school—it’s best-in-class.

Unrivaled Industry Reputation

The company boasts a pristine reputation with industry regulators, including the NFA and CFTC. This reflects their rigorous adherence to ethical practices, secure fund management, and transparent dealings. Their numerous 5 out of 5-star TrustPilot rankings further attest to their stellar service and client satisfaction.

Diverse Platform Offerings

Cannon Trading empowers traders with a wide selection of FREE, top-performing trading platforms. Whether a trader prefers advanced analytical tools, fast execution speeds, mobile access, or intuitive interfaces, there’s a platform tailored to meet their needs. Their lineup includes platforms like SierraChart, TradingView, CQG, and others—each chosen for reliability and performance.

Comprehensive Futures Trading Access

From commodities and indices to currencies and interest rate products, Cannon Trading enables clients to access virtually all futures trading markets. This breadth allows clients to diversify and hedge their portfolios efficiently, with expert support for every asset class.

Client-First Philosophy

Cannon’s culture emphasizes education, empowerment, and long-term relationships. They offer free consultations, educational webinars, market newsletters, and timely updates to help traders remain informed and proactive. This holistic support system makes them a favorite among both retail and institutional clients.

Sustaining Excellence: Cannon Trading’s Legacy of Leadership

How has Cannon Trading Company not only survived but thrived in a notoriously competitive industry? Several key factors account for their enduring success:

Visionary Leadership

Founded by industry veterans who recognized the importance of client trust and market expertise, Cannon Trading has always prioritized ethical conduct and innovation. Their forward-thinking approach has kept them ahead of the curve.

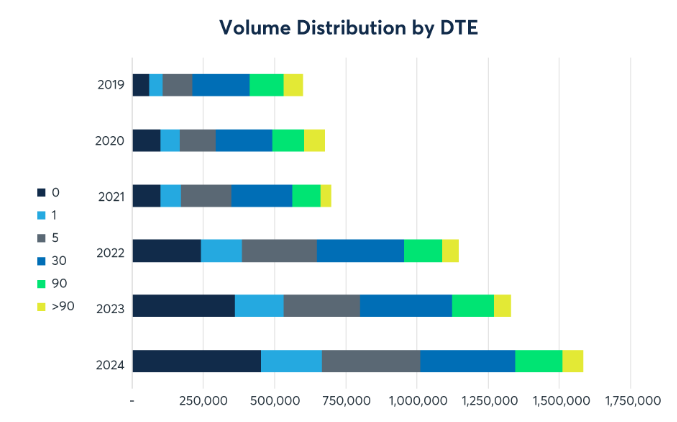

Adaptability to Technological Change

While staying true to their core values, Cannon has continually evolved technologically. They’ve integrated new platforms, leveraged real-time data feeds, and offered cloud-based solutions to ensure clients have the most advanced tools at their disposal.

Commitment to Client Education

Cannon Trading invests heavily in client education. From beginner tutorials to advanced trading techniques, they provide a treasure trove of resources to foster client success. This not only builds loyalty but also enhances trading outcomes.

Staff Retention and Institutional Knowledge

Many brokers at Cannon have remained with the company for decades. This stability ensures that clients receive guidance from experts who have weathered numerous market cycles and who understand long-term trading dynamics.

Conclusion: The Clear Choice for Futures Trading Excellence

Futures trading offers enormous potential—but also significant complexity and risk. In this high-stakes arena, the value of partnering with a qualified, experienced, and client-focused futures broker cannot be overstated. Such professionals are strategic allies, risk managers, educators, and gatekeepers to success.

Among the many choices available, Cannon Trading Company stands out as one of the best futures brokers due to its client-first approach, stellar regulatory record, long-serving staff, top-rated customer satisfaction, and commitment to trading excellence. Their unmatched combination of human touch, technological savvy, and institutional integrity makes them a benchmark in the world of futures trading.

Whether you are a new trader taking your first steps or a seasoned professional seeking a partner for sophisticated strategies, Cannon Trading offers a rare blend of tradition and innovation—a partnership built to last in the dynamic world of trading futures.

For more information, click here.

Ready to start trading futures? Call us at1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading