|

|

|

This Blog provides futures market outlook for different commodities and futures trading markets, mostly stock index futures, as well as support and resistance levels for Crude Oil futures, Gold futures, Euro currency and others. At times the daily trading blog will include educational information about different aspects of commodity and futures trading.

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The second half of 2025 presents traders with extraordinary opportunities in futures trading, but it also demands heightened responsibility, discipline, and insight. Volatility remains elevated across commodities, equities, cryptocurrencies, and interest-rate derivatives as central banks adjust policies amid a turbulent global economy. Traders are increasingly relying on their futures brokers not just for execution but also for guidance, risk management tools, and robust trading platforms.

Choosing the best futures brokers isn’t just about low commissions or fast executions—it’s about aligning yourself with a trusted partner who helps you navigate complexity with confidence. In this context, Cannon Trading Company stands out as one of the top-rated futures brokers USA, thanks to its decades of industry experience, an exemplary regulatory record, cutting-edge platform offerings, and hundreds of verified five-star ratings on TrustPilot.

In this article, we’ll explore:

The Evolving Role of Futures Brokers in 2025

In 2025, the role of a futures broker has transformed from that of a simple trade executor to that of a comprehensive trading partner. Traditional brokers offered order execution and access to exchanges, but modern futures brokers are now:

When working with the best futures brokers, traders aren’t just selecting a transactional service—they’re choosing a strategic partner capable of helping them make smarter, more responsible decisions when trading futures.

Why Responsible Futures Trading Matters in H2 2025

The second half of 2025 brings heightened uncertainty across asset classes:

These dynamics underscore the importance of disciplined strategies. Traders who over-leverage or ignore risk parameters face amplified losses. Responsible trading in this environment involves:

The right futures brokers USA empower traders to adapt, manage risk, and maintain consistency amid shifting markets.

How Traders Can Leverage Their Futures Broker for Responsible Trading

In H2 2025, execution speed and analytical capabilities matter more than ever. The best futures brokers provide traders with access to world-class futures options trading platforms, such as:

By leveraging these technologies, traders can better evaluate price action, manage positions, and implement advanced strategies responsibly.

A seasoned futures broker serves as an invaluable resource for risk mitigation. They help traders:

Traders working with experienced futures brokers USA gain a safety net against avoidable mistakes, enabling them to maintain longevity in volatile markets.

The best futures brokers go beyond execution to deliver actionable intelligence. Educational resources include:

This combination of technology and education is essential for building a disciplined approach to trading futures responsibly.

Unlike discount-only firms, full-service futures brokers like Cannon Trading Company offer personal guidance. In 2025, compliance remains critical as regulators tighten oversight to protect retail traders. A trusted futures broker helps ensure:

By acting as both a compliance resource and execution partner, a broker reduces legal and financial risks for traders.

Why Cannon Trading Company Stands Out

Decades of Experience

Founded in 1988, Cannon Trading Company has spent nearly four decades helping traders succeed in dynamic futures markets. This depth of experience gives the firm unparalleled insight into market cycles, trader psychology, and technological innovation.

Five-Star TrustPilot Ratings

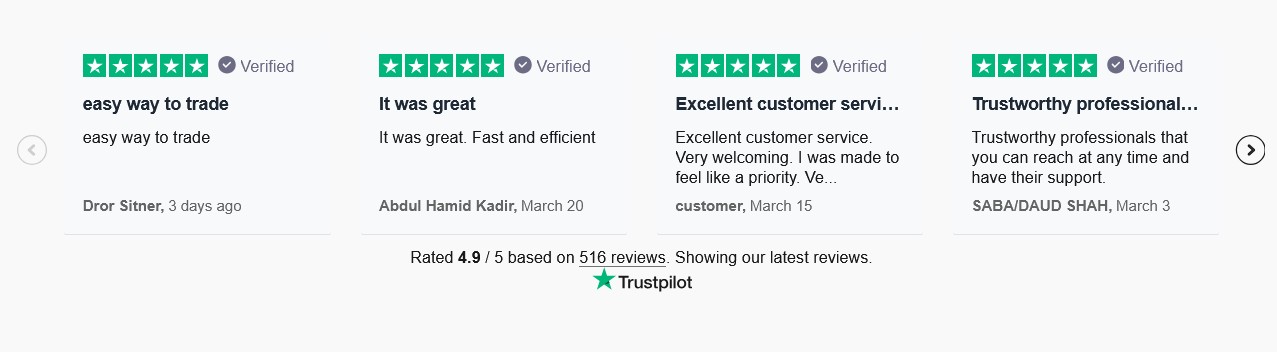

With numerous verified 5 out of 5-star ratings on TrustPilot, Cannon Trading Company has earned a stellar reputation among traders worldwide. These reviews highlight exceptional customer service, transparent pricing, and fast execution.

Exemplary Regulatory Reputation

Cannon maintains spotless relationships with federal and independent regulators, including the CFTC and NFA. Their emphasis on compliance gives traders confidence that they’re working with one of the best futures brokers in the industry.

Wide Selection of Futures Trading Platforms

Unlike brokers tied to a single platform, Cannon offers a diverse suite of futures options trading platforms to match every trader’s style, including CQG, Rithmic, TradingView, and MotiveWave.

This flexibility empowers traders to choose the ideal tools for their strategy while enjoying expert support from Cannon’s team.

The Power of Futures Options with the Right Broker

An area where a skilled futures options broker shines is helping traders incorporate options into their strategies. Options on futures contracts enable traders to:

With Cannon Trading Company’s expertise, traders gain access to cutting-edge futures broker options and personalized guidance on how to integrate options into their portfolio responsibly.

Responsible Trading Strategies for H2 2025

To thrive in today’s markets, traders should combine advanced tools with discipline. Here are key strategies:

With a trusted futures broker like Cannon Trading Company, these strategies become easier to execute effectively.

The second half of 2025 will test traders’ discipline, adaptability, and strategy. Partnering with the best futures brokers—especially those with deep experience, regulatory excellence, and cutting-edge tools—is essential for success.

Cannon Trading Company continues to stand out as a premier choice among futures brokers USA, offering:

For traders looking to navigate complex markets responsibly, Cannon Trading Company is more than just a futures broker—it’s a strategic ally.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

As the world shifts into the final half of 2025, investors and speculators alike are closely watching the gold futures market. Traditionally viewed as a hedge against inflation, economic instability, and geopolitical turbulence, gold continues to hold its place as a bedrock commodity in the global financial ecosystem. With the second and third trimesters of 2025 already underway, it’s crucial for traders to understand what might shape the gold futures price, what economic and geopolitical trends could drive volatility, and how trusted futures brokers—especially the seasoned professionals at Cannon Trading Company—can support your trading futures strategies.

This comprehensive analysis will provide a 360-degree look at the current and anticipated gold futures market conditions and offer a detailed case for why Cannon Trading Company, with its cannonx powered by cqg platform, reputation among futures brokers USA, and a deep bench of experienced advisors, is a powerful ally for anyone trading gold futures in the remaining months of 2025.

In 2025, the gold futures price has already shown considerable movement in response to multiple macroeconomic factors. As inflation remains persistent in both developed and emerging economies, central banks—particularly the Federal Reserve and the European Central Bank—are maintaining a cautious approach to rate cuts. This sustained inflationary pressure has continued to support bullish trends in the gold futures market.

Furthermore, global debt levels have hit historic highs. Sovereign debt in the U.S., Japan, and EU nations has led to renewed concern about long-term fiscal sustainability, pushing institutional investors to consider gold futures as a safer store of value. As we move through the last two trimesters of 2025, these factors are expected to remain critical in shaping the gold futures price.

With geopolitical hotspots persisting across the globe—from escalations in the Middle East to ongoing tensions in Eastern Europe and the South China Sea—safe-haven demand for gold remains elevated. The market has seen periods of rapid gold futures price spikes following geopolitical flare-ups, reflecting its continued appeal during crises.

Analysts predict that the next six months could feature more of the same: short bursts of volatility driven by global events, keeping the gold futures market lively and unpredictable.

Central banks, particularly in emerging markets such as China, Russia, and India, have significantly increased their gold reserves in the first trimester of 2025. This trend is expected to continue through the end of the year, potentially tightening supply and providing upward momentum for the gold futures price.

Based on current technical indicators and historical trends, analysts are watching key resistance levels near $3475.00 and $3550.00 per ounce. Strong support zones are holding near $3250.00 and $3300.00. As long as futures brokers see the gold market respecting these technical levels, range-bound trading strategies and momentum breakouts will likely remain viable.

The Commitment of Traders (COT) report for July 2025 shows a growing net-long position among commercial hedgers, signaling increasing bullish sentiment. Retail traders are advised to pay close attention to these sentiment shifts, particularly as trading futures becomes more algorithmically driven.

As economic and political uncertainties mount, implied volatility for gold futures options has surged. This signals a potential for larger-than-average price swings, making risk management tools and broker expertise critical. Reliable future brokers can offer the analytics and risk control features necessary to navigate this environment.

When evaluating futures brokers USA or anywhere else globally, several key criteria stand out: experience, platform diversity, regulatory integrity, and customer satisfaction. Cannon Trading Company meets and exceeds these benchmarks, making it a top choice among the best futures brokers for gold futures trading in 2025.

Founded over 35 years ago, Cannon Trading has consistently maintained its position among the most trusted futures brokers in the United States. Their longevity speaks to their adaptability, insight, and client-first philosophy. In a world of ever-evolving market structures, having an experienced futures broker can be a game-changer.

Across the board, Cannon Trading boasts an impressive array of five out of five-star reviews on TrustPilot, with clients highlighting their quick response times, deep market knowledge, and outstanding support. This reflects a true commitment to the trader’s experience—an asset that cannot be overstated, especially when managing the complexities of trading futures like gold.

Cannon Trading enjoys an exemplary standing with both federal and independent futures industry regulators. As a registered Introducing Broker with the CFTC and a member of the NFA, Cannon ensures that its practices are fully compliant, transparent, and centered on ethical trading. This reputation puts it in a league with only the best futures brokers.

The firm’s proprietary CannonX powered by CQG trading platform combines the power of CQG’s robust charting, execution, and data capabilities with Cannon’s tailored futures brokerage services. This platform is especially powerful for gold futures traders who need advanced tools for technical analysis, one-click execution, and seamless access to market data.

With CannonX, traders can also set up custom alerts, use multiple order types, and integrate their strategies with a wide variety of APIs. It’s built to serve everyone from the retail trader exploring gold futures for the first time to the institutional trader managing large-scale hedging operations.

Beyond CannonX, Cannon Trading offers access to a suite of top-performing platforms including:

This level of platform diversity ensures that clients can tailor their trading futures experience to their exact preferences, strategy needs, and risk tolerance.

One of the most critical factors in gold futures trading is leverage. While it allows for significant profit potential, it also increases the risk of outsized losses. Future brokers like Cannon Trading educate clients on proper margin usage, capital allocation, and stop-loss strategies.

Cannon’s clients benefit from daily market commentary, strategy webinars, and bespoke market research. This intelligence provides an edge in an environment where speed and information are critical.

Unlike many large firms where traders are little more than account numbers, Cannon offers access to seasoned futures broker specialists who can guide clients through strategy execution, order placement, and risk mitigation. Whether you’re a newcomer or a seasoned professional, personalized support makes a tangible difference.

Based on the confluence of economic indicators, investor sentiment, and central bank behavior, the last two trimesters of 2025 are expected to lean bullish for gold futures. Key themes supporting this outlook include:

Still, traders must remain vigilant. The high level of volatility and frequent news-driven price shocks demand tight execution, robust risk management, and a reliable brokerage partner.

Cannon Trading Company—Your Best Ally in Gold Futures Trading

In a market as dynamic and consequential as gold futures, having the right partner is as important as having the right strategy. Cannon Trading Company is not just one of the best futures brokers—they are a full-spectrum solutions provider for those trading gold futures, offering:

Whether you’re hedging, speculating, or diversifying, Cannon Trading Company is uniquely equipped to support your goals in the gold market. If you’re evaluating future brokers as we close out 2025, there’s simply no better choice.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The silver futures contract is a powerful instrument for investors and speculators seeking exposure to the silver market without directly owning the physical metal. As we move into the final two trimesters of 2025, the silver market stands at a critical juncture influenced by macroeconomic shifts, industrial demand, and investor sentiment. In this detailed analysis, we’ll explore the expected trajectory of silver futures prices, key drivers shaping the market, and how reputable firms like Cannon Trading Company provide a robust foundation for trading success.

With decades of experience, 5-star TrustPilot ratings, and a reputation for excellence with both federal and independent regulators, Cannon Trading Company is one of the best futures brokers for navigating the complexities of trading futures—particularly in volatile markets like silver.

A silver futures contract is a legally binding agreement to buy or sell a specific quantity of silver (typically 5,000 troy ounces) at a predetermined price and date in the future. These contracts are traded on commodities exchanges like the CME Group and are used for hedging, speculation, and price discovery.

Key Features

Whether you’re hedging against inflation or speculating on silver futures prices, this instrument offers a level of flexibility and exposure that spot silver simply cannot match.

As we enter the second half of 2025, several critical factors are shaping the outlook for silver future prices.

The Federal Reserve’s trajectory in the latter half of 2025 is expected to shift slightly dovish after a series of rate hikes between late 2024 and early 2025. A cooling labor market and slowing inflation have raised the possibility of modest rate cuts. This could benefit precious metals, particularly silver, which tends to thrive in low-interest-rate environments.

Silver futures are inversely correlated with real interest rates. As yields decline, the opportunity cost of holding non-yielding assets like silver diminishes, potentially driving up silver futures prices.

Escalating tensions in Eastern Europe and disruptions in global trade routes have increased the appeal of safe-haven assets. Investors traditionally turn to gold, but silver, being both a precious and industrial metal, sees dual inflows from risk-averse and opportunistic investors.

These geopolitical developments could lead to increased volatility in the silver futures contract market, attracting traders looking for profitable price swings.

Silver’s unique properties make it indispensable for several high-growth industries:

As industrial usage rises, silver future prices may experience strong upward pressure, especially during Q3 and Q4 when many factories ramp up production ahead of the holiday and fiscal year-end cycles.

Silver Futures Price Forecast for the Final Trimesters of 2025

Q3 2025: Moderate Bullish Outlook

Market participants may see silver futures prices move steadily upward in Q3, but not without periods of pullbacks and profit-taking.

Q4 2025: High Volatility with Bullish Tilt

Q4 may witness explosive moves in silver futures, driven by institutional repositioning and tight physical supply constraints. Traders should be prepared for sudden price swings, making risk management crucial.

Navigating the nuanced world of trading futures, especially something as volatile as silver, requires expertise, reliable tools, and exceptional client support. That’s exactly what Cannon Trading Company delivers.

Established in 1988, Cannon Trading Company has weathered every major market storm, from the Dot-Com Bubble to the 2008 financial crisis to the COVID-19 crash. Their longevity is a testament to their deep knowledge of futures trading and their ability to adapt to new challenges.

When dealing with complex instruments like the silver futures contract, experience is everything.

Cannon Trading maintains an exemplary standing with both federal regulators (such as the CFTC and NFA) and independent industry watchdogs. This ensures clients operate in a secure, compliant, and transparent trading environment.

Among futures brokers USA, very few match the regulatory track record of Cannon Trading Company.

Cannon boasts numerous 5 out of 5-star ratings on TrustPilot, an independent consumer review platform. Clients routinely praise their responsiveness, personalized service, and the quality of their trading insights. This makes them a strong contender among the best futures brokers in the world.

“Knowledgeable brokers and amazing service. Always willing to help. Highly recommend!” – Verified TrustPilot Reviewer

Whether you’re a scalper, swing trader, or long-term investor in silver futures, Cannon Trading provides access to powerful trading platforms:

Having access to multiple platforms allows traders to customize their strategy, which is essential when dealing with unpredictable silver future prices.

CannonX Powered by CQG: The Game-Changer

Among the various platforms offered, CannonX powered by CQG stands out. Built on one of the most reliable infrastructures in the industry, this platform enables:

For traders focused on silver futures prices, speed, accuracy, and low latency can mean the difference between a gain and a missed opportunity. CannonX delivers all three with finesse.

Futures Brokers vs. Best Futures Brokers: Why Cannon Leads

The difference between ordinary futures brokers and the best futures brokers lies in the details:

| Criteria | Average Brokers | Cannon Trading Company |

| Years in Business | 5–10 | 35+ |

| Platform Variety | 1–2 | 10+ |

| Regulatory Standing | Mixed | Exceptional |

| TrustPilot Ratings | 3.5–4.0 stars | 5 out of 5 stars |

| Client Support Hours | Limited | Extended (phone/email/chat) |

| Educational Resources | Basic | Extensive (blogs, webinars, 1-on-1 coaching) |

Traders seeking the best futures brokers for silver contracts will find that Cannon offers unmatched value in service and tools.

Educational Support: Equipping Traders for Success

Beyond just account management, Cannon Trading believes in empowering its clients. Their suite of educational materials includes:

This commitment to client growth distinguishes them from many future brokers who focus solely on transactional relationships.

Trading silver futures contracts involves inherent risks due to leverage and market volatility. Here are some essential strategies Cannon brokers recommend:

To prevent catastrophic losses during rapid price reversals, use stop-loss levels based on technical indicators or volatility bands.

For portfolio managers, hedging with silver futures can protect against price fluctuations in physical holdings or ETFs.

Track economic indicators like interest rates, GDP data, and industrial production. These elements directly impact silver futures prices.

Cannon Trading supports these efforts by offering real-time market updates and personalized trading alerts, making it one of the most responsive futures brokers USA has to offer.

It’s essential to remember that silver futures prices are influenced not just by domestic trends but by global events. Key international factors include:

Cannon Trading provides global insights through its research desk, ensuring clients stay ahead of international trends affecting silver futures.

The silver futures contract continues to be one of the most dynamic and rewarding financial instruments available to modern traders. With the final two trimesters of 2025 promising high volatility and potential bullish momentum, now is a pivotal time to get involved. Whether you’re a seasoned veteran or new to trading futures, choosing the right brokerage partner is crucial.

Cannon Trading Company stands out among futures brokers USA thanks to its:

When evaluating futures brokers, there’s a clear distinction between average and elite. Cannon belongs in the upper echelon of best futures brokers, delivering consistent value, integrity, and results.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading