In today’s increasingly uncertain and complex financial environment, futures brokers play a more crucial role than ever. As markets are rocked by volatility, shaped by unpredictable geopolitical shifts, and molded by regulatory fluctuations, futures trading has become a key strategy for both institutional and retail investors seeking to hedge risks and discover opportunities. Within this context, future brokers act as indispensable guides, facilitating access to markets, providing strategic insight, and ensuring compliance and precision in execution.

This research paper explores why futures brokers are more important than ever, how they help traders manage risk, and how global policies—particularly tariffs introduced by President Trump—are shaping the futures markets. It also highlights why Cannon Trading Company stands as one of the best futures brokers in the industry, backed by its legacy, reputation, and client-first approach.

The Essential Role of Futures Brokers Today

The financial world has changed dramatically in recent decades. With high-frequency trading, algorithmic systems, global interconnectedness, and mounting political instability, today’s investors face complexities that demand expertise and personalized support. Here’s why futures brokers have become indispensable:

10 Reasons Why Futures Brokers Are More Important Than Ever

- Expert Navigation Through Volatile Markets In highly volatile markets, futures brokers offer real-time guidance that helps traders make informed decisions. Their expertise becomes a critical factor in avoiding major financial missteps.

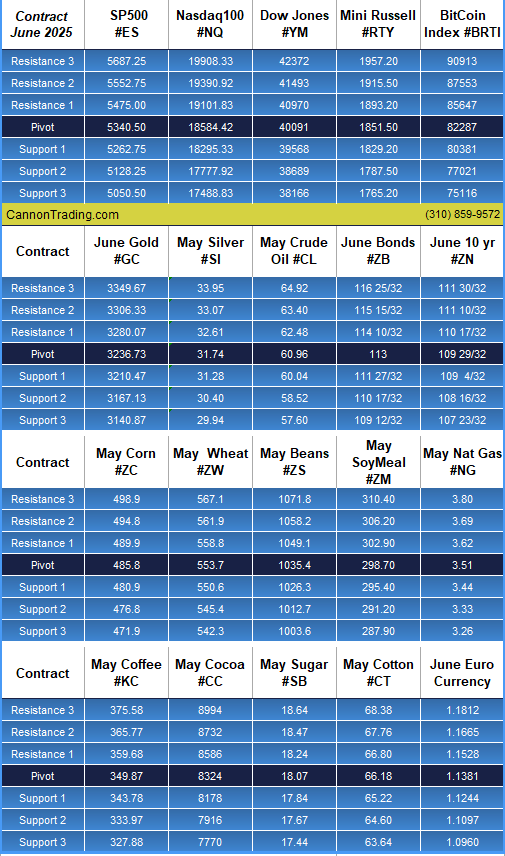

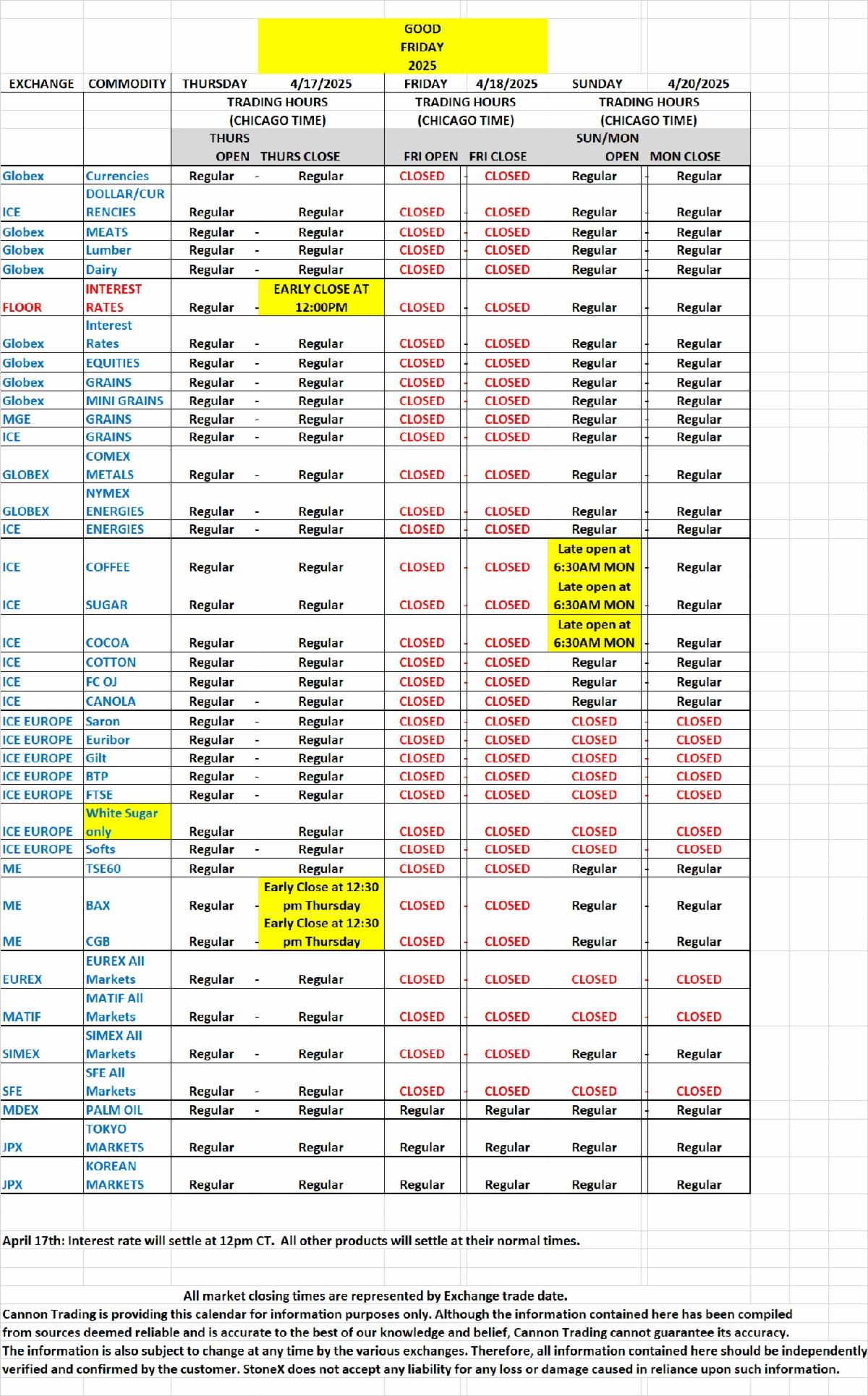

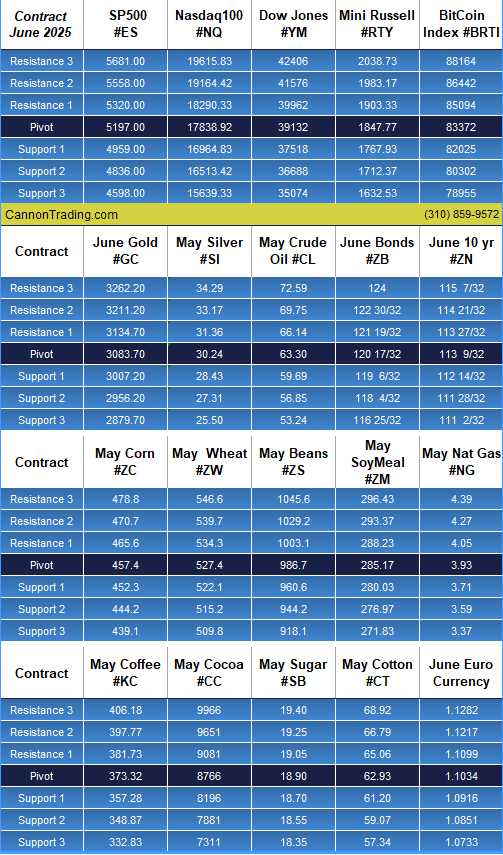

- Access to Global Exchanges The global nature of modern futures trading requires access to multiple exchanges worldwide. Futures brokers provide seamless access, allowing traders to diversify their portfolios and capitalize on international opportunities.

- Advanced Trading Platforms From charting tools to order execution systems, futures brokers offer state-of-the-art platforms that support all levels of futures trading. Cannon Trading Company, for instance, provides multiple FREE top-performing platforms tailored to different trading styles.

- Personalized Trading Strategies With tailored approaches to risk tolerance, market goals and asset allocation, futures brokers offer custom strategies that go beyond algorithmic or one-size-fits-all solutions.

- Regulatory Compliance and Risk Mitigation Future brokers ensure that trades align with regulatory standards. In a landscape where compliance breaches can result in severe penalties, their role is vital.

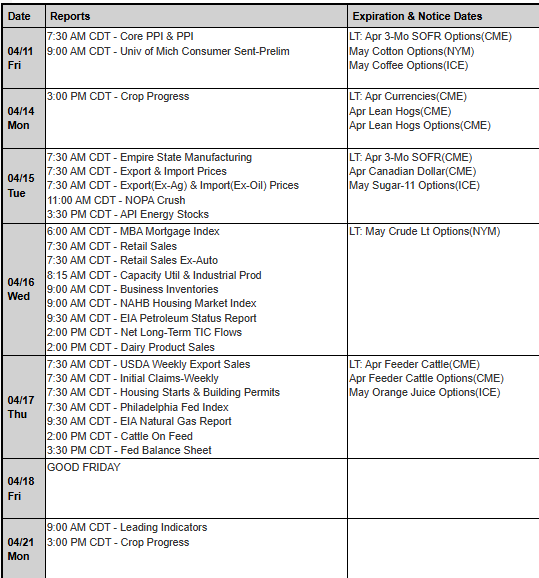

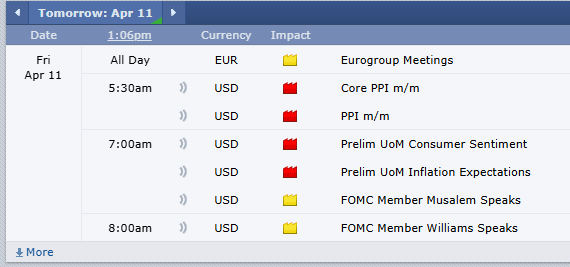

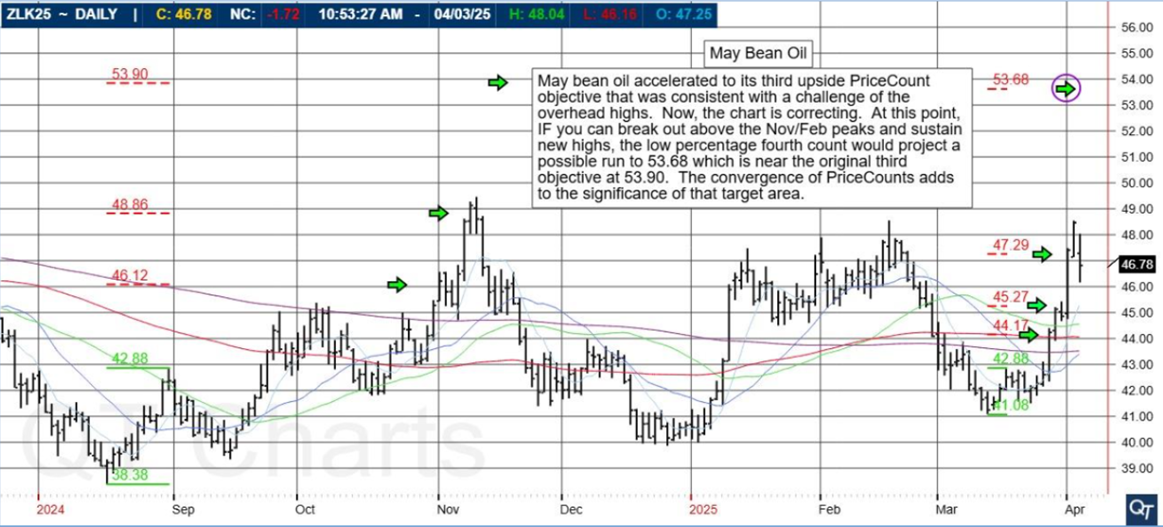

- Market Intelligence and Research Futures brokers often provide proprietary research and market forecasts that traders can use to develop informed strategies, especially in emerging sectors or under volatile conditions.

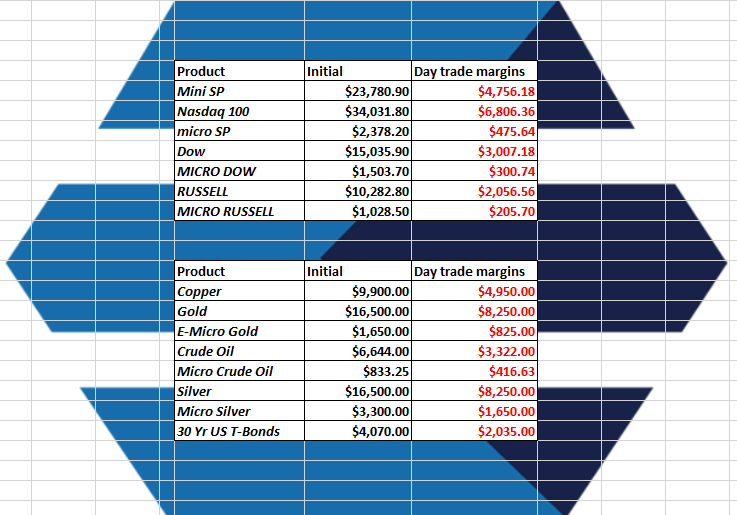

- High-Leverage Instrument Management: Futures trading involves leverage, which can magnify both profits and losses. Experienced brokers help manage margin requirements and recommend risk-management techniques.

- Support and Real-Time Assistance Cannon Trading Company exemplifies this with experienced brokers just a phone call away—no automated systems. This kind of access can be life-saving in a fast-moving market.

- Education and Mentorship From webinars to one-on-one consultations, futures brokers offer educational resources that empower traders, especially those new to the field.

- Portfolio Diversification Through Futures Contracts With assets spanning commodities, indices, interest rates, and currencies, futures brokers provide the gateway to broad diversification that shields investors from sector-specific downturns.

Risk Mitigation Through Futures Brokers in Volatile Markets

Futures trading is inherently riskier than traditional equity investing due to its leveraged nature. However, with volatility comes opportunity, and future brokers are uniquely positioned to help traders harness this potential while mitigating risk.

Key Ways Futures Brokers Help Manage Risk:

- Stop-Loss and Limit Orders: Brokers can guide traders in placing strategic stop-loss and limit orders, automatically closing positions to help prevent runaway losses.

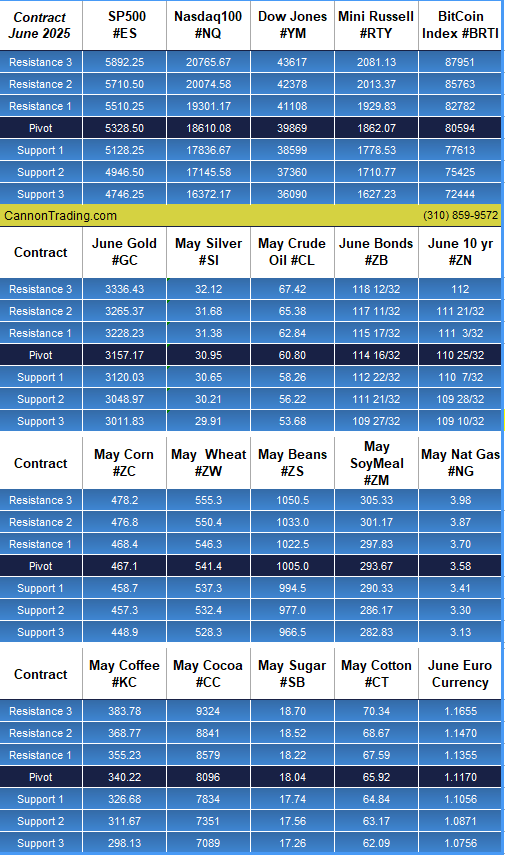

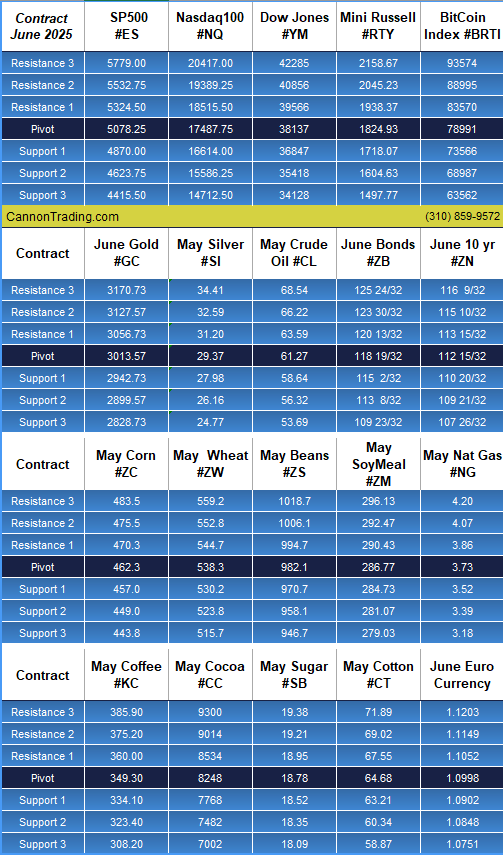

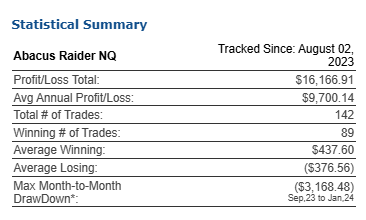

- Risk Assessment Tools: Top futures brokers provide tools and calculators to measure exposure, potential drawdowns, and margin requirements.

- Hedging Strategies: Agricultural producers, for instance, rely on futures brokers to lock in prices through hedging, minimizing exposure to price swings in commodities.

- Diversification Advice: Instead of overloading a position in one market, brokers encourage diversification across sectors and asset classes.

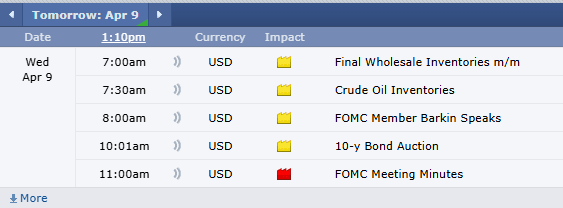

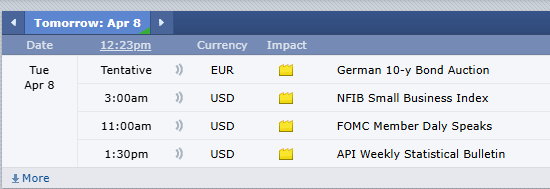

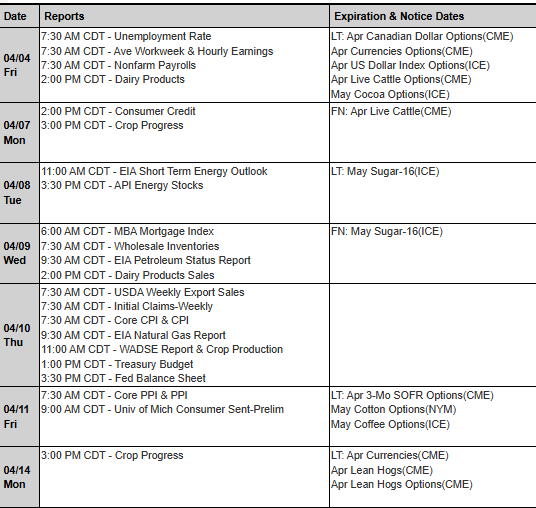

- Real-Time Market Monitoring: With constant updates and alerts, brokers ensure clients can respond instantly to news or economic reports that could influence the futures markets.

These services offer more than convenience. They are a shield against market upheaval. [need to be qualified, like maybe “They are a collective set of tools to help shield against market upheaval.” With political and financial dynamics changing by the day, a skilled futures broker can mean the difference between profit and peril.

Tariffs Under President Trump: Effects on the Futures Market

The imposition of tariffs by President Donald Trump during this administration fundamentally altered international trade dynamics. These changes had significant ripple effects across the futures markets, especially in commodities, metals, and agricultural products.

Key Impacts of Trump’s Tariffs on Futures Trading:

Agricultural Markets

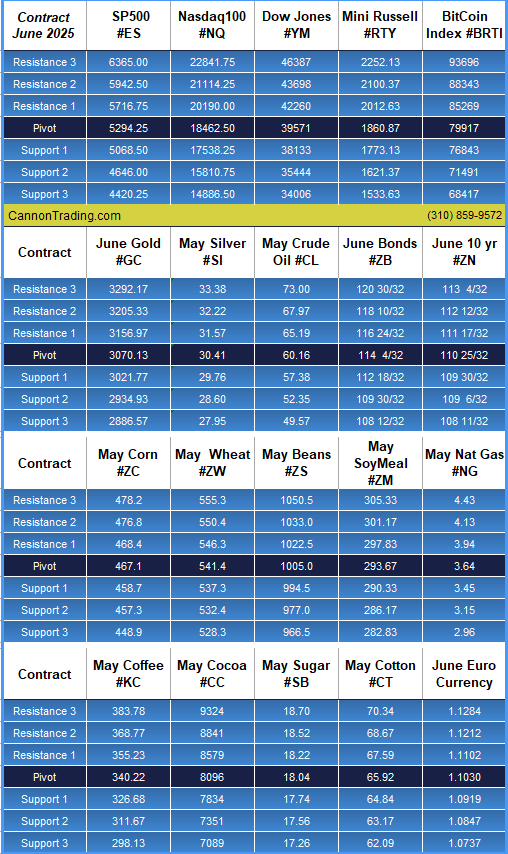

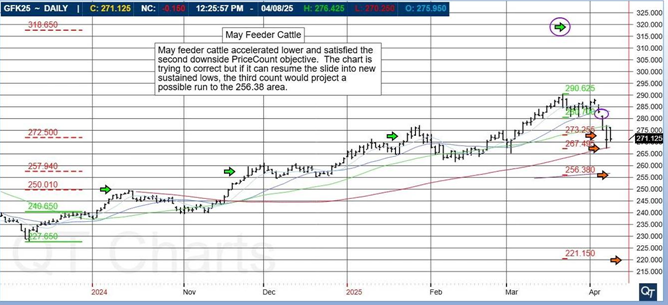

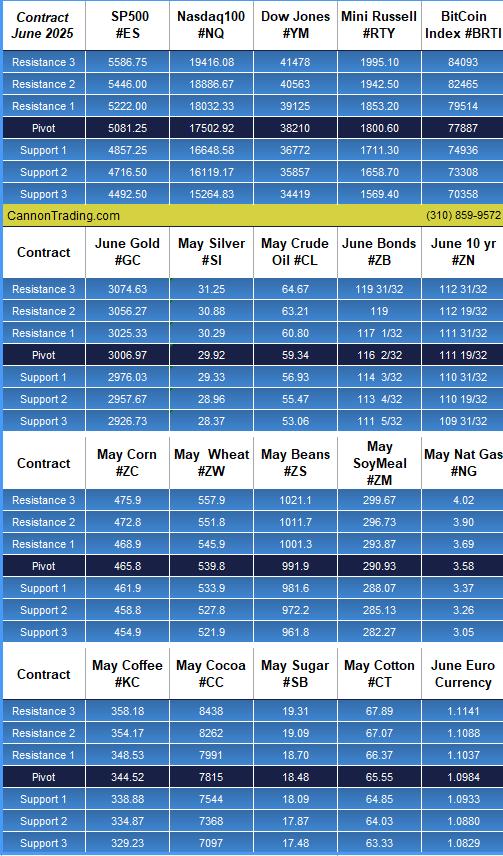

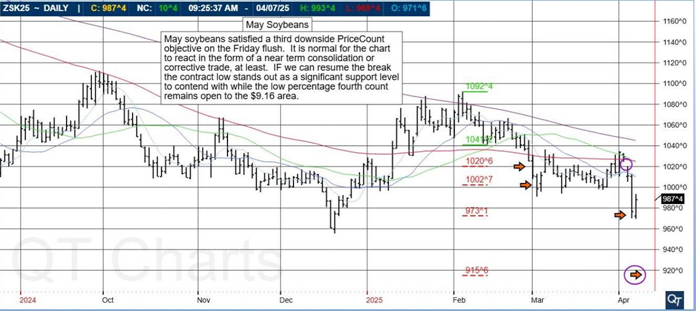

China retaliated with tariffs on U.S. soybeans, pork, and corn, causing American farmers to potentially suffer and prices to plummet. These shifts increased volume and volatility in the agricultural futures trading sector.

Steel and Aluminum Futures

As domestic industries were protected by tariffs, global prices fluctuated, leading to volatility in metals contracts.

Currency Futures Volatility

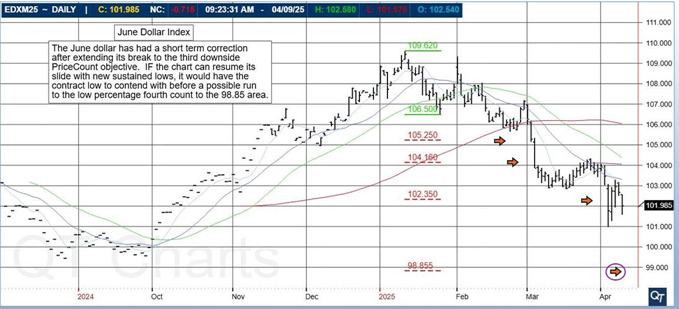

Trade tensions created uncertainty in forex markets. The U.S. dollar saw unpredictable moves, affecting currency futures brokers and traders.

Inflation and Interest Rate Speculation

Tariffs contributed to inflation concerns, leading traders to speculate in interest-rate futures trading markets. Brokers helped traders navigate these shifts.

Market Uncertainty and Sentiment

Tariffs shook investor confidence and led to unpredictable price movements across multiple asset classes. This amplified the need for skilled futures brokers who could help interpret news and guide strategic responses.

Working With Brokers Amid Tariffs and Market Disruption

Navigating the turbulent waters of trade wars and tariffs requires a seasoned futures broker who can become a trusted partner in weathering storms. Here’s how traders can collaborate effectively with their brokers:

Transparency in Objectives and Risk Appetite

Sharing one’s financial goals and risk tolerance helps the futures broker tailor a suitable trading strategy.

Leveraging Research and Insights

Best futures brokers, like Cannon Trading Company offer daily market commentary, reports, and real-time alerts that traders can use to stay ahead of policy shifts.

Hedging Against Policy Risk

If tariffs threaten supply chains or input costs, traders can work with brokers to hedge those risks through carefully chosen futures contracts.

Flexible and Responsive Platforms

Cannon Trading’s multiple FREE trading platforms allow traders to switch strategies, automate positions, and adapt to market developments instantly.

Risk Controls and Position Management

By working closely with brokers, traders can monitor exposure, modify stops, and rebalance portfolios.

Why Cannon Trading Company Is One of the Best Futures Brokers

In the realm of futures trading, few names carry the gravitas and trust that Cannon Trading Company commands. Founded in 1988, Cannon has remained a stalwart in the industry, offering traders the tools, service, and expertise needed for long-term success.

Decades of Industry Experience

With over 35 years in the business, Cannon has weathered multiple economic cycles, earning credibility and trust among traders.

Direct Access to Experienced Brokers

Clients never speak to machines. Cannon Trading Company ensures that real, licensed futures brokers are just a call away—a rarity in today’s automated world.

5-Star TrustPilot Ratings

Hundreds of satisfied clients have awarded Cannon with consistent 5/5-star ratings on TrustPilot, citing integrity, responsiveness, and deep expertise.

Wide Range of Free Trading Platforms

Unlike many firms that limit clients to a single system, Cannon offers access to a diverse array of high-performing platforms at no extra cost.

Reputation With Industry Regulators

Cannon boasts an exemplary compliance record with the NFA and CFTC, offering traders peace of mind in an era of increased scrutiny.

Global Market Access

Through their infrastructure, clients can trade futures contracts on global exchanges across sectors such as energy, metals, currencies, indices, and more.

Custom Broker Relationships

Whether a novice or a professional, each client receives personalized attention. This commitment to service sets Cannon apart from other futures brokers.

Cannon Trading’s Legacy: A Testament to Excellence

What makes a company thrive for over three decades in such a competitive space? The answer lies in consistency, ethics, innovation, and relationships.

Keys to Cannon Trading’s Longevity:

- Client-Centric Philosophy: Cannon believes in empowering the trader, not in pushing sales or fees.

- Constant Innovation: The company continually evaluates and adds trading tools, ensuring clients are never left behind technologically.

- Transparency: Pricing, risk, and performance metrics are openly discussed with clients, fostering trust.

- Education: Cannon Trading Company offers webinars, newsletters, and one-on-one coaching to enhance client competency in futures trading.

Their sustained excellence makes them one of the best futures brokers in an industry where firms come and go with the tides.

The role of future brokers is not just preserved but elevated in today’s financial ecosystem. With the global economy growing more unpredictable, futures brokers offer a lighthouse amid the fog of market volatility and political shifts. They provide risk mitigation, strategic insight, regulatory compliance, and platform support that no automated system can match.

Cannon Trading Company, with its decades of service, client-first model, regulatory integrity, and top-tier tools, stands as a beacon among the best futures brokers. Their legacy of trust, combined with modern infrastructure and personalized support, makes them the ideal partner for anyone serious about futures trading.

Whether you are navigating tariffs, leveraging diversification, or simply seeking to hedge against uncertainty, working with a top-tier futures broker like Cannon Trading can elevate your trading journey to new heights.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading